Market Cap 300 billion is just a step away.

After securing the title of "King of A-shares" for 2024, the "first stock of AI Chips" continues to surge forward in the new year.

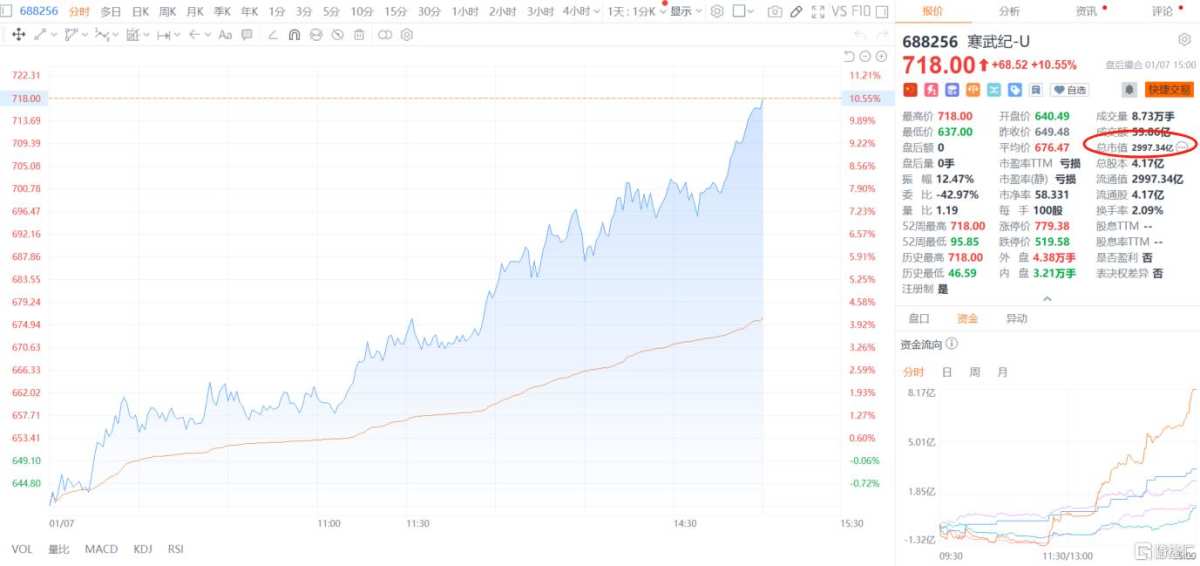

On January 7, Cambricon surged significantly, with the stock price once again breaking the 700 yuan mark, setting a new historical high.

As of the market close, it increased by 10.55% to 718 yuan, reaching a 60-day high; the latest total Market Cap reached 299.734 billion yuan, just one step away from the 300 billion threshold.

As of the market close, it increased by 10.55% to 718 yuan, reaching a 60-day high; the latest total Market Cap reached 299.734 billion yuan, just one step away from the 300 billion threshold.

In the past year of 2024, Cambricon topped the A-shares with an annual rise of 387%.

Today’s explosive growth of Cambricon may be partly due to the surprises brought by NVIDIA at CES 2025, which enhanced market speculation and expectations.

On the other hand, from the perspective of Capital Trend, today’s Block Orders saw a net inflow of 0.448 billion yuan, accounting for 7.59% of the total transaction volume, while retail funds experienced a net outflow of 0.442 billion yuan, which made up 7.49% of the total transaction volume.

The top player in the Technology circle "makes a splash".

This afternoon, the A-shares started a counterattack, particularly the Semiconductors, Chips and other Concepts performed very strongly.

Apart from Cambricon, Haiguang Information surged over 9%, Semiconductor Manufacturing International Corporation rose over 4%, and NAURA Technology Group, Will Semiconductor and others rose over 3%.

A major Bullish factor behind the strengthening of Semiconductors: the top player in the Technology circle, NVIDIA, "makes a splash".

Today, the international Consumer Electronics Show (CES 2025), known as the "Spring Festival Gala of the Technology world," opened, and NVIDIA's Jensen Huang turned the opening speech into a large AI showcase.

During this period, NVIDIA revealed several "big bombs," including the debut of the GeForce RTX 50 series GPUs and the introduction of the most powerful graphics card, the RTX 5090.

Jensen Huang, who COSplayed the Captain America, also stated that the Blackwell chip has entered full production, and three new Blackwell systems will be launched, including the production of the Grace Blackwell supercomputer and NVLink 72s.

In addition to the aforementioned products, there are also automotive processors "Thor," the AI foundation model "Cosmos," the Llama Nemotron language foundation model, the world's smallest AI supercomputer Project Digits, as well as Siasun Robot&Automation, and self-driving cars.

Overall, Jensen Huang is determined to fully embrace the "AI belief."

Under the global AI wave, the carnival of semiconductors and chips seems to have just begun.

Driving the acceleration of domestic processes.

From the domestic policy perspective, continuous bullish measures are accelerating domestic substitution.

Today, the Zhuhai Municipal Bureau of Industry and Information Technology publicly solicited opinions on the "Zhuhai Electronic Chemicals Industry Development Three-Year Action Plan (2025-2027) (Draft for Comments)."

It mentions focusing on developing 8-inch and 12-inch silicon wafers, Silicon Carbide, Gallium Nitride, Indium Phosphide, and other new generation compound semiconductor substrate materials and epitaxial wafers; and proactively laying out fourth generation semiconductor materials like Gallium Oxide, Gallium Antimonide, and Indium Antimonide.

At the same time, focus on developing uniform glue chrome plates for photomasks, KrF, ArF transfer photomasks, and strategically layout deep ultraviolet (DUV) masks.

Guokai Securities pointed out that Semiconductors are an important field in the competition for Technology, and the policy side continues to strengthen and accelerate the domestic process. In the future, the competition surrounding the technology sector may further intensify, making the demand for achieving high-level technological independence and self-reliance particularly urgent.

With the trend of recovery in the industry cycle, cash flow and valuation will improve, thus enhancing the activity of mergers and acquisitions; coupled with the backdrop of the current slowdown in A-share IPOs, mergers and acquisitions in the semiconductor industry will enter an opportunity period, catalyzing the investment value of the sector.

Looking ahead to 2025, Sinolink Securities states that AI applications and independent control will continue to drive the semiconductor cycle upward.

Applications spawned by generative AI are expected to become mainstream in the AI wave, and the upgrade and innovation of terminal demand will drive the demand for chips, thus promoting the continuous expansion of the entire semiconductor market scale.

CITIC SEC stated that as AI evolves deeply into industries, by 2025, the modeling capabilities of artificial intelligence companies will reach new heights, and competition for talent and capital will intensify. However, there will also be opportunities for rapid growth in market share and revenue.

In the past two years, the excess returns of American AI companies have been significant, and Chinese AI companies have quickly followed. It is determined that in the next 1-2 years, Chinese artificial intelligence companies and Assets will bring considerable excess returns.

截至收盘,涨10.55%报718元,

截至收盘,涨10.55%报718元,