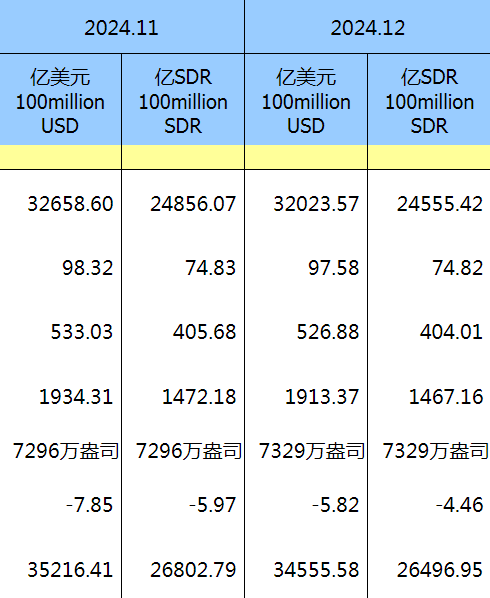

In December 2024, the People's Bank of China continued the momentum of increased shareholding from November, expanding its Gold reserves for two consecutive months after halting for six months. Data released on January 7 by the People's Bank of China shows that the country's Gold reserves at the end of December 2024 were 73.29 million ounces (approximately 2279.58 tons), an increase of 0.33 million ounces (approximately 10.26 tons) compared to the end of November 2024.

People's Bank of China official website

People's Bank of China official websiteWang Qing, Chief Macro Analyst at Orient Jin Cheng, stated that the official Gold reserves increased for two consecutive months at the end of December, in line with market expectations. The central bank's continuous increase in Gold over two months may be related to Trump's election as President of the USA in November, and future changes in international political and economic situations, making international Gold prices likely to remain high for an extended period. This indicates a decreasing necessity to pause Gold increase from a cost control perspective.

Wang Qing noted that for the whole year, the central bank increased its Gold reserves by 1.42 million ounces in 2024, marking the third consecutive year of Gold accumulation. The main reason is the relatively low proportion of Gold reserves in the country's international reserves. As of December 2024, Gold accounts for about 5.5% of China's official international reserve assets, significantly lower than the global average level of around 15%. From the perspective of optimizing the international reserve structure and promoting the internationalization of the RMB, he predicts that the central bank's increase in Gold will continue to be a major trend.

Additionally, according to previous calculations by Guan Tao, Chief Economist at Bank of China Global, from November 2022 to September 2023, there was a strong negative correlation of 0.751 between China's increased Gold reserves and the international Gold price (monthly average). This indicates that China pays more attention to buying low rather than chasing high in the process of increasing Gold reserves.

Additionally, according to previous calculations by Guan Tao, Chief Economist at Bank of China Global, from November 2022 to September 2023, there was a strong negative correlation of 0.751 between China's increased Gold reserves and the international Gold price (monthly average). This indicates that China pays more attention to buying low rather than chasing high in the process of increasing Gold reserves.

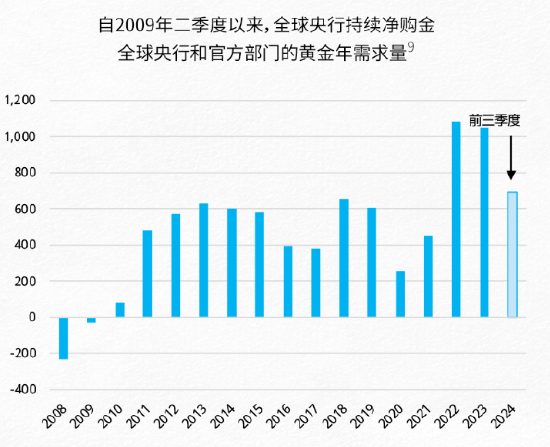

Image source: World Gold Council

Image source: World Gold CouncilOver the past 15 years, Global central banks have continuously net purchased Gold, and the importance of Gold in Forex reserves has been widely recognized. Gold can serve as a long-term value storage tool and an investment risk diversification tool, performing well during crises and having no credit risk. In the context of increasing sovereign debt and geopolitical uncertainties, the role of Gold has been further consolidated.

According to a survey and analysis by the World Gold Council, the current purchasing trend of central banks for Gold will continue. The World Gold Council believes that demand for Gold purchases exceeding 500 tons (close to the long-term trend) will continue to have a positive impact on Gold performance, and that Global central bank demand is expected to exceed this level in 2025. However, if demand falls below this level, it will put additional pressure on Gold prices.

In 2024, driven by the easing of USA monetary policy, rising demand for safe-haven assets, and continued purchases by Global central banks, Gold prices refreshed historical records 40 times, reaching a peak of 2789.95 USD/ounce. For the whole year of 2024, the spot Gold price rose a cumulative 27.23%, marking the largest increase since 2010. However, after Trump won the USA election, boosting the USD, the momentum of Gold prices retreated. Recently, Goldman Sachs adjusted its expectations for Gold prices, extending the timeline for international Gold prices to reach 3000 USD/ounce. Due to the anticipated reduction in the number of interest rate cuts by the Federal Reserve, the pace of international Gold price increases has slowed, but stable demand from central banks remains a key factor for a bullish outlook in the long run.

另据中银全球首席经济学家管涛此前测算,2022年11月—2023年9月,中国增持黄金储备与国际金价(月均)之间为强负相关0.751,这意味着中国在增持黄金储备的过程中更加注意逢低买入而不是追高。

另据中银全球首席经济学家管涛此前测算,2022年11月—2023年9月,中国增持黄金储备与国际金价(月均)之间为强负相关0.751,这意味着中国在增持黄金储备的过程中更加注意逢低买入而不是追高。