Shanghai Suochen Information Technology Co.,Ltd. (SHSE:688507) shareholders won't be pleased to see that the share price has had a very rough month, dropping 27% and undoing the prior period's positive performance. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 40% share price drop.

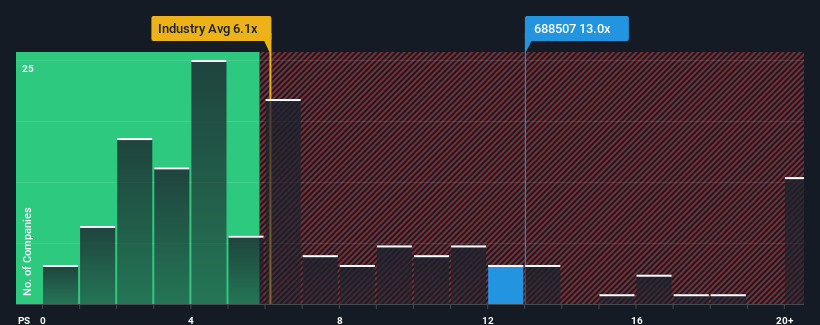

Even after such a large drop in price, Shanghai Suochen Information TechnologyLtd's price-to-sales (or "P/S") ratio of 13x might still make it look like a strong sell right now compared to other companies in the Software industry in China, where around half of the companies have P/S ratios below 6.1x and even P/S below 3x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

What Does Shanghai Suochen Information TechnologyLtd's P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, Shanghai Suochen Information TechnologyLtd has been doing relatively well. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. If not, then existing shareholders might be a little nervous about the viability of the share price.

Keen to find out how analysts think Shanghai Suochen Information TechnologyLtd's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Shanghai Suochen Information TechnologyLtd would need to produce outstanding growth that's well in excess of the industry.

In order to justify its P/S ratio, Shanghai Suochen Information TechnologyLtd would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered an exceptional 24% gain to the company's top line. The latest three year period has also seen an excellent 82% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 58% during the coming year according to the four analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 30%, which is noticeably less attractive.

In light of this, it's understandable that Shanghai Suochen Information TechnologyLtd's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Shanghai Suochen Information TechnologyLtd's P/S?

Shanghai Suochen Information TechnologyLtd's shares may have suffered, but its P/S remains high. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Shanghai Suochen Information TechnologyLtd's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

Before you take the next step, you should know about the 3 warning signs for Shanghai Suochen Information TechnologyLtd that we have uncovered.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.