Whales with a lot of money to spend have taken a noticeably bearish stance on GameStop.

Looking at options history for GameStop (NYSE:GME) we detected 30 trades.

If we consider the specifics of each trade, it is accurate to state that 23% of the investors opened trades with bullish expectations and 46% with bearish.

From the overall spotted trades, 17 are puts, for a total amount of $757,990 and 13, calls, for a total amount of $493,365.

From the overall spotted trades, 17 are puts, for a total amount of $757,990 and 13, calls, for a total amount of $493,365.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $5.0 and $125.0 for GameStop, spanning the last three months.

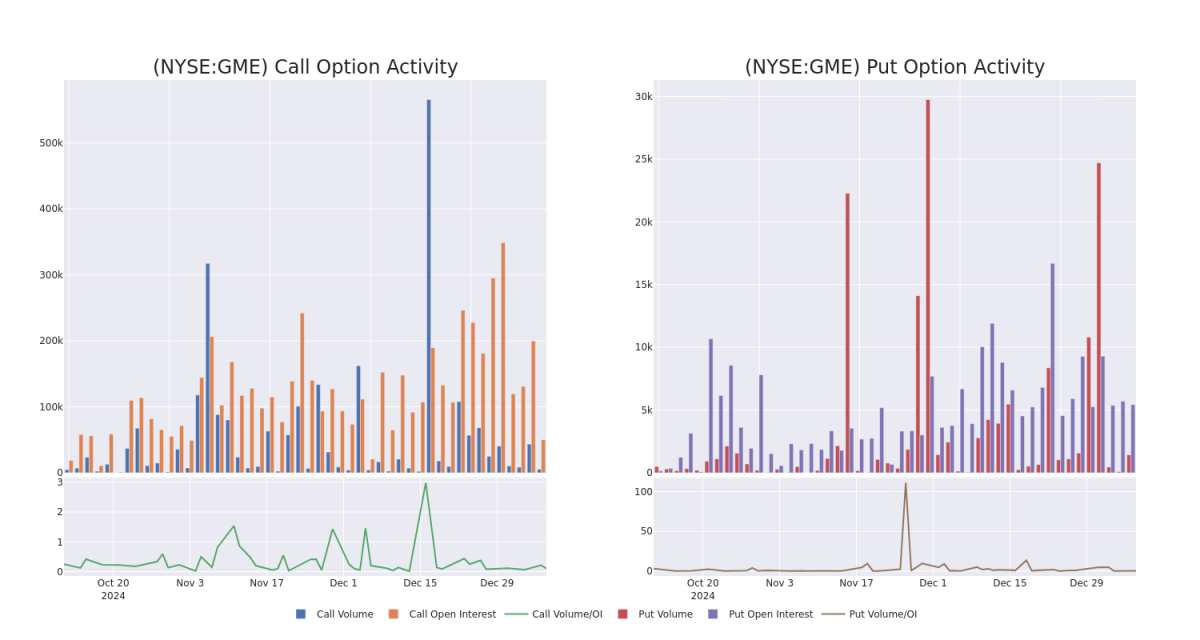

Volume & Open Interest Development

In today's trading context, the average open interest for options of GameStop stands at 4273.08, with a total volume reaching 6,735.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in GameStop, situated within the strike price corridor from $5.0 to $125.0, throughout the last 30 days.

GameStop Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GME | CALL | SWEEP | BULLISH | 02/21/25 | $5.9 | $5.75 | $5.9 | $30.00 | $85.5K | 4.4K | 380 |

| GME | PUT | SWEEP | NEUTRAL | 01/16/26 | $96.1 | $92.6 | $94.8 | $125.00 | $56.8K | 5.4K | 137 |

| GME | PUT | SWEEP | NEUTRAL | 01/16/26 | $96.45 | $92.5 | $94.8 | $125.00 | $56.8K | 5.4K | 129 |

| GME | PUT | TRADE | BEARISH | 01/16/26 | $95.9 | $92.15 | $94.8 | $125.00 | $56.8K | 5.4K | 123 |

| GME | PUT | SWEEP | BULLISH | 01/16/26 | $96.45 | $94.8 | $94.8 | $125.00 | $56.8K | 5.4K | 93 |

About GameStop

GameStop Corp is a U.S. multichannel video game, consumer electronics, and services retailer. The company operates across Europe, Canada, Australia, and the United States. GameStop sells new and second-hand video game hardware, physical and digital video game software, and video game accessories, mainly through GameStop, EB Games, and Micromania stores and international e-commerce sites. The majority of sales are from the United States.

After a thorough review of the options trading surrounding GameStop, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

GameStop's Current Market Status

- With a trading volume of 5,368,738, the price of GME is down by -0.2%, reaching $32.76.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 77 days from now.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.