Wolfe Research strategists still believe that growth stocks will outperform the market in 2025 and select S&P 500 index constituent stocks that are expected to increase revenue by at least 25%.

Zhitong Finance learned that Wolfe Research strategists still believe that growth stocks will outperform the market in 2025, and have listed stocks that are expected to increase revenue by at least 25% this year. In a recent report, strategists said they prefer cyclical and growth stocks over high quality and value stocks; and prefer small to medium stocks over large cap stocks. They expect the seven tech giants Apple (AAPL.US), Microsoft (MSFT.US), Alphabet (GOOGL.US), Amazon (AMZN.US), Nvidia (NVDA.US), Meta (META.US), and Tesla (TSLA.US) to perform better than other components of the S&P 500 index.

Chris Senyek, chief investment strategist at Wolfe Research, said: “We still believe that solid fundamentals and increased AI spending will drive it to perform better than the S&P 500 this year.”

Furthermore, strategists said that by 2025, revenue growth in the information technology (XLK.US), energy (XLE.US) and communications services (XLC.US) sectors is expected to increase by more than 25%, by 46%, 32%, and 26%, respectively. In contrast, Wolfe analysts said that revenue in the essential consumer goods (XLP.US) sector is not expected to increase significantly; revenue growth in the utilities sector is only 6%, compared to 7% in the materials sector (XLB.US).

Furthermore, strategists said that by 2025, revenue growth in the information technology (XLK.US), energy (XLE.US) and communications services (XLC.US) sectors is expected to increase by more than 25%, by 46%, 32%, and 26%, respectively. In contrast, Wolfe analysts said that revenue in the essential consumer goods (XLP.US) sector is not expected to increase significantly; revenue growth in the utilities sector is only 6%, compared to 7% in the materials sector (XLB.US).

They also forecast real GDP growth in the US of 2.5% in 2025 and 2026, while Wall Street economists' average forecast is 2% -2.1%. He believes that as long as the US does not fall into recession or there are no major changes in AI spending expectations, market concentration will remain at a high level in 2025.

Senyek said, “Economic surprises are on the rise, and we think this trend will continue because we believe consumer and business confidence will rise, as all industries will be deregulated, tax cuts will be extended, and there may be moderate additional tax cuts starting in 2026.”

Furthermore, Wolfe analysts said they believe the weak performance of the stock market in December was a “technical sell-off, as investors may sell stocks to lock in last year's gains.”

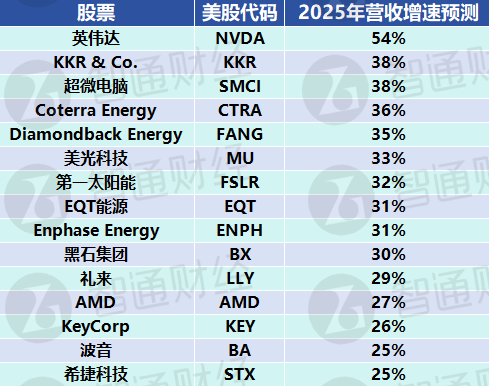

Here are the stocks that Wolfe Research analysts believe will increase revenue by at least 25% among the components of the S&P 500 index in 2025:

此外,策略师们表示,预计到2025年,信息技术(XLK.US)、能源(XLE.US)和通信服务(XLC.US)板块的收入增长幅度将超过25%,分别增长46%、32%和26%。相比之下,Wolfe分析师表示,必需消费品(XLP.US)板块的收入料不会出现大幅增长;公用事业板块收入增幅只有6%,而材料板块(XLB.US)为7%。

此外,策略师们表示,预计到2025年,信息技术(XLK.US)、能源(XLE.US)和通信服务(XLC.US)板块的收入增长幅度将超过25%,分别增长46%、32%和26%。相比之下,Wolfe分析师表示,必需消费品(XLP.US)板块的收入料不会出现大幅增长;公用事业板块收入增幅只有6%,而材料板块(XLB.US)为7%。