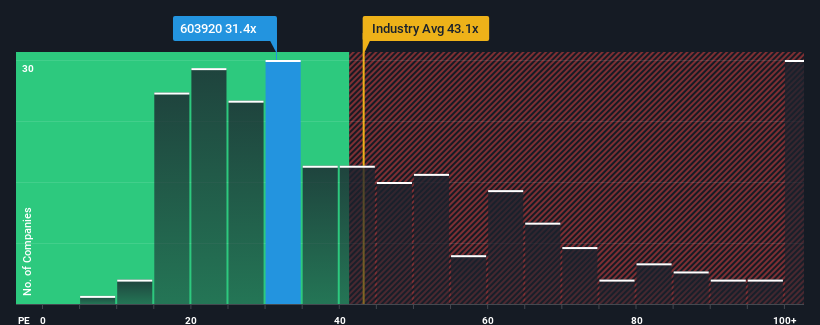

With a median price-to-earnings (or "P/E") ratio of close to 33x in China, you could be forgiven for feeling indifferent about Olympic Circuit Technology Co., Ltd's (SHSE:603920) P/E ratio of 31.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Olympic Circuit Technology certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. It might be that many expect the strong earnings performance to deteriorate like the rest, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Is There Some Growth For Olympic Circuit Technology?

There's an inherent assumption that a company should be matching the market for P/E ratios like Olympic Circuit Technology's to be considered reasonable.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. However, a few strong years before that means that it was still able to grow EPS by an impressive 98% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. However, a few strong years before that means that it was still able to grow EPS by an impressive 98% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Looking ahead now, EPS is anticipated to climb by 21% during the coming year according to the four analysts following the company. Meanwhile, the rest of the market is forecast to expand by 38%, which is noticeably more attractive.

With this information, we find it interesting that Olympic Circuit Technology is trading at a fairly similar P/E to the market. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Key Takeaway

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Olympic Circuit Technology's analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Plus, you should also learn about these 2 warning signs we've spotted with Olympic Circuit Technology.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.