Traders abandon bullish options bets as NVIDIA's stock price declines.

According to Zhitong Finance, investors sold a large number of Call Options for NVIDIA (NVDA.US) on Tuesday, with the stock declining after reaching the highest peak since November of last year. Chris Murphy, co-head of derivatives strategy at Susquehanna International Group, stated that during Regular Trading Hours, approximately 0.2 million Call Options expiring on January 17 with a strike price of $140, and about 0.6 to 0.7 million Call Options expiring on February 21 with strike prices ranging from $159 to $165 were effectively sold.

The company had previously announced a wide range of new products, but failed to propel this AI chip manufacturer to new heights. NVIDIA's CEO, Jensen Huang, will deliver a speech on Monday evening at the International Consumer Electronics Show (CES) in Las Vegas, where a series of new products will be launched. In the several trading days leading up to this, there was a large amount of Call buying for the company, but the selling seems to be reversing this trend. NVIDIA's stock price closed down 6.2% on Tuesday to $140.14, erasing a 3.4% gain from Monday and marking the largest one-day decline in four months.

The trading price of NVIDIA has returned to the levels seen last Thursday. Murphy pointed out, "The February Call Options we emphasized last Friday and Monday are being heavily sold, and the Call Options expiring in January with a strike price of around $140 are similarly affected."

The trading price of NVIDIA has returned to the levels seen last Thursday. Murphy pointed out, "The February Call Options we emphasized last Friday and Monday are being heavily sold, and the Call Options expiring in January with a strike price of around $140 are similarly affected."

Analysts noted that although NVIDIA's latest announcements have led to optimism about the company's long-term prospects, the short-term upside potential is not as large as some investors are seeking. A report from Stifel Financial Corp. stated that the information NVIDIA released is significant but pertains to the long term. Other comments mentioned that Huang provided relatively few details about the company’s most profitable business — chips used for training and running AI models, merely noting that its Blackwell AI processors have entered full production.

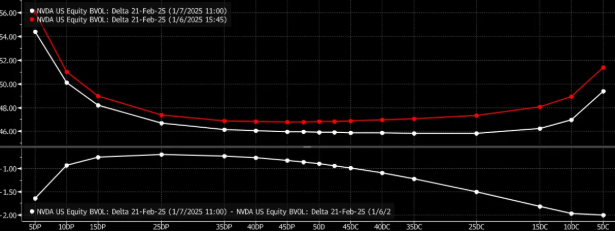

As of the time of publication, the total Volume of options reached 6.73 million, the highest since November 21. The changes in the implied volatility of February options indicate the selling trend, with Call Options trading at a discount compared to bearish Put Options, whereas both were generally consistent on Monday.

Brent Kochuba, founder of SpotGamma, said: "The skew of NVIDIA's stock price saw a significant increase yesterday, it appears that early trading Call Options were really bought up, which means people are actively buying Call Options. Then we observed the most severe sell-off at least in the past 30 days."

Jensen Huang introduced several new products at the "Technology Spring Festival", with ambitious AI strategy.

On Monday, on the stage in Las Vegas, Jensen Huang delivered a keynote speech at the International Consumer Electronics Show (CES), known as the "Technology Spring Festival". He showcased a new lineup and presented a vision of how AI will spread throughout the economy. The company aims for its products to be at the core of the future tech world - targeting 1 billion personal robots, 10 million automated factories, and 1.5 billion self-driving cars and trucks.

As companies compete to deploy new AI computing devices, there is a strong interest in NVIDIA's products and Jensen Huang's predictions. In a speech lasting over 90 minutes, he introduced NVIDIA's products and strategy, including collaborations with Auto Manufacturers Toyota Motor and MediaTek.

Before the drop on Tuesday, NVIDIA's stock price had more than doubled in the past 12 months. During this period, Asian chip suppliers, including Taiwan Semiconductor and Fujifilm Holdings Corporation Unsponsored ADR's parent company Foxconn, also surged due to optimistic sentiment about NVIDIA's prospects.

NVIDIA's Chief Financial Officer Colette Kress stated at another event that the AI transformation will continue to drive growth over the next decade. On Tuesday, she mentioned in a talk with JPMorgan: "It will accompany us for the next decade and even longer. We still have many growth opportunities ahead."

AI Gaming Chips

During Monday's speech, Jensen Huang announced a range of new products, including a new type of GeForce graphics processing unit (GPU) for gaming computers, which NVIDIA claims is based on Blackwell design. The new GeForce 50 series graphics cards will create a more realistic experience for computer gamers. Traditional graphics chips build images by calculating shadows for each pixel, while the new technology will rely more on AI to predict the next frame image.

The flagship RTX 5090 model will be launched later this month at a price of $1999, followed by slightly weaker graphics cards. The RTX 5070, priced at $549, will be available in February and will outperform the previous generation's top model, the RTX 4090. NVIDIA stated that laptops using this chip will also have longer battery life. The company also mentioned that high-performance desktop users will not have to sacrifice a more responsive gaming experience for a more realistic one.

In 2022, gaming was still NVIDIA's largest source of sales. Now, the chip manufacturer's datacenter business is much larger. Due to the popularity of the company’s accelerator chips among the world's largest technology companies, the datacenter business is expected to contribute over $100 billion this year. NVIDIA's next step is to introduce hardware and software to more enterprises and government institutions to diversify its revenue.

Autonomous Driving

Jensen Huang announced that Toyota Motor, the world's largest auto manufacturer, is now a customer of NVIDIA's autonomous driving AI products and will use its Drive chips and software. NVIDIA will collaborate with Toyota Motor to develop the next generation of autonomous vehicles, and NVIDIA's automotive business is expected to expand to $5 billion by fiscal year 2026. Jensen Huang stated that this sector is the next market that could reach trillions of dollars.

Jensen Huang stated that Drive OS has become the first certified programmable AI computing functional safety software, reaching the highest automotive safety standard, ASIL-D. Huang also announced the companies with which NVIDIA is collaborating in the automotive field, including domestic manufacturers such as BYD, Lixiang, Xiaomi, and ZEEKR.

NVIDIA stated that expanding AI to more physical worlds will change industries valued at $50 trillion. However, this move will also bring challenges. Robots and cars will need software that can safely handle the complexities of real life. Huang mentioned that NVIDIA created Nvidia Cosmos to help robots become smarter and to produce fully autonomous driving vehicles.

Cosmos technology can create videos from inputs such as text. This video then serves as the basis for virtual training, helping to reduce reliance on costly and time-consuming real-world experiments. The generated videos can be searched and refined for repeated testing of important but rare events—such as a car encountering an emergency vehicle.

NVIDIA is also working with Uber Technologies (UBER.US) to develop autonomous driving technology. The millions of rides handled by Uber each day will provide a vast amount of data for training AI models.

NVIDIA stated that mass-market Auto Manufacturers will shift to using a single computer and operating system across all models, rather than systems divided by vehicle categories. The company believes that this shift will lay the groundwork for broader adoption of the chip design company's comprehensive products. To speed up this process, NVIDIA has already secured certification for its products from government transportation safety organizations.

AI Supercomputer

Jensen Huang also revealed that NVIDIA is developing the world's smallest AI supercomputer. He stated that NVIDIA is working on a project named 'Project Digits,' which is equipped with NVIDIA's super chip GB10. The super chip GB10, which NVIDIA has included in the $3000 Project Digits, is a combination of a central processing unit and graphics semiconductor—featuring large memory and fast connectivity. The idea is to provide developers with hardware capable of running very large AI models, which current laptops struggle to handle.

This new machine developed in collaboration with MediaTek will run a version of the Linux operating system and is not designed for everyday use. Instead, it is intended to help AI developers work locally in situations where connecting to the cloud or using traditional computers is impractical or impossible.

The reason NVIDIA chose MediaTek to help manufacture the main chip for Digits is that MediaTek has expertise in producing low-power semiconductors. When asked if Project Digits marks NVIDIA's desire to enter the personal computer market more broadly, Jensen Huang stated that this machine is designed for AI developers and students. However, he also hinted that NVIDIA has a larger interest in the industry.

英伟达的交易价格回到了上周四的水平,Murphy指出:“我们在上周五和周一强调的2月份看涨期权正在大举抛售,1月份到期、执行价140美元左右的看涨期权也是如此。”

英伟达的交易价格回到了上周四的水平,Murphy指出:“我们在上周五和周一强调的2月份看涨期权正在大举抛售,1月份到期、执行价140美元左右的看涨期权也是如此。”