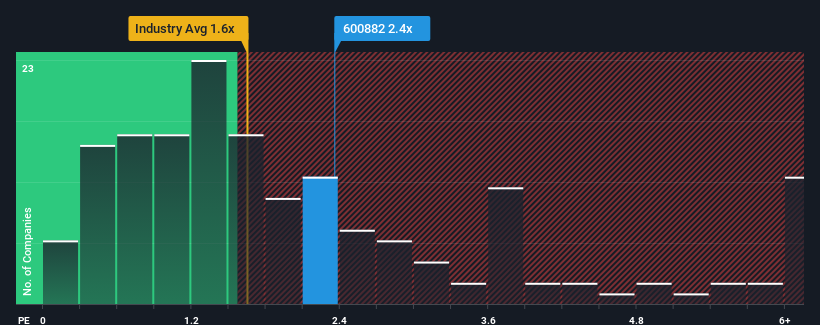

When you see that almost half of the companies in the Food industry in China have price-to-sales ratios (or "P/S") below 1.6x, Shanghai Milkground Food Tech Co., Ltd (SHSE:600882) looks to be giving off some sell signals with its 2.4x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

How Has Shanghai Milkground Food Tech Performed Recently?

While the industry has experienced revenue growth lately, Shanghai Milkground Food Tech's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. If not, then existing shareholders may be extremely nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Shanghai Milkground Food Tech.What Are Revenue Growth Metrics Telling Us About The High P/S?

Shanghai Milkground Food Tech's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 26%. As a result, revenue from three years ago have also fallen 11% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 26%. As a result, revenue from three years ago have also fallen 11% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 37% as estimated by the six analysts watching the company. That's shaping up to be materially higher than the 15% growth forecast for the broader industry.

With this information, we can see why Shanghai Milkground Food Tech is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Shanghai Milkground Food Tech's P/S

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Shanghai Milkground Food Tech's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for Shanghai Milkground Food Tech with six simple checks will allow you to discover any risks that could be an issue.

If these risks are making you reconsider your opinion on Shanghai Milkground Food Tech, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.