The Kyland Technology Co., Ltd. (SZSE:300353) share price has fared very poorly over the last month, falling by a substantial 26%. Looking back over the past twelve months the stock has been a solid performer regardless, with a gain of 16%.

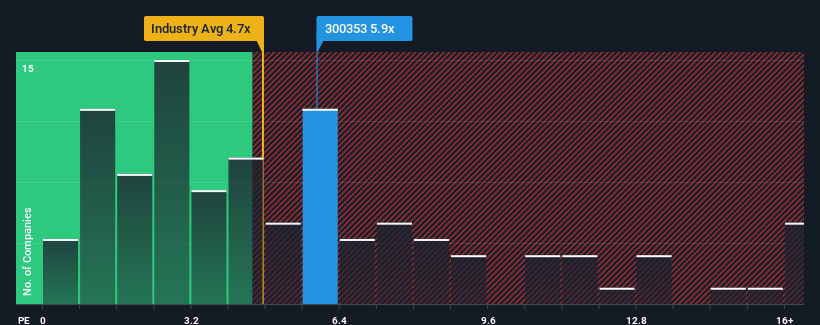

Even after such a large drop in price, Kyland Technology may still be sending sell signals at present with a price-to-sales (or "P/S") ratio of 5.9x, when you consider almost half of the companies in the Communications industry in China have P/S ratios under 4.7x and even P/S lower than 2x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

What Does Kyland Technology's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Kyland Technology's revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Kyland Technology will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Kyland Technology?

In order to justify its P/S ratio, Kyland Technology would need to produce impressive growth in excess of the industry.

In order to justify its P/S ratio, Kyland Technology would need to produce impressive growth in excess of the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 7.7%. Even so, admirably revenue has lifted 64% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to climb by 28% during the coming year according to the only analyst following the company. With the industry predicted to deliver 36% growth, the company is positioned for a weaker revenue result.

With this information, we find it concerning that Kyland Technology is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Bottom Line On Kyland Technology's P/S

There's still some elevation in Kyland Technology's P/S, even if the same can't be said for its share price recently. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've concluded that Kyland Technology currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Before you take the next step, you should know about the 3 warning signs for Kyland Technology (2 can't be ignored!) that we have uncovered.

If you're unsure about the strength of Kyland Technology's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.