C*Core Technology Co., Ltd. (SHSE:688262) shares have retraced a considerable 28% in the last month, reversing a fair amount of their solid recent performance. Longer-term shareholders would now have taken a real hit with the stock declining 5.3% in the last year.

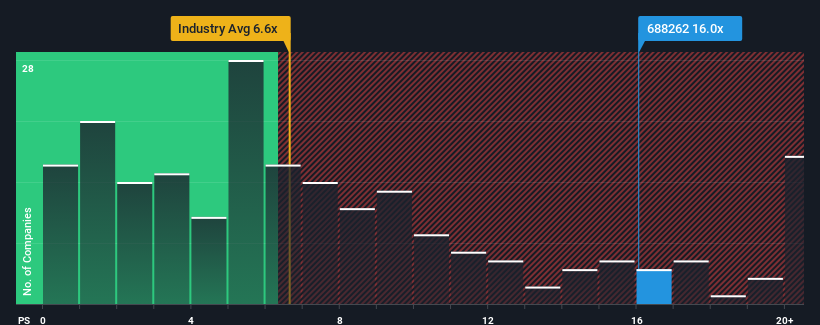

Even after such a large drop in price, C*Core Technology's price-to-sales (or "P/S") ratio of 16x might still make it look like a strong sell right now compared to other companies in the Semiconductor industry in China, where around half of the companies have P/S ratios below 6.6x and even P/S below 3x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

What Does C*Core Technology's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, C*Core Technology's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on C*Core Technology will help you uncover what's on the horizon.How Is C*Core Technology's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as C*Core Technology's is when the company's growth is on track to outshine the industry decidedly.

The only time you'd be truly comfortable seeing a P/S as steep as C*Core Technology's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered a frustrating 11% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 27% overall rise in revenue. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Shifting to the future, estimates from the one analyst covering the company suggest revenue should grow by 75% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 52%, which is noticeably less attractive.

With this in mind, it's not hard to understand why C*Core Technology's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On C*Core Technology's P/S

Even after such a strong price drop, C*Core Technology's P/S still exceeds the industry median significantly. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look into C*Core Technology shows that its P/S ratio remains high on the merit of its strong future revenues. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Having said that, be aware C*Core Technology is showing 1 warning sign in our investment analysis, you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.