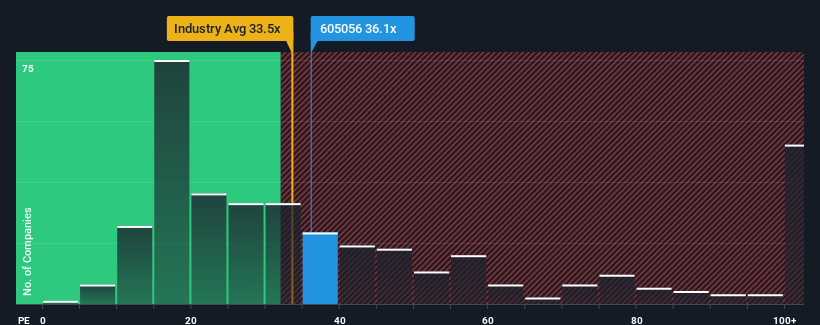

There wouldn't be many who think Xianheng International Science&Technology Co., Ltd.'s (SHSE:605056) price-to-earnings (or "P/E") ratio of 36.1x is worth a mention when the median P/E in China is similar at about 34x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Recent times haven't been advantageous for Xianheng International Science&Technology as its earnings have been falling quicker than most other companies. It might be that many expect the dismal earnings performance to revert back to market averages soon, which has kept the P/E from falling. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. If not, then existing shareholders may be a little nervous about the viability of the share price.

Is There Some Growth For Xianheng International Science&Technology?

Xianheng International Science&Technology's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 14%. As a result, earnings from three years ago have also fallen 48% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 14%. As a result, earnings from three years ago have also fallen 48% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 108% during the coming year according to the two analysts following the company. Meanwhile, the rest of the market is forecast to only expand by 38%, which is noticeably less attractive.

In light of this, it's curious that Xianheng International Science&Technology's P/E sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From Xianheng International Science&Technology's P/E?

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Xianheng International Science&Technology currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

There are also other vital risk factors to consider before investing and we've discovered 3 warning signs for Xianheng International Science&Technology that you should be aware of.

Of course, you might also be able to find a better stock than Xianheng International Science&Technology. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.