Considering that the Japanese authorities may not intervene in the market and the schedule of the central bank meeting, the Exchange Rates of the yen against the dollar may again test the forty-year low reached in July.

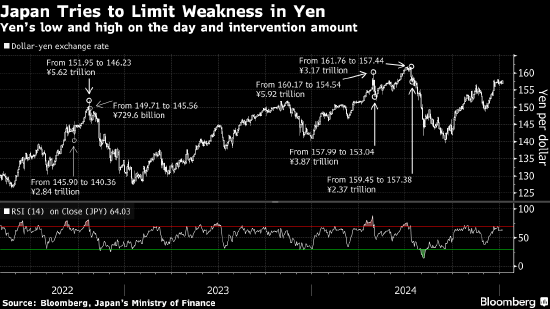

A simple line chart with technical momentum Indicators provides some useful signals, showing when the risk of intervention will increase. Generally speaking, based on past patterns, when USD/JPY breaks through past highs and the RSI momentum Indicators are bullish, the Japanese Ministry of Finance tends to take action.

If the USD/JPY breaks above the July 3 high of 161.95 and the upward momentum is strong, then intervention is possible. However, before President Trump is inaugurated on January 20, Japanese Ministry of Finance officials may be reluctant to act in order to avoid tariff threats—especially after the United States vetoed Japan's purchase of United States Steel, highlighting the rise of trade protectionism.

Meanwhile, the Bank of Japan will announce a policy decision a few days after Trump takes office, and the next meeting will not be held until mid-March. If the Bank of Japan remains inactive at the next meeting, then yen bears will be eager to sell yen without worrying about an interest rate hike from the central bank within two months.

Meanwhile, the Bank of Japan will announce a policy decision a few days after Trump takes office, and the next meeting will not be held until mid-March. If the Bank of Japan remains inactive at the next meeting, then yen bears will be eager to sell yen without worrying about an interest rate hike from the central bank within two months.

Of course, officials from the Ministry of Finance and Bank of Japan Governor Ueda Kazuo may curb the depreciation of the yen through verbal intervention, but the market likely wants to see actual action rather than mere words.

与此同时,日本央行将在特朗普上任几天后宣布政策决定,之后一直要到3月中旬才召开会议。如果日本央行在下次会议上按兵不动,那么日元空头会乐于抛售日元,而不必担心央行在两个月内加息。

与此同时,日本央行将在特朗普上任几天后宣布政策决定,之后一直要到3月中旬才召开会议。如果日本央行在下次会议上按兵不动,那么日元空头会乐于抛售日元,而不必担心央行在两个月内加息。