Chewy Set For Over 50% Upside In Bull Case: 'Entering Beast Mode For 2025,' Says Analyst

Chewy Set For Over 50% Upside In Bull Case: 'Entering Beast Mode For 2025,' Says Analyst

Mizuho Securities upgraded Chewy Inc. (NYSE:CHWY) to Outperform from Neutral and raised its price target to $42, representing a 13.29% increase from current price levels, citing improving pet category fundamentals and multiple growth catalysts for 2025.

瑞穗證券將Chewy Inc.(紐交所:CHWY)的評級從中立上調至跑贏大盤,並將其目標價提高至42美元,較當前價格水平上漲13.29%,理由是寵物品類基本面改善及2025年的多重增長催化劑。

What Happened: The e-commerce pet supplies retailer is poised to benefit from recovering industry trends and internal initiatives that could drive EBITDA margin expansion toward high single to double digits, according to Mizuho analyst David Bellinger.

發生了什麼:這家電子商務寵物用品零售商有望受益於行業趨勢的復甦和內部舉措,這些措施可能會推動EBITDA利潤率向高個位數到雙位數擴張,瑞穗分析師大衛·貝林傑表示。

"The pet category is beginning to recover into 2025, yielding a return to net active customer growth for Chewy and a subsequent top-line re-acceleration," Bellinger wrote in a Jan. 6 research note, adding, "Chewy notches to our top pick overall and within our consumer internet vertical. Bull case suggests +50% upside."

貝林傑在1月6日的研究報告中寫道:"寵物品類將開始在2025年恢復,Chewy的淨活躍客戶將恢復增長,後續的收入將加速,"並補充道,"Chewy是我們所有推薦中的首選,並在我們的消費Internet Plus-related垂直領域中表現突出。樂觀情況下暗示上漲50%。"

Key growth drivers include Chewy's underpenetrated mobile app, which currently accounts for about 20% of revenues but could exceed 40-50% penetration over the next 12-24 months. The company's automation initiatives have already reduced order-to-delivery times by 10% while cutting fulfillment costs by 30% across 40% of volumes.

主要的增長驅動因素包括Chewy尚未滲透的移動應用程序,目前佔營業收入的約20%,但在未來12-24個月內有可能超過40-50%的滲透率。該公司的自動化措施已將訂單到交付時間縮短了10%,同時在40%的業務量中降低了30%的履行成本。

Mizuho projects Chewy's revenue growth of 4.5% in fiscal 2025, accelerating to 7.9% in the financial year 2026 and 8.1% in the financial year 2027. The firm forecasts adjusted EBITDA margins reaching 5.5% in the financial year 2025, expanding to 6.5% in the financial year 2026 and 7.2% in the financial year 2027 – slightly ahead of consensus estimates.

瑞穗預計Chewy在2025財年的營業收入增長爲4.5%,在2026財年加速至7.9%,在2027財年爲8.1%。該公司預測調整後的EBITDA利潤率在2025財年達到5.5%,在2026財年擴展到6.5%, 在2027財年達到7.2%——略高於市場共識預期。

Chewy gained significant attention last year when influential trader Keith Gill, known as Roaring Kitty, accumulated and later sold a stake in the company.

去年,具有影響力的交易員基思·吉爾(Keith Gill),以"咆哮的小貓"(Roaring Kitty)而聞名,積累並隨後出售了對該公司的股份,從而引起了廣泛關注。

Why It Matters: The upgrade follows Chewy's strong third-quarter performance, where it added approximately 160,000 net active customers. JPMorgan projects this growth could accelerate to 650,000 new customers in 2025.

這次升級是在Chewy強勁的第三季度表現之後做出的,當時該公司增加了約160,000個淨活躍客戶。摩根大通預計這一增長在2025年將加速到65萬新客戶。

Bellinger noted that concerns about higher advertising spend are "short-sighted," as the company maintains a strong return on investment metrics while investing in customer acquisition. The analyst highlighted Chewy's high revenue visibility through its Autoship subscription program, which accounts for over 80% of sales.

貝林傑指出,關於廣告支出增加的擔憂是"短視的",因爲公司在客戶獲取上維持着強大的投資回報率指標。分析師強調Chewy通過其自動配送訂閱計劃實現了高營業收入可見度,該計劃佔總銷售額的80%以上。

The new price target represents a multiple of 20x the financial year 2026 estimated EBITDA of $868 million, reflecting a premium to e-commerce peers given Chewy's exposure to the resilient pet category and a clear path to margin expansion. The company also has over $400 million remaining in its share buyback program.

新的價格目標代表着2026財年預計EBITDA爲$86800萬的20倍,反映出相比其他電子商務同行的溢價,考慮到Chewy在堅韌寵物行業的曝光和明確的利潤擴張路徑。該公司在股票回購計劃中還有超過$40000萬的資金。

Price Action: Chewy's stock closed at $37.07 on Monday, reflecting a 3.09% increase. In after-hours trading, the stock fell by 1.97%. Over the past year, Chewy has experienced a notable growth of 79.17%, according to data from Benzinga Pro.

價格走勢:Chewy的股票週一收盤於$37.07,反映出3.09%的上漲。在盤後交易中,股票下跌1.97%。根據Benzinga Pro的數據,過去一年中,Chewy經歷了79.17%的顯著增長。

The stock's 52-week range is between $14.69 and $39.10. With a market capitalization of $14.80 billion, Chewy holds a price-to-earnings ratio of 40.29 and a relative strength index of 53.

該股票的52周區間在$14.69至$39.10之間。Chewy市值爲$148億,市盈率爲40.29,相對強弱指數爲53。

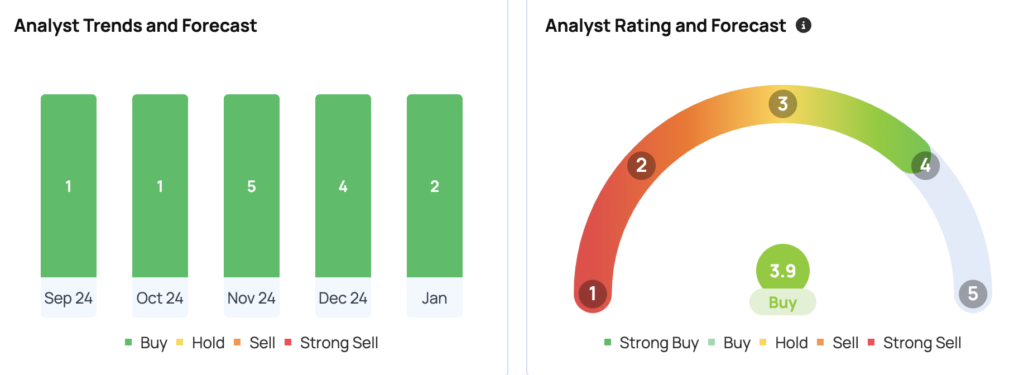

Chewy has a consensus price target of $35.19. The high target is $42, and the low is $25. Recent ratings suggest a $39 target, implying a 7.32% upside.

Chewy的共識價格目標爲$35.19。最高目標爲$42,最低目標爲$25。近期評級建議的目標爲$39,意味着7.32%的上行空間。

- Warren Buffett's Berkshire Hathaway Subsidiary Sued Over Unaffordable Loans, 2008-Style Predatory Loan Approval Tactics

- 禾倫·巴菲特的伯克希爾·哈撒韋子公司因無法負擔的貸款和2008年風格的掠奪性貸款審批策略而被起訴。

Image Via Shutterstock

圖片來自Shutterstock。

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

免責聲明:本內容部分使用人工智能工具生成,並經Benzinga編輯審核發佈。

Key growth drivers include Chewy's underpenetrated mobile app, which currently accounts for about 20% of revenues but could exceed 40-50% penetration over the next 12-24 months. The company's automation initiatives have already reduced order-to-delivery times by 10% while cutting fulfillment costs by 30% across 40% of volumes.

Key growth drivers include Chewy's underpenetrated mobile app, which currently accounts for about 20% of revenues but could exceed 40-50% penetration over the next 12-24 months. The company's automation initiatives have already reduced order-to-delivery times by 10% while cutting fulfillment costs by 30% across 40% of volumes.