① The Shanghai Stock Exchange announced that Changchun Up Optotech and its sponsor GTJA withdrew their application for the issuance and listing, deciding to terminate its review for listing on the Star board; ② Before the IPO was terminated, Changchun Up Optotech had been inquired by the Shanghai Stock Exchange about related transactions, the rationality of the valuation, and whether it harmed the interests of public investors, and it wasn't until February 2024 that Changchun Up Optotech responded.

On January 8, the Star Daily reported (Reporter Chen Junqing) that the information from the Shanghai Stock Exchange's official website on January 7 showed that Changchun Up Optotech Co., Ltd. (hereinafter referred to as: Changchun Up Optotech) and its sponsor GTJA Securities Co., Ltd. have withdrawn their application for issuance and listing, deciding to terminate its review for listing on the Star board.

Changchun Up Optotech was established in 2012, emerging from the "new China optical cradle" at the Changchun Institute of Optics, Fine Mechanics and Physics of the Chinese Academy of Sciences. The prospectus shows that the company’s main business is the research, design, testing, sales of high-performance CMOS image Sensors, and related customization services.

The Star Daily reporter noticed that companies incubated by the Changchun Institute of Optics have begun to seek listing on the Star board intensively. Among them, Changchun Huaxin has been listed and traded on the Star board since April 1, 2022; the Changchun Satellite's IPO on the Star board was terminated on December 4, 2024; and Changchun Up Optotech's IPO application on the Star board was terminated on January 7, 2025.

The Star Daily reporter noticed that companies incubated by the Changchun Institute of Optics have begun to seek listing on the Star board intensively. Among them, Changchun Huaxin has been listed and traded on the Star board since April 1, 2022; the Changchun Satellite's IPO on the Star board was terminated on December 4, 2024; and Changchun Up Optotech's IPO application on the Star board was terminated on January 7, 2025.

Cash dividends, large stock payments, etc. led to losses.

For this IPO, Changchun Up Optotech initially planned to raise 1.557 billion yuan. The funds were intended for the research and industrialization projects of a series of CMOS image Sensors aimed at machine vision, scientific instruments, professional imaging, and medical imaging fields, as well as the construction project of a high-end CMOS image Sensors research center, and to supplement working capital.

In terms of finances, the revenue growth rate of Changchun Up Optotech has fluctuated significantly. From 2020 to 2022, the company’s revenue growth was relatively fast, amounting to 0.198 billion yuan, 0.411 billion yuan, and 0.604 billion yuan respectively. However, in 2023, the growth trend reversed, remaining nearly the same as in 2022, at 0.605 billion yuan.

It is worth mentioning that Changchun Up Optotech turned a profit in 2023. From 2020 to 2023, the net income attributable to the parent company was 59.3872 million yuan, -33.1685 million yuan, -83.1481 million yuan, and 0.174 billion yuan respectively.

Changchun Up Optotech's losses in 2021 and 2022 were mainly due to cash dividends and the recognition of significant share-based payment expenses. Its prospectus mentioned that high share-based payment costs resulted in negative net income attributable to the parent company in the last two years and a risk of cumulative unremedied losses at the end of the last year.

In terms of dividends, in 2020 and 2021, Changchun Up Optotech distributed cash dividends of 14.75 million yuan and 22.125 million yuan respectively.

Regarding share-based payments, from 2021 to 2022, Changchun Up Optotech implemented an employee stock ownership plan. Based on the grant date confirmed by the signed agreement and the fair value of equity instruments near the grant date, the specific amounts for share-based payment expenses recognized in 2021 and 2022 were 0.215 billion yuan and 0.377 billion yuan respectively.

The recognition of significant share-based payment expenses directly led to negative net income attributable to the parent company from 2021 to 2022, and resulted in cumulative unremedied losses at the end of 2022, thereby creating a possibility that it may not be able to distribute cash dividends for a certain period.

The rationality of the hundred billion valuation has faced inquiries.

Before the termination of this IPO, Changchun Up Optotech was queried by the Shanghai Stock Exchange in July 2023. The Exchange raised questions regarding its related party transactions, valuation rationality, and whether it harms the interests of public investors, and Changchun Up Optotech only responded in February 2024.

In terms of related party transactions, from 2020 to 2022, Changchun Up Optotech's revenue experienced significant growth driven by customer A's demands. However, in the first half of 2023, the company's sales revenue from customer A was halved. During the aforementioned period, the related sales from customer A were 35.0595 million yuan, 87.8228 million yuan, 0.136 billion yuan, and 0.111 billion yuan, accounting for 17.7%, 21.39%, 22.58%, and 18.21% of the total revenue respectively.

In the latest response, Changchun Up Optotech indicated that customer A has gradually began purchasing high-performance CMOS image sensor products and customized services from it. During the course of its operational development, Changchun Up Optotech continued to have related party transactions with customer A. The decline in sales revenue in 2023 was primarily due to the impact of customer project phases, which resulted in a reduction in the number of customized chip products sold to them.

Due to cash dividends, large share payments, and other reasons mentioned above, Changchun Up Optotech has substantial accumulated unremedied losses that must be shared by both new and old shareholders, and cash dividends cannot be made within a certain period. In this regard, the Exchange inquired whether this action harms the interests of public investors.

Changchun Up Optotech responded that the company plans to distribute dividends based on its accumulated operation from 2018 to 2021 and has continued to incur share payment expenses from 2016 to 2023 for incentive purposes, expecting to eliminate all accumulated unremedied losses by the first half of 2024, thus there is no harm to the interests of public investors.

It is noteworthy that in the employee stock ownership plan implemented by Changchun Up Optotech from 2021 to 2022, the fair values granted in July and November 2021 were both based on the assessment report dated October 31, 2021, determining the company valuation at 2.612 billion yuan, while the fair value when granted in October 2022 referred to the company valuation of 10 billion yuan corresponding to the external shareholders' entry in June of that year.

In response, the Exchange raised questions in the inquiry letter, asking Changchun Up Optotech to explain the rationality of its valuation rising from 2.612 billion yuan to 10 billion yuan within a year.

Changchun Up Optotech replied that the significant difference in the company's valuation during the aforementioned two instances primarily included: expected performance growth, scarcity of equity, expectations of listing and liquidity improvement, special shareholder rights premium, and conformance to industry investment logic and indicators range.

The actual controllers Wang Xinyang and Zhang Yanxia hold 47.63% of shares.

Changchun Up Optotech's controlling shareholder is Wang Xinyang, and the actual controllers are Wang Xinyang and Zhang Yanxia.

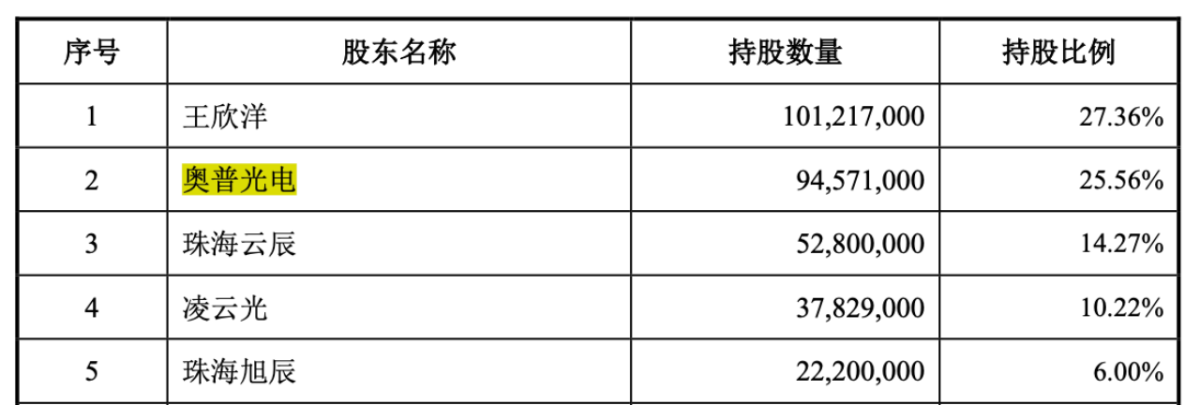

At the time of the listing application, Wang Xinyang directly held 27.36% of the shares of Changchun Up Optotech, indirectly controlling 20.27% of shares through Zhuhai Yuncheng and Zhuhai Xucheng, and with Zhang Yanxia's direct holding of 1.91%, the couple directly and indirectly controlled a total of 49.53% of the shares, making them the actual controllers of the company.

Wang Xinyang graduated from Delft University of Technology in the Netherlands in 2008 with a PhD in Microelectronics and CMOS Image Sensor Design. After graduation, he has been engaged in research on CMOS image sensors, working successively at Cyprus Semiconductor, CMOSIS, and the Changchun Institute of Optics, Fine Mechanics and Physics, Chinese Academy of Sciences. Since September 2012, he has served as the General Manager of Changchun Up Optotech.

Other major shareholders holding more than 5% of the company's shares or voting rights include Changchun Up Optotech, Zhuhai Yunchan, Lingyun Optics, and Zhuhai Xuchen. Among them, Changchun Up Optotech holds 25.56% of Changchun Up Optotech's shares, making it the second-largest single shareholder; Zhuhai Xuchen directly holds 14.27%; Lingyun directly holds 10.22%.

On the evening of January 7, Changchun Up Optotech and Lingyun announced that the review of Changchun Up Optotech's initial public offering and listing on the Star has been terminated, and it will not have a significant adverse impact on the company’s production and operation.

《科创板日报》记者注意到,长春光机所孵化的企业开始密集谋求科创板上市。其中,长光华芯已于2022年4月1日在科创板上市交易;长光卫星科创板IPO于2024年12月4日审核终止;长光辰芯的科创板IPO申请则于2025年1月7日终止。

《科创板日报》记者注意到,长春光机所孵化的企业开始密集谋求科创板上市。其中,长光华芯已于2022年4月1日在科创板上市交易;长光卫星科创板IPO于2024年12月4日审核终止;长光辰芯的科创板IPO申请则于2025年1月7日终止。