Shuangliang Eco-Energy Systems Co.,Ltd (SHSE:600481) shares have retraced a considerable 29% in the last month, reversing a fair amount of their solid recent performance. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 37% share price drop.

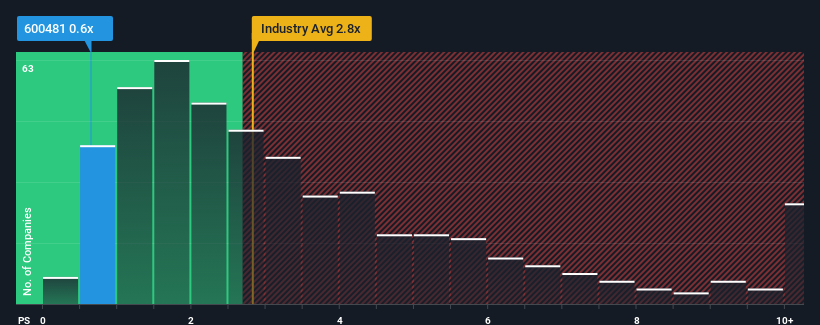

After such a large drop in price, Shuangliang Eco-Energy SystemsLtd may be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.6x, since almost half of all companies in the Machinery industry in China have P/S ratios greater than 2.8x and even P/S higher than 5x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

How Has Shuangliang Eco-Energy SystemsLtd Performed Recently?

While the industry has experienced revenue growth lately, Shuangliang Eco-Energy SystemsLtd's revenue has gone into reverse gear, which is not great. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Shuangliang Eco-Energy SystemsLtd will help you uncover what's on the horizon.How Is Shuangliang Eco-Energy SystemsLtd's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as depressed as Shuangliang Eco-Energy SystemsLtd's is when the company's growth is on track to lag the industry decidedly.

The only time you'd be truly comfortable seeing a P/S as depressed as Shuangliang Eco-Energy SystemsLtd's is when the company's growth is on track to lag the industry decidedly.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 40%. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, despite the drawbacks experienced in the last 12 months. Accordingly, shareholders will be pleased, but also have some serious questions to ponder about the last 12 months.

Looking ahead now, revenue is anticipated to climb by 77% during the coming year according to the two analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 22%, which is noticeably less attractive.

With this in consideration, we find it intriguing that Shuangliang Eco-Energy SystemsLtd's P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Bottom Line On Shuangliang Eco-Energy SystemsLtd's P/S

Having almost fallen off a cliff, Shuangliang Eco-Energy SystemsLtd's share price has pulled its P/S way down as well. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Shuangliang Eco-Energy SystemsLtd's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Before you take the next step, you should know about the 2 warning signs for Shuangliang Eco-Energy SystemsLtd (1 is concerning!) that we have uncovered.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.