The Changbai Mountain Tourism Co., Ltd. (SHSE:603099) share price has softened a substantial 26% over the previous 30 days, handing back much of the gains the stock has made lately. Looking at the bigger picture, even after this poor month the stock is up 50% in the last year.

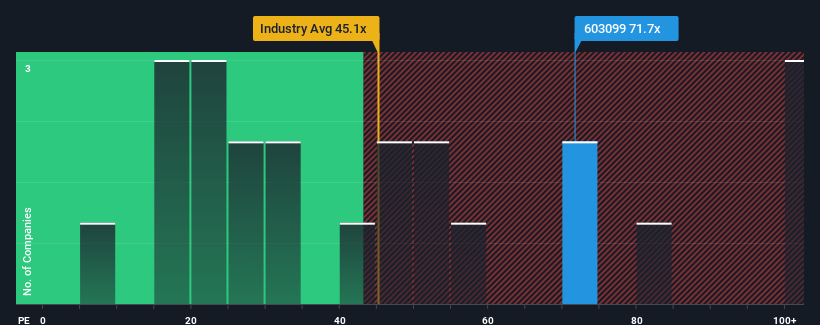

Although its price has dipped substantially, given close to half the companies in China have price-to-earnings ratios (or "P/E's") below 32x, you may still consider Changbai Mountain Tourism as a stock to avoid entirely with its 71.7x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Changbai Mountain Tourism certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. The P/E is probably high because investors think the company will continue to navigate the broader market headwinds better than most. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, Changbai Mountain Tourism would need to produce outstanding growth well in excess of the market.

In order to justify its P/E ratio, Changbai Mountain Tourism would need to produce outstanding growth well in excess of the market.

If we review the last year of earnings growth, the company posted a worthy increase of 13%. However, due to its less than impressive performance prior to this period, EPS growth is practically non-existent over the last three years overall. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Shifting to the future, estimates from the three analysts covering the company suggest earnings should grow by 48% over the next year. That's shaping up to be materially higher than the 38% growth forecast for the broader market.

In light of this, it's understandable that Changbai Mountain Tourism's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Changbai Mountain Tourism's P/E?

Changbai Mountain Tourism's shares may have retreated, but its P/E is still flying high. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Changbai Mountain Tourism's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Changbai Mountain Tourism you should know about.

If these risks are making you reconsider your opinion on Changbai Mountain Tourism, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.