Barclays analyst Jeff Bernstein upgrades $Shake Shack (SHAK.US)$ to a buy rating, and adjusts the target price from $125 to $159.

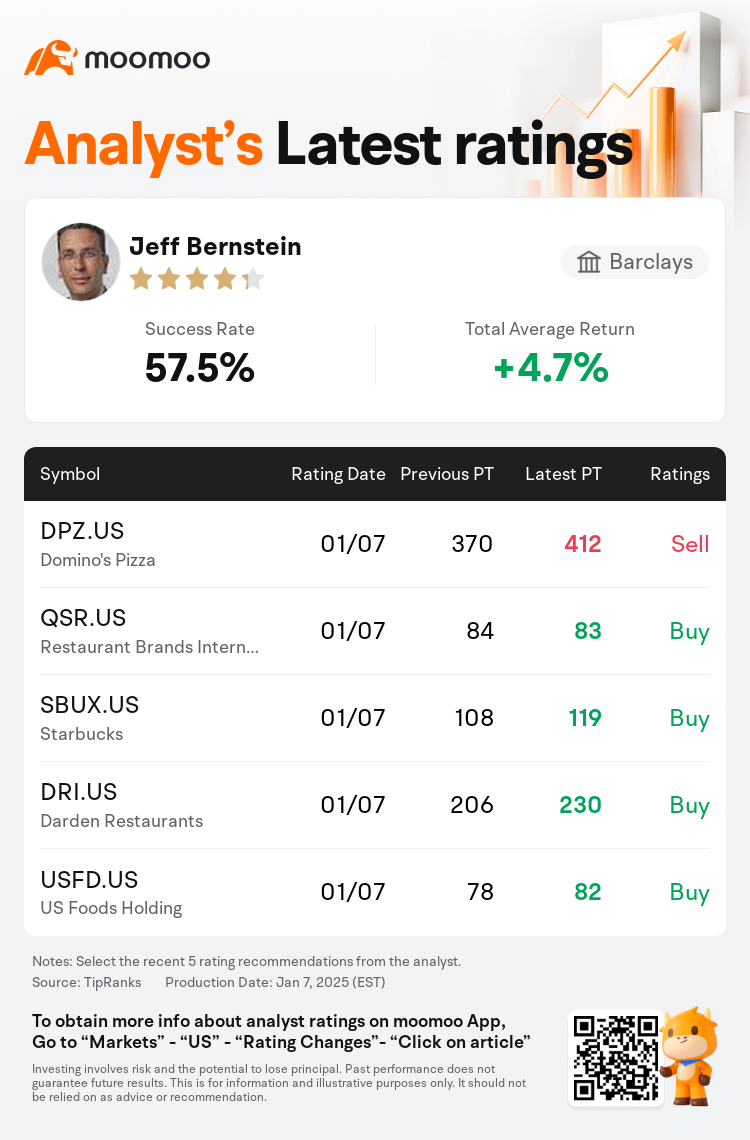

According to TipRanks data, the analyst has a success rate of 57.5% and a total average return of 4.7% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Shake Shack (SHAK.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Shake Shack (SHAK.US)$'s main analysts recently are as follows:

UBS maintains a more optimistic view on the U.S. restaurant sector's sales outlook for 2025, anticipating that the U.S. macroeconomic backdrop and industry environment will modestly improve. Many companies are expected to see improved margins by 2025 due to benign food inflation, although traffic remains a key variable. There are risks noted from reduced pricing power, ongoing labor cost inflation, and heightened discounting activities.

The firm anticipates that the company will project comp growth in the low single-digit-plus range by 2025, accompanied by unit growth in the mid-teens-plus range which is expected to support mid teens-plus revenue growth. Given the relatively modest comp comparisons and the stock's valuation which is no longer outsized compared to its high-growth peers, continued outperformance of the shares in 2025 is expected.

Yum! Brands is seen as a large-cap with low current investor enthusiasm, anticipated to show an above-average growth in same-store sales for 2025, positioning its financial model more favorably against its global counterparts. Darden has shown a 16% rise since its last earnings disclosure, with significant catalysts expected to drive performance against easier past comparisons and potentially exceed modest expectations. Shake Shack is perceived to have a new management strategy that could be a significant, yet underappreciated, influence on leveraging unused sales and margin potential.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

巴克萊銀行分析師Jeff Bernstein上調$Shake Shack (SHAK.US)$至買入評級,並將目標價從125美元上調至159美元。

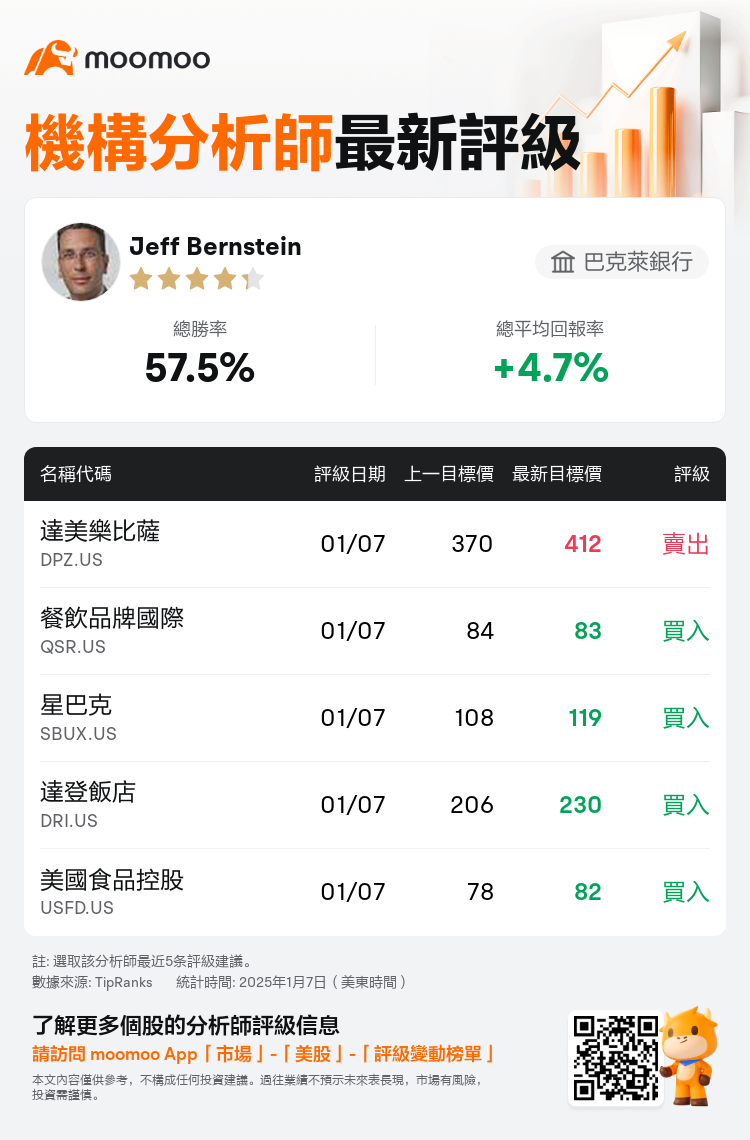

根據TipRanks數據顯示,該分析師近一年總勝率為57.5%,總平均回報率為4.7%。

此外,綜合報道,$Shake Shack (SHAK.US)$近期主要分析師觀點如下:

此外,綜合報道,$Shake Shack (SHAK.US)$近期主要分析師觀點如下:

瑞銀對美國餐飲業2025年的銷售前景保持更爲樂觀的看法,預計美國的宏觀經濟背景和行業環境將略有改善。儘管流量仍然是一個關鍵變量,但由於良性的食品通脹,預計到2025年,許多公司的利潤率將有所提高。定價能力降低、勞動力成本持續上漲和折扣活動的加強都存在風險。

該公司預計,到2025年,公司收入增長將保持在較低的個位數以上的區間,同時在青少年中期以上的單位增長,預計這將支持青少年以上的收入增長。鑑於比較相對溫和,而且該股的估值與高增長同行相比已不再過高,因此預計該股在2025年將持續跑贏大盤。

好極了!品牌被視爲當前投資者熱情低下的大盤股,預計2025年同店銷售額的增長將高於平均水平,使其財務模式與全球同行相比更加有利。自上次業績披露以來,達登已上漲16%,與過去比較相比,重要的催化劑預計將推動業績增長,並可能超過溫和的預期。Shake Shack被認爲有了一項新的管理策略,該戰略可能會對利用未使用的銷售額和利潤潛力產生重大但未被充分重視的影響。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$Shake Shack (SHAK.US)$近期主要分析師觀點如下:

此外,綜合報道,$Shake Shack (SHAK.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of