Financial giants have made a conspicuous bullish move on Rivian Automotive. Our analysis of options history for Rivian Automotive (NASDAQ:RIVN) revealed 17 unusual trades.

Delving into the details, we found 52% of traders were bullish, while 47% showed bearish tendencies. Out of all the trades we spotted, 8 were puts, with a value of $423,053, and 9 were calls, valued at $501,941.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $10.0 to $25.0 for Rivian Automotive over the recent three months.

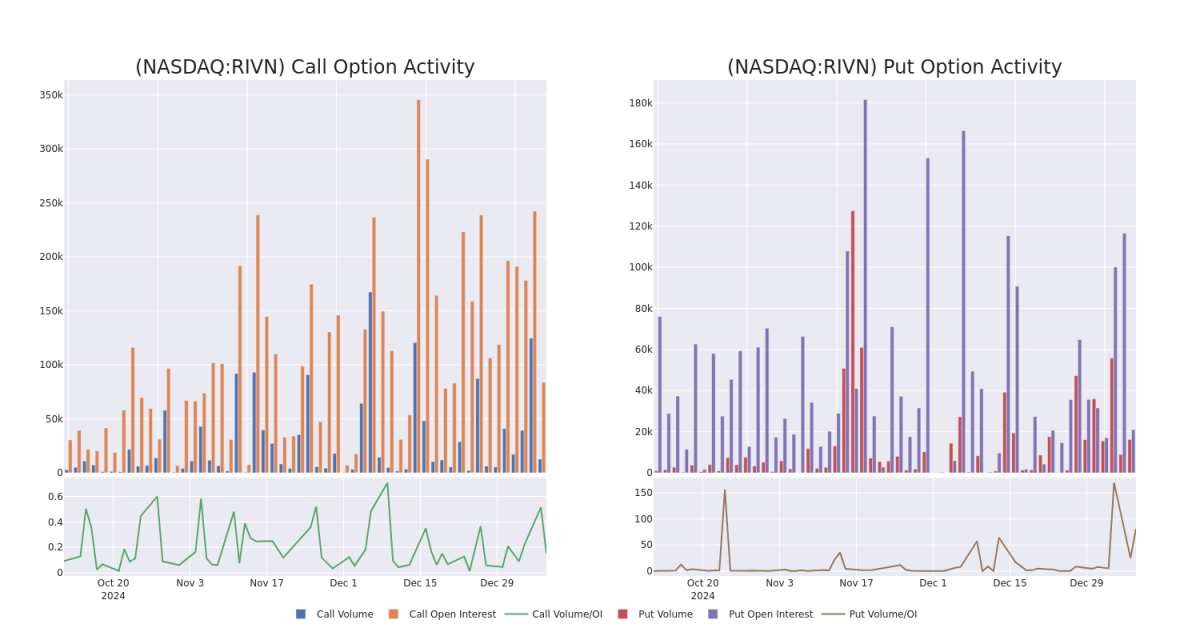

Volume & Open Interest Trends

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Rivian Automotive's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Rivian Automotive's whale trades within a strike price range from $10.0 to $25.0 in the last 30 days.

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Rivian Automotive's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Rivian Automotive's whale trades within a strike price range from $10.0 to $25.0 in the last 30 days.

Rivian Automotive 30-Day Option Volume & Interest Snapshot

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| RIVN | CALL | SWEEP | BULLISH | 01/10/25 | $0.35 | $0.34 | $0.34 | $16.50 | $150.9K | 7.6K | 1.2K |

| RIVN | PUT | TRADE | BEARISH | 03/21/25 | $9.45 | $9.4 | $9.45 | $25.00 | $140.8K | 4 | 300 |

| RIVN | CALL | TRADE | BULLISH | 03/21/25 | $2.35 | $2.3 | $2.35 | $15.00 | $94.0K | 16.8K | 495 |

| RIVN | PUT | SWEEP | BULLISH | 03/21/25 | $3.25 | $3.2 | $3.2 | $17.50 | $52.4K | 4.2K | 1 |

| RIVN | PUT | SWEEP | BULLISH | 02/21/25 | $3.4 | $3.35 | $3.35 | $18.00 | $51.2K | 367 | 865 |

About Rivian Automotive

Rivian Automotive Inc designs, develops, and manufactures category-defining electric vehicles and accessories. In the consumer market, the company launched the R1 platform with the first generation of consumer vehicles: the R1T, a two-row, five-passenger pickup truck, and the R1S, a three-row, seven-passenger sport utility vehicle (SUV).

In light of the recent options history for Rivian Automotive, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Rivian Automotive's Current Market Status

- Currently trading with a volume of 22,526,055, the RIVN's price is up by 1.37%, now at $15.93.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 44 days.

Professional Analyst Ratings for Rivian Automotive

3 market experts have recently issued ratings for this stock, with a consensus target price of $13.666666666666666.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* Reflecting concerns, an analyst from Baird lowers its rating to Neutral with a new price target of $16.* Reflecting concerns, an analyst from Truist Securities lowers its rating to Hold with a new price target of $12.* In a cautious move, an analyst from Cantor Fitzgerald downgraded its rating to Overweight, setting a price target of $13.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Rivian Automotive with Benzinga Pro for real-time alerts.