Nvidia investors expect Hwang In-hoon's speech at CES to trigger a new round of major stock price breakthroughs; the core focus of the market will be Nvidia Blackwell's AI GPU demand prospects and humanoid robots.

Nvidia (NVDA.US) and investors in AI-related stocks have high hopes for CEO Wong In-hoon's CES speech on Monday local time. It is hoped that Hwang In-hoon's latest speech will greatly boost the “AI faith” that has been slightly sluggish recently, thereby driving the AI investment boom to once again sweep through the financial market, driving the stock price of this AI chip hegemon to a new round of upward trend, and at the same time drive all stock prices related to artificial intelligence into a new upward curve.

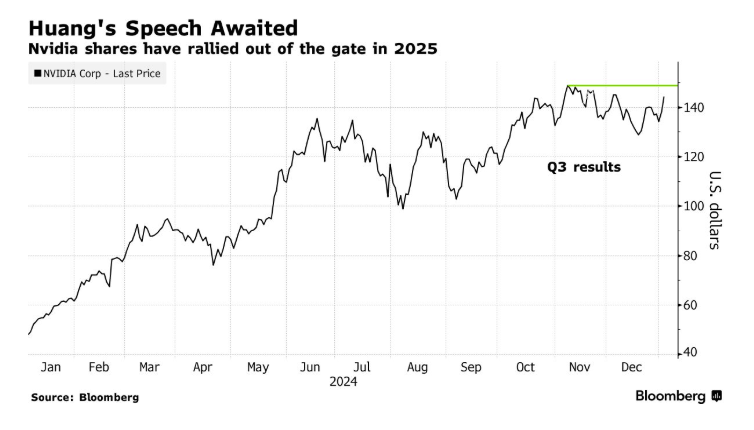

Nvidia's stock price seems to have remained stable since November of last year. In contrast, the stock price was in a “boom mode” for most of 2024 and the whole of 2023. Nvidia investors expect Hwang In-hoon's speech at CES to trigger a new round of Nvidia's stock price breakthroughs, while “AI believers” hope that Hwang In-hoon's speech will drive the prices of all AI-related stocks such as AMD, Broadcom, and the Philadelphia Semiconductor Index ETF to start a new round of sharp increases.

Advances in cutting-edge research on AI chips and end-side artificial intelligence are expected to be the core focus of the 2025 International Consumer Electronics Show (CES). In particular, exploring how AI can be more perfectly integrated into end-side consumer electronics products and exploring how AI can deeply penetrate human daily life. In particular, “AI humanoid robots”, a new product in the field of end-side AI, and the core robot technology development process, have attracted the attention of global investors and technology industry fans.

Advances in cutting-edge research on AI chips and end-side artificial intelligence are expected to be the core focus of the 2025 International Consumer Electronics Show (CES). In particular, exploring how AI can be more perfectly integrated into end-side consumer electronics products and exploring how AI can deeply penetrate human daily life. In particular, “AI humanoid robots”, a new product in the field of end-side AI, and the core robot technology development process, have attracted the attention of global investors and technology industry fans.

Therefore, in Hwang In-hoon's upcoming CES speech, which is attracting the attention of global investors, the core focus of the market will be the demand prospects for Nvidia Blackwell-architected AI GPUs and Nvidia's latest artificial intelligence-related technology developments in the field of humanoid robots. Nvidia CEO Hwang In-hoon may reveal BlackWell's latest demand prospects, as well as more information on the Blackwell Ultra and Rubin architecture to be launched in the future. He may also present its latest humanoid robot strategy and the Jetson Thor platform designed specifically for humanoid robots at CES 2025.

Hwang In-hoon will make a big appearance at the Las Vegas International Consumer Electronics Show (CES), which has attracted the attention of Wall Street investment institutions and global investors. Nvidia CEO Hwang In-hoon usually uses this major exhibition in the global technology industry to showcase consumer electronics devices using its chip products and forward-looking news about next-generation AI GPU architectures.

Investors will focus on comments on any prospective nature of the Blackwell series AI GPUs on Monday local time. The AI chip architecture is regarded by the financial market as Nvidia's next core performance growth catalyst, and will also be the strongest fuel that will drive Nvidia's continued blowout beyond expectations. According to information revealed by Nvidia executives at the last performance conference, despite strong demand, Blackwell AI GPUs are still facing supply restrictions, partly due to manufacturing challenges that have slowed their launch rate and AI chip production capacity restrictions from Nvidia Blackwell's exclusive chip foundry TSMC.

Blackwell's AI GPU series products are unquestionably the “performance ceiling” in the field of AI computing power infrastructure. Nvidia's CUDA ecosystem barriers are forcing technology companies to continue to invest heavily in Nvidia AI GPUs and broader AI infrastructure. Demand from tech giants such as Microsoft, Amazon, and Google, as well as demand from Saleforce and Servicenow software companies, continues to be booming. This is why the market expects Blackwell to continue to drive explosive growth in Nvidia's performance.

As a benchmark, Blackwell's performance is far more powerful than the previous generation “performance ceiling” Hopper. In the MLPerf Training benchmark, Blackwell's performance per GPU was greatly improved by 2 times compared to Hopper in GPT-3 pre-training tasks. This means that with the same number of GPUs, model training can be completed faster with Blackwell. For the Llama 2 70B model's LoRa fine-tuning task, Blackwell's performance per GPU was 2.2 times better than Hopper, which indicates that Blackwell is more efficient at handling specific high-load AI tasks

Matt Chopa, portfolio manager from Franklin Templeton's equity business unit, said: “Analysts expect Blackwell's demand to remain very strong. This may cause the financial market to refocus on Nvidia's ultimate long-term opportunity, which in turn will push the stock price into the next round of breakthroughs.”

Nvidia investors had plenty of reasons to be optimistic about Nvidia's stock price trend even before Huang Renxun opened his CES speech. Over the past six months, Hwang In-hoon's remarks about the demand for AI chips have boosted the company's stock price significantly. In October, he emphasized that the market demand for Blackwell was “too crazy”. In November, he said that due to “very strong” demand, the first batch of Blackwell will be shipped in large quantities this fiscal season (within three months ending the end of January).

However, under the pressure of continued high interest rate expectations brought about by the hawkish Federal Reserve, the stock experienced a rare “monthly decline” since 2023 in December 2024, but it still rose 171% in 2024. Nvidia, which has a relatively high weight, also became the single biggest driver of the S&P 500 index's overall rise in 2024.

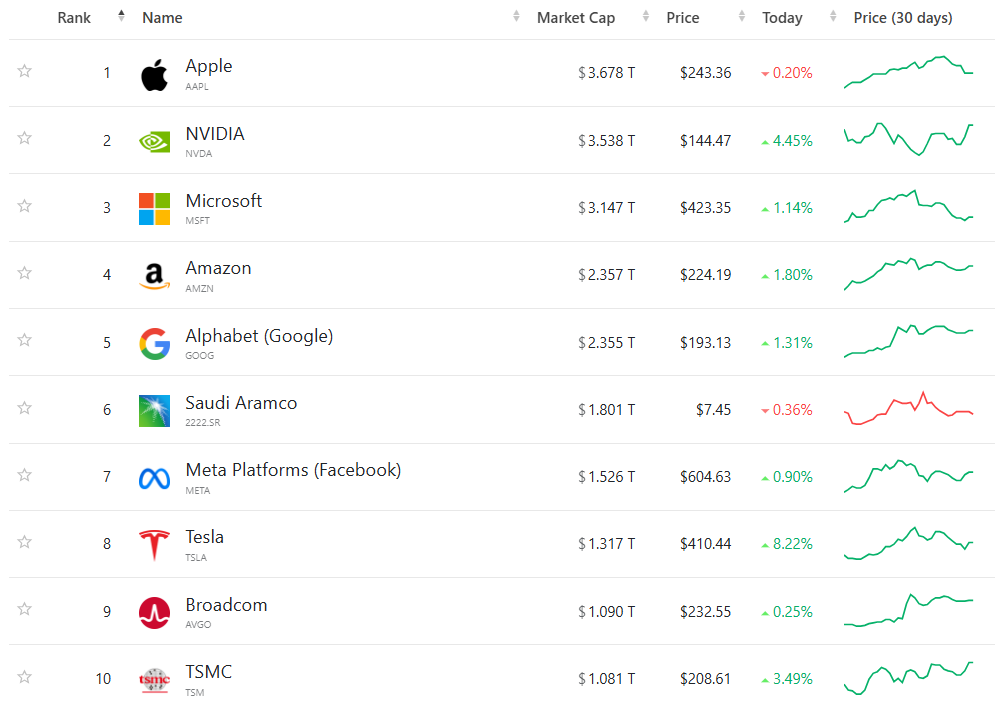

Since this year, Nvidia's stock price has risen by nearly 8%. Currently, the transaction price is only 3% lower than the highest closing price in history. Hwang In-hoon's latest speech may even drive Nvidia's stock price to a record high. Nvidia's current market capitalization is around 3.54 trillion US dollars, second only to Apple.

The latest results failed to drive Nvidia's stock price to continue to rise sharply, and the market is looking forward to a new catalyst

After Nvidia released its latest performance report on November 20 EST, although the company's stock price briefly hit a record high, it plummeted over a period of time thereafter. The company's performance outlook failed to leave a deep impression on Wall Street. Wall Street has become accustomed to Nvidia's performance forecasts significantly exceeding average expectations, making the “threshold range” for Nvidia's performance exceeding expectations getting higher and higher.

At a time when Nvidia's stock price has almost stagnated, market excitement over AI spending has spread to other areas of the semiconductor industry. For example, in the field of AI ASIC chips, this is Nvidia's AI GPU currently the strongest AI infrastructure competitor.

The stock price of Broadcom (AVGO.US), the most powerful AI ASIC force, has soared by nearly 30% over the past few weeks, entering the “trillion stock market capitalization club”. The company previously predicted that the market for artificial intelligence core hardware components designed for data center operators would experience an unprecedented boom. The stock price of Marvell Technology (MRVL.US), another major AI ASIC chip force, has risen more than 20% since its performance report showed that demand for customized artificial intelligence chips has greatly exceeded expectations.

However, according to major Wall Street companies such as Morgan Stanley, there is no so-called “complete replacement” between AI GPUs and AI ASICs, and these two completely different AI hardware routes will “coexist harmoniously” for a long time. Combining ASIC and GPU will make AI ASICs more focused on normalized AI tasks or AI applications with fixed structures, such as common operations in deep neural networks, such as matrix operations and convolution operations, while Nvidia AI GPUs focus on more complex artificial intelligence computing power tasks that require much higher computing power, such as self-attention mechanisms and neural network structure generation adversarial networks (GANs) composed of generators and discriminators, as well as broader and larger general-purpose computing tasks. GPUs have very powerful floating-point computing capabilities and high memory bandwidth. Ideal for tasks that require large amounts of data and complex algorithms.

The Morgan Stanley stock analyst team, led by Joseph Moore, likened the rise in these AI-related stocks such as Broadcom to a “brief transfer of Nvidia's AI wealth”. After Broadcom's extremely strong performance report was released, Nvidia's stock price fell for four consecutive trading days, and the market value shrunk by more than 200 billion dollars. However, Nvidia is still Morgan Stanley's “stock of choice,” and Daimo analysts believe the chip giant will still dominate the AI infrastructure market share this year. They also expect Hwang In-hoon's CES keynote address to be a “positive catalytic event.”

“The messaging should be the same — Blackwell's demand is strong, but supply is limited,” they wrote in a recent research report. “By mid-year, we still believe that the market focus will remain on Blackwell, which will be the core driver of revenue in the second half of the year.”

Bank of America (Bank of America)'s analyst team recently released the 2025 “Preferred Chip Stock List” for the US stock market, which includes the “Big Three AI chip companies” that have been investing in US stocks since 2023 — namely Nvidia, Broadcom, and Mywell Technology, all ranked in the Bank of America's 2025 “Preferred Chip Stock List”. The chip stocks on this list also include semiconductor equipment giant Fanlin Group (LRCX.US), automotive chip leader Ansemi Semiconductor (ON.US), and Keng Teng Electronics (CDNS.US), one of the leaders in EDA software. Bank of America gave Nvidia a medium-term price target of up to $190. As of last Friday's US stock close, Nvidia's stock price closed at $144.470.

For Nvidia investors, it's an “all-or-nothing” moment

Technology industry expert Jordan Klein from Mizuho Securities believes that any popular event on AI at CES, as well as Hwang In-hoon's artificial intelligence keynote, is a key test of recent market investor sentiment and risk appetite in the technology industry.

He wrote that if Nvidia's stock price falls or stays where it is within a few days of Hwang In-hoon's speech, then “in my opinion, this will have a moderate negative impact on the global stock market in January.” He also said that since the earnings season for tech companies will not begin until later this month, “investors who love tech stocks had almost no positive basis to measure fundamentals and prospects until then.”

Following Hwang In-hoon's speech, Nvidia's stock price is likely to rise and fall very much, as its sharp rise in stock prices has heightened people's concerns about valuation. The stock's expected price-earnings ratio based on revenue prospects is around 18x, making it one of the 10 stocks with the highest expected price-earnings ratio in the Nasdaq 100 Index. The stock's expected price-earnings ratio based on earnings per share (EPS) is also close to 34x, while the expected price-earnings ratio of the chip stock benchmark, the Philadelphia Semiconductor Index, is about 24x.

The team of chief investment strategists from John Hancock Investments remains optimistic about Nvidia and other major US tech stocks, but they expect “more volatility” in the future. “At some point, 2025 will be a critical moment to 'prove it to me', and at that time, we will have to restate this AI narrative logic. Valuation is clearly an issue. It is important to pay attention to how high the market's valuation can be under rapid growth in performance, even if the tailwind factors of artificial intelligence remain intact.”

In addition to Blackwel, the market also focuses on humanoid robots

We are likely to hear more detailed market supply and demand news about the company's Blackwell-architected AI GPUs published by Hwang In-hoon. The first batch of this series of AI GPUs will be supplied at the end of 2024, and mass shipments may begin at the beginning of this year.

CES 2025 may be a good start for combining an increasingly mature generative AI software ecosystem with humanoid robots. Wall Street analysts generally expect that Nvidia may be showcasing its latest humanoid robot strategy and the Jetson Thor platform designed specifically for humanoid robots at CES in 2025, which will be closely related to Nvidia's “embodied AI (embodied AI)” strategy.

When the AI chip deployment scale for data center servers processing parallel computing meets the benchmark computing power requirements of global enterprises and individuals and the huge computing power support required for the iterative development of AI models, according to technological trends, in consumer electronics application terminals including smartphones, PCs, and humanoid robots, as well as application terminals such as electric vehicle software systems and industrial production applications, AI models with more powerful artificial intelligence inference performance such as GPT-4O and O1 will eventually be integrated into these terminal devices and can use more powerful AI computing power in the cloud for immediate cooperation. This is also known as end-side AI.