Deep-pocketed investors have adopted a bullish approach towards KLA (NASDAQ:KLAC), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in KLAC usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 8 extraordinary options activities for KLA. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 50% leaning bullish and 37% bearish. Among these notable options, 3 are puts, totaling $125,240, and 5 are calls, amounting to $494,570.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $640.0 to $790.0 for KLA during the past quarter.

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $640.0 to $790.0 for KLA during the past quarter.

Volume & Open Interest Trends

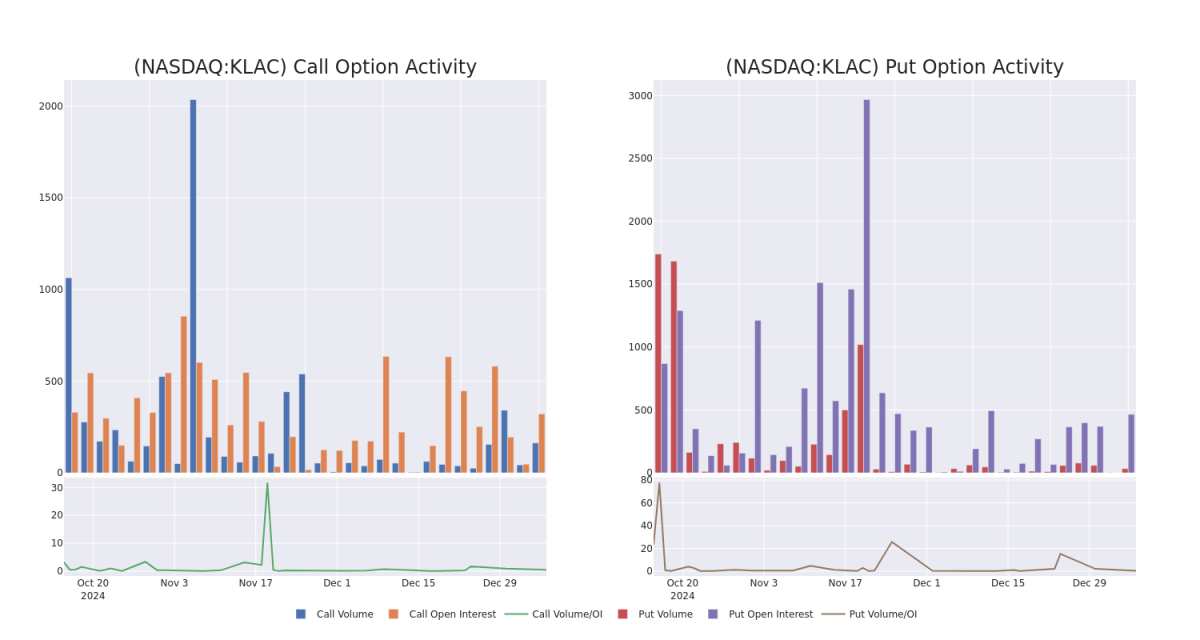

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for KLA's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across KLA's significant trades, within a strike price range of $640.0 to $790.0, over the past month.

KLA 30-Day Option Volume & Interest Snapshot

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| KLAC | CALL | SWEEP | BULLISH | 01/17/25 | $56.8 | $49.8 | $56.79 | $640.00 | $199.0K | 272 | 38 |

| KLAC | CALL | SWEEP | BEARISH | 02/21/25 | $47.9 | $44.0 | $44.4 | $680.00 | $154.7K | 4 | 35 |

| KLAC | CALL | SWEEP | BEARISH | 02/21/25 | $11.0 | $6.7 | $10.0 | $790.00 | $67.9K | 0 | 69 |

| KLAC | PUT | TRADE | BEARISH | 01/15/27 | $113.0 | $88.0 | $110.5 | $650.00 | $44.2K | 16 | 4 |

| KLAC | CALL | TRADE | BULLISH | 02/21/25 | $42.9 | $39.4 | $42.15 | $690.00 | $42.1K | 2 | 13 |

About KLA

KLA is one of the largest semiconductor wafer fabrication equipment, or WFE, manufacturers in the world. It specializes in the market segment of semiconductor process control, wherein machines inspect semiconductor wafers during research and development and manufacturing for defects and verify precise measurements. In this section of the market, KLA holds a majority share. It also has a small exposure to the etch and deposition segments of the WFE market. It counts as top customers the largest chipmakers in the world, including TSMC and Samsung.

Following our analysis of the options activities associated with KLA, we pivot to a closer look at the company's own performance.

Where Is KLA Standing Right Now?

- Currently trading with a volume of 345,709, the KLAC's price is up by 5.84%, now at $695.41.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 17 days.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for KLA with Benzinga Pro for real-time alerts.