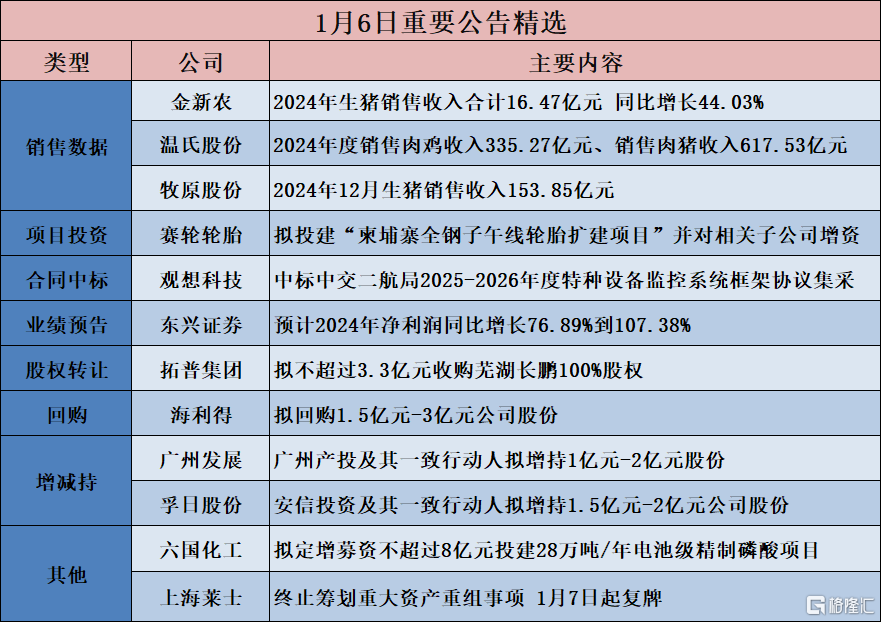

Anhui Liuguo Chemical: Plans to raise no more than 0.8 billion yuan through a private placement to invest in a 0.28 million tons/year Battery-grade refined phosphoric acid project.

[Sales Data]

Shenzhen Kingsino Technology (002548.SZ): In 2024, the total revenue from Hog Sale is 1.647 billion yuan, an increase of 44.03% year-on-year.

CGN Power Co.,Ltd. (003816.SZ): The total power generation of Nuclear Power units in 2024 is expected to be approximately 242.181 billion kWh, a year-on-year growth of 6.08%.

Anhui Honglu Steel Construction (002541.SZ): The total newly signed sales contract amount in 2024 is approximately 28.298 billion yuan, a year-on-year decrease of 4.76%.

Muyuan Foods (002714.SZ): Hog Sale revenue in December 2024 is 15.385 billion yuan.

Wens Foodstuff Group (300498.SZ): Sales revenue from meat chickens for the year 2024 is 33.527 billion yuan and sales revenue from meat pigs is 61.753 billion yuan.

[Project Investment]

Sailun Group (601058.SH): Plans to invest in the "Cambodia all-steel radial tire expansion project" and increase capital for related subsidiaries.

[Contract Bid Awarded]

Guanxiang Technology (301213.SZ): Awarded the bid for the 2025-2026 annual special equipment monitoring system framework agreement centralized procurement by China Communications Second Harbor Engineering Company.

Shengtak New Materials (300881.SZ): Awarded a project worth 0.175 billion yuan.

[Performance Forecast]

Valiant Co.,Ltd (002643.SZ): The projected net income for the fiscal year 2024 is expected to decrease by 65%-75%.

Bichamp Cutting Technology (002843.SZ): Expected net income in 2024 will decrease by 58.67%-70.69% year-on-year.

Dongxing (601198.SH): It is expected that in 2024, the net income will increase by 76.89% to 107.38% year-on-year.

[Equity Acquisition]

Huayang Technology (301502.SZ): is planning to acquire no less than 51% of the equity of Quanan Milling.

Ningbo Tuopu Group (601689.SH): intends to acquire 100% of Wuhu Changpeng's equity for no more than 0.33 billion yuan.

[Repurchase]

Zhejiang Hailide New Material (002206.SZ): plans to repurchase company shares worth 0.15 billion yuan to -0.3 billion yuan.

Hangzhou CNCR-IT (300250.SZ): Plans to spend 15 million to -30 million yuan to repurchase shares.

【Increase and Decrease】

Offcn Education Technology (002607.SZ): The controlling Shareholder and its concerted parties have cumulatively increased their Shareholding by 28.043 million yuan in the company shares.

Guangzhou Development Group Incorporated (600098.SH): Guangzhou Industrial Investment and its concerted parties plan to increase their shareholding by 0.1 billion yuan to -0.2 billion yuan.

Sunvim Group (002083.SZ): Anxin Investment and its concerted parties plan to increase Shareholding of the company's shares by 0.15 billion yuan to -0.2 billion yuan.

【Other】

【Other】