Whales with a lot of money to spend have taken a noticeably bullish stance on Alibaba Gr Hldgs.

Looking at options history for Alibaba Gr Hldgs (NYSE:BABA) we detected 36 trades.

If we consider the specifics of each trade, it is accurate to state that 58% of the investors opened trades with bullish expectations and 25% with bearish.

From the overall spotted trades, 8 are puts, for a total amount of $1,542,948 and 28, calls, for a total amount of $1,774,458.

From the overall spotted trades, 8 are puts, for a total amount of $1,542,948 and 28, calls, for a total amount of $1,774,458.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $30.0 to $150.0 for Alibaba Gr Hldgs during the past quarter.

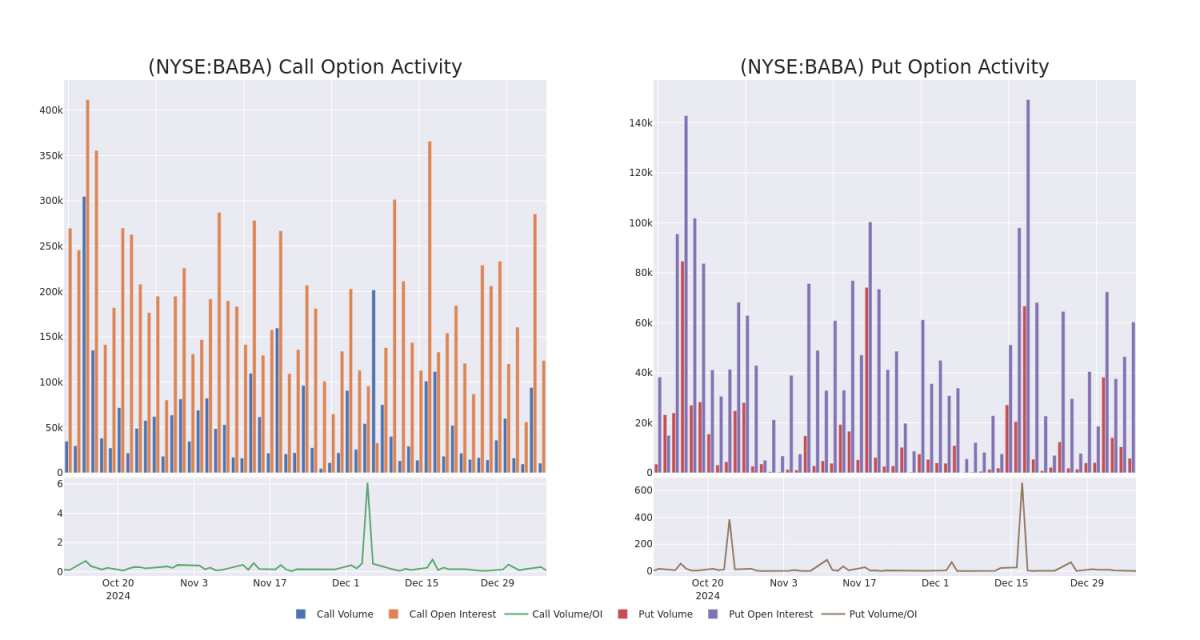

Volume & Open Interest Trends

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Alibaba Gr Hldgs's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Alibaba Gr Hldgs's whale trades within a strike price range from $30.0 to $150.0 in the last 30 days.

Alibaba Gr Hldgs 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|

| BABA | PUT | TRADE | BULLISH | 03/21/25 | $3.1 | $3.0 | $3.02 | $80.00 | $906.0K | 12.1K | 3.0K |

| BABA | PUT | TRADE | NEUTRAL | 04/17/25 | $6.05 | $5.95 | $6.0 | $85.00 | $228.0K | 1.7K | 390 |

| BABA | CALL | SWEEP | BULLISH | 01/16/26 | $13.75 | $13.65 | $13.75 | $85.00 | $206.2K | 1.5K | 172 |

| BABA | CALL | SWEEP | BULLISH | 01/16/26 | $2.23 | $2.13 | $2.15 | $150.00 | $123.4K | 15.7K | 1.2K |

| BABA | PUT | TRADE | NEUTRAL | 03/21/25 | $1.66 | $1.52 | $1.59 | $75.00 | $119.2K | 7.3K | 757 |

About Alibaba Gr Hldgs

Alibaba is the world's largest online and mobile commerce company as measured by gross merchandise volume. It operates China's online marketplaces, including Taobao (consumer-to-consumer) and Tmall (business-to-consumer). The China commerce retail division is the most valuable cash flow-generating business at Alibaba. Additional revenue sources include China commerce wholesale, international commerce retail/wholesale, local consumer services, cloud computing, digital media and entertainment platforms, Cainiao logistics services, and innovation initiatives/other.

After a thorough review of the options trading surrounding Alibaba Gr Hldgs, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of Alibaba Gr Hldgs

- Currently trading with a volume of 5,604,336, the BABA's price is down by -0.72%, now at $84.9.

- RSI readings suggest the stock is currently may be approaching oversold.

- Anticipated earnings release is in 29 days.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Alibaba Gr Hldgs with Benzinga Pro for real-time alerts.

大量资金的大户对阿里巴巴集团的态度明显看好。

查看阿里巴巴集团(纽交所:BABA)的期权历史,我们发现了36笔交易。

如果考虑每笔交易的具体情况,准确来说,58%的投资者以看好的预期开盘,25%以看淡的预期开盘。

从整体观察到的交易中,8笔是看跌期权,总金额为$1,542,948,28笔是看涨期权,总金额为$1,774,458。

从整体观察到的交易中,8笔是看跌期权,总金额为$1,542,948,28笔是看涨期权,总金额为$1,774,458。

预期价格变动

通过分析这些合约的成交量和持仓量,可以看出在过去一个季度,大玩家盯上了阿里巴巴集团的价格区间从$30.0到$150.0。

成交量和未平仓量趋势

观察成交量和持仓量在交易期权时是一个强有力的举动。这个数据可以帮助你追踪阿里巴巴集团在特定执行价格的期权的流动性和关注度。以下,我们可以观察到在过去30天内,阿里巴巴集团的所有大宗交易的看涨和看跌期权的成交量和持仓量的演变,执行价格范围从$30.0到$150.0。

阿里巴巴集团(Alibaba Gr Hldgs)30天期权成交量和持仓量截图

最大的期权交易:

Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|

BABA | PUT | TRADE | BULLISH | 03/21/25 | $3.1 | $3.0 | $3.02 | $80.00 | $906.0K | 12.1K | 3.0K |

BABA | PUT | TRADE | NEUTRAL | 04/17/25 | $6.05 | $5.95 | $6.0 | $85.00 | $228.0K | 1.7K | 390 |

BABA | CALL | SWEEP | BULLISH | 01/16/26 | $13.75 | $13.65 | $13.75 | $85.00 | $206.2K | 1.5K | 172 |

BABA | CALL | SWEEP | BULLISH | 01/16/26 | $2.23 | $2.13 | $2.15 | $150.00 | $123.4K | 15.7K | 1.2K |

BABA | PUT | TRADE | NEUTRAL | 03/21/25 | $1.66 | $1.52 | $1.59 | $75.00 | $119.2K | | |

关于阿里巴巴集团控股

阿里巴巴是全球最大的在线和移动商务公司,按交易总额计算。它运营着中国的在线市场,包括淘宝(消费者对消费者)和天猫(企业对消费者)。中国商务零售部门是阿里巴巴最有价值的现金流产生业务。其他收入来源包括中国商务批发、国际商务零售/批发、本地消费服务、云计算服务商、数字媒体和娱乐平台、菜鸟物流服务以及创新倡议/其他。

在对阿里巴巴集团的期权交易进行全面审查后,我们开始更详细地检查该公司。这包括对其当前市场状态和表现的评估。

阿里巴巴集团控股的当前持仓

检测到期权异动:聪明资金正在行动

Benzinga Edge的期权异动板块在市场发生变化之前发现潜在的市场动向。看看大资金在你喜欢的股票上采取了什么仓位。点击这里获取访问权限。

交易期权涉及更大的风险,但也提供了更高收益的潜力。精明的交易者通过持续教育、策略性交易调整、利用各种因子,并紧跟市场动态来降低这些风险。通过Benzinga Pro跟踪最新的阿里巴巴期权交易,获取实时提醒。

从整体观察到的交易中,8笔是看跌期权,总金额为$1,542,948,28笔是看涨期权,总金额为$1,774,458。

从整体观察到的交易中,8笔是看跌期权,总金额为$1,542,948,28笔是看涨期权,总金额为$1,774,458。

From the overall spotted trades, 8 are puts, for a total amount of $1,542,948 and 28, calls, for a total amount of $1,774,458.

From the overall spotted trades, 8 are puts, for a total amount of $1,542,948 and 28, calls, for a total amount of $1,774,458.