Deep-pocketed investors have adopted a bearish approach towards Taiwan Semiconductor (NYSE:TSM), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in TSM usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 118 extraordinary options activities for Taiwan Semiconductor. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 33% leaning bullish and 51% bearish. Among these notable options, 56 are puts, totaling $6,557,375, and 62 are calls, amounting to $5,032,902.

What's The Price Target?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $65.0 and $310.0 for Taiwan Semiconductor, spanning the last three months.

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $65.0 and $310.0 for Taiwan Semiconductor, spanning the last three months.

Insights into Volume & Open Interest

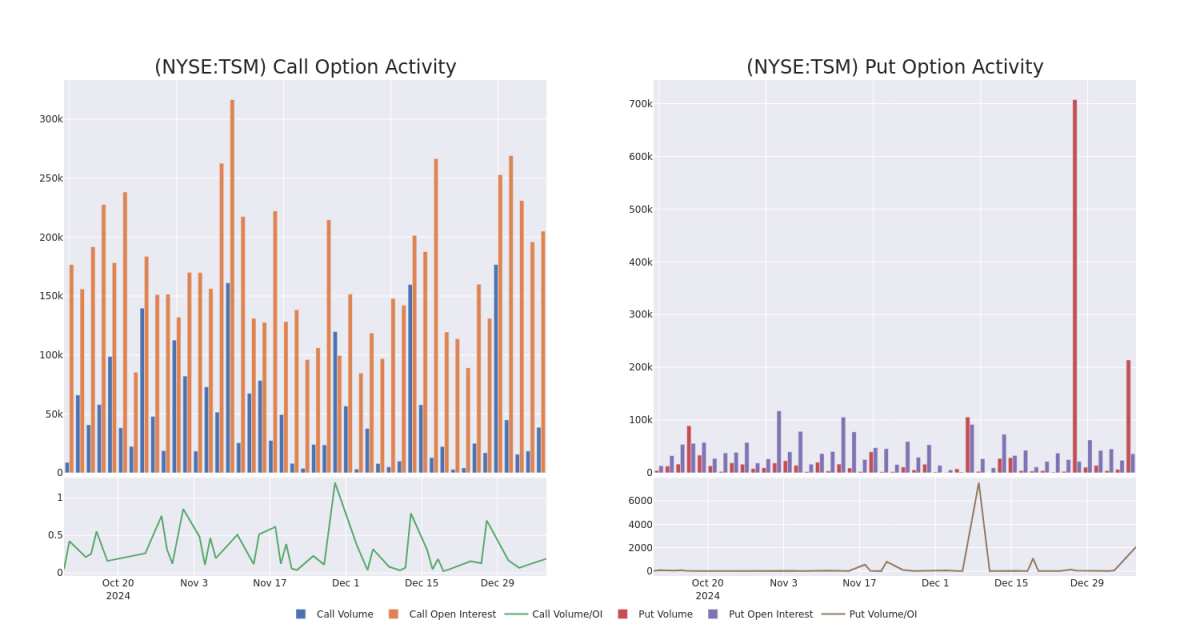

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Taiwan Semiconductor's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Taiwan Semiconductor's whale trades within a strike price range from $65.0 to $310.0 in the last 30 days.

Taiwan Semiconductor Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TSM | PUT | TRADE | BEARISH | 06/20/25 | $8.0 | $7.85 | $7.99 | $180.00 | $1.5M | 1.7K | 2.0K |

| TSM | PUT | TRADE | BULLISH | 07/18/25 | $10.75 | $10.55 | $10.56 | $185.00 | $1.0M | 127 | 1.0K |

| TSM | PUT | SWEEP | NEUTRAL | 02/21/25 | $30.35 | $29.45 | $29.96 | $240.00 | $597.9K | 53 | 300 |

| TSM | CALL | SWEEP | BULLISH | 01/17/25 | $9.7 | $9.6 | $9.7 | $210.00 | $291.0K | 24.8K | 2.5K |

| TSM | PUT | TRADE | BEARISH | 01/16/26 | $13.6 | $13.5 | $13.6 | $175.00 | $238.0K | 1.4K | 281 |

About Taiwan Semiconductor

Taiwan Semiconductor Manufacturing Co. is the world's largest dedicated chip foundry, with over 60% market share. TSMC was founded in 1987 as a joint venture of Philips, the government of Taiwan, and private investors. It went public as an ADR in the us in 1997. TSMC's scale and high-quality technology allow the firm to generate solid operating margins, even in the highly competitive foundry business. Furthermore, the shift to the fabless business model has created tailwinds for TSMC. The foundry leader has an illustrious customer base, including Apple, AMD, and Nvidia, that looks to apply cutting-edge process technologies to its semiconductor designs. TSMC employs more than 73,000 people.

Following our analysis of the options activities associated with Taiwan Semiconductor, we pivot to a closer look at the company's own performance.

Present Market Standing of Taiwan Semiconductor

- Currently trading with a volume of 8,980,779, the TSM's price is down by -2.75%, now at $213.96.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 9 days.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Taiwan Semiconductor options trades with real-time alerts from Benzinga Pro.