Spotlight on Quantum-Si: Analyzing the Surge in Options Activity

Spotlight on Quantum-Si: Analyzing the Surge in Options Activity

Whales with a lot of money to spend have taken a noticeably bearish stance on Quantum-Si.

有很多钱可以花的鲸鱼对量子硅采取了明显的看跌立场。

Looking at options history for Quantum-Si (NASDAQ:QSI) we detected 10 trades.

查看量子硅(纳斯达克股票代码:QSI)的期权历史记录,我们发现了10笔交易。

If we consider the specifics of each trade, it is accurate to state that 30% of the investors opened trades with bullish expectations and 60% with bearish.

如果我们考虑每笔交易的具体情况,可以准确地说,30%的投资者以看涨的预期开启交易,60%的投资者持看跌预期。

From the overall spotted trades, 4 are puts, for a total amount of $112,131 and 6, calls, for a total amount of $212,469.

在已发现的全部交易中,有4笔是看跌期权,总额为112,131美元,6笔看涨期权,总额为212,469美元。

Expected Price Movements

预期的价格走势

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $2.5 and $10.0 for Quantum-Si, spanning the last three months.

在评估了交易量和未平仓合约之后,很明显,主要市场走势者将重点放在过去三个月的量子硅2.5美元至10.0美元之间的价格区间上。

Analyzing Volume & Open Interest

分析交易量和未平仓合约

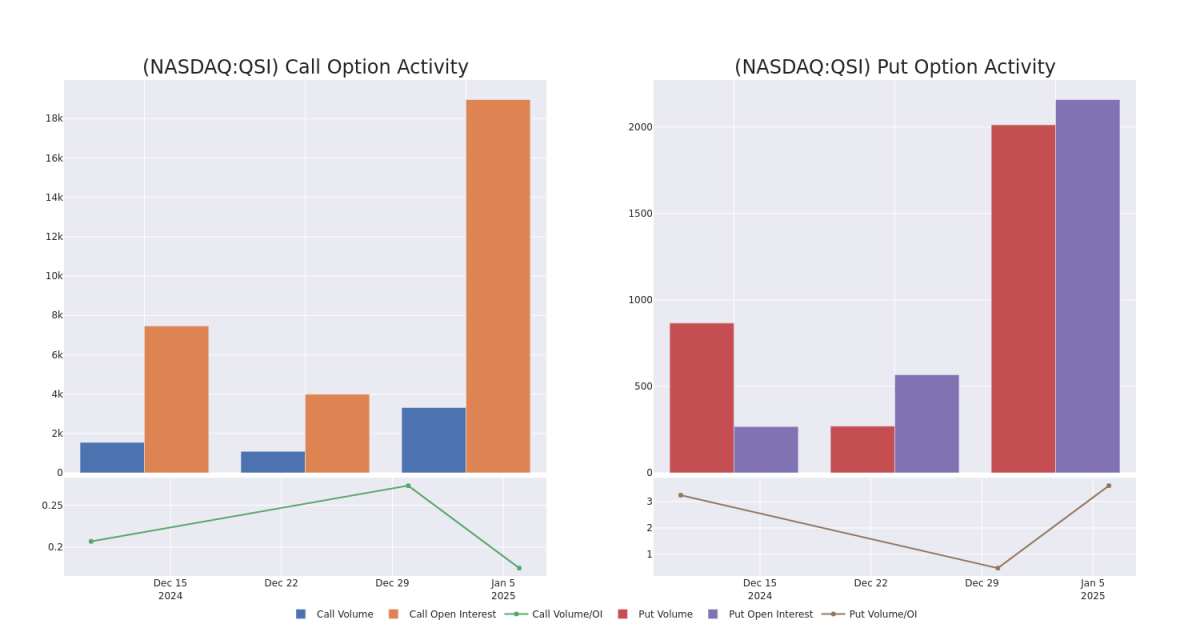

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Quantum-Si's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Quantum-Si's whale trades within a strike price range from $2.5 to $10.0 in the last 30 days.

交易期权时,查看交易量和未平仓合约是一个强有力的举动。这些数据可以帮助您跟踪Quantum-Si期权在给定行使价下的流动性和利息。下面,我们可以分别观察过去30天内Quantum-Si所有鲸鱼交易的看涨和看跌期权交易量和未平仓合约的变化,其行使价在2.5美元至10.0美元之间。

Quantum-Si Option Volume And Open Interest Over Last 30 Days

过去 30 天的量子硅期权交易量和未平仓合约

Largest Options Trades Observed:

观察到的最大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| QSI | CALL | SWEEP | BEARISH | 02/21/25 | $1.1 | $1.05 | $1.06 | $5.00 | $54.1K | 3.5K | 763 |

| QSI | CALL | TRADE | BEARISH | 02/21/25 | $2.25 | $2.15 | $2.15 | $2.50 | $43.0K | 2.1K | 91 |

| QSI | PUT | TRADE | BEARISH | 01/17/25 | $3.5 | $3.5 | $3.5 | $7.50 | $35.0K | 138 | 100 |

| QSI | CALL | TRADE | NEUTRAL | 01/10/25 | $0.35 | $0.25 | $0.3 | $5.00 | $30.0K | 1.7K | 1.3K |

| QSI | CALL | TRADE | BEARISH | 04/17/25 | $1.7 | $1.55 | $1.6 | $5.00 | $28.8K | 5.3K | 354 |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| QSI | 打电话 | 扫 | 粗鲁的 | 02/21/25 | 1.1 美元 | 1.05 美元 | 1.06 美元 | 5.00 美元 | 54.1 万美元 | 3.5K | 763 |

| QSI | 打电话 | 贸易 | 粗鲁的 | 02/21/25 | 2.25 美元 | 2.15 美元 | 2.15 美元 | 2.50 美元 | 43.0 万美元 | 2.1K | 91 |

| QSI | 放 | 贸易 | 粗鲁的 | 01/17/25 | 3.5 美元 | 3.5 美元 | 3.5 美元 | 7.50 美元 | 35.0 万美元 | 138 | 100 |

| QSI | 打电话 | 贸易 | 中立 | 01/10/25 | 0.35 美元 | 0.25 美元 | 0.3 美元 | 5.00 美元 | 30.0 万美元 | 1.7K | 1.3K |

| QSI | 打电话 | 贸易 | 粗鲁的 | 04/17/25 | 1.7 美元 | 1.55 美元 | 1.6 美元 | 5.00 美元 | 28.8 万美元 | 5.3K | 354 |

About Quantum-Si

关于 Quantum-Si

Quantum-Si Inc is focused on revolutionizing the growing field of proteomics. The company's suite of technologies is powered by a first-of-its-kind semiconductor chip designed to enable single-molecule next-generation protein sequencing and genomics, and digitize proteomic research in order to advance drug discovery and diagnostics beyond DNA sequencing.

Quantum-Si Inc致力于革新不断发展的蛋白质组学领域。该公司的技术套件由首创的半导体芯片提供支持,该半导体芯片旨在实现下一代单分子蛋白质测序和基因组学,并实现蛋白质组学研究的数字化,从而推进DNA测序之外的药物发现和诊断。

After a thorough review of the options trading surrounding Quantum-Si, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在对围绕量子硅的期权交易进行了全面审查之后,我们将对该公司进行更详细的审查。这包括评估其当前的市场状况和表现。

Current Position of Quantum-Si

量子硅的现状

- With a volume of 55,103,941, the price of QSI is down -4.43% at $4.1.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 52 days.

- QSI的交易量为55,103,941美元,下跌了-4.43%,至4.1美元。

- RSI指标暗示标的股票可能接近超买。

- 下一份财报预计将在52天后公布。

Unusual Options Activity Detected: Smart Money on the Move

检测到不寻常的期权活动:智能货币在移动

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Benzinga Edge的不寻常期权委员会在潜在的市场推动者发生之前就发现了它们。看看大笔资金对你最喜欢的股票持有哪些头寸。点击此处访问。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Quantum-Si with Benzinga Pro for real-time alerts.

交易期权涉及更大的风险,但也提供了更高利润的潜力。精明的交易者通过持续的教育、战略贸易调整、利用各种指标以及随时关注市场动态来降低这些风险。使用Benzinga Pro获取实时警报,了解量子硅的最新期权交易。

From the overall spotted trades, 4 are puts, for a total amount of $112,131 and 6, calls, for a total amount of $212,469.

From the overall spotted trades, 4 are puts, for a total amount of $112,131 and 6, calls, for a total amount of $212,469.