Track the latest developments in Southbound Funding

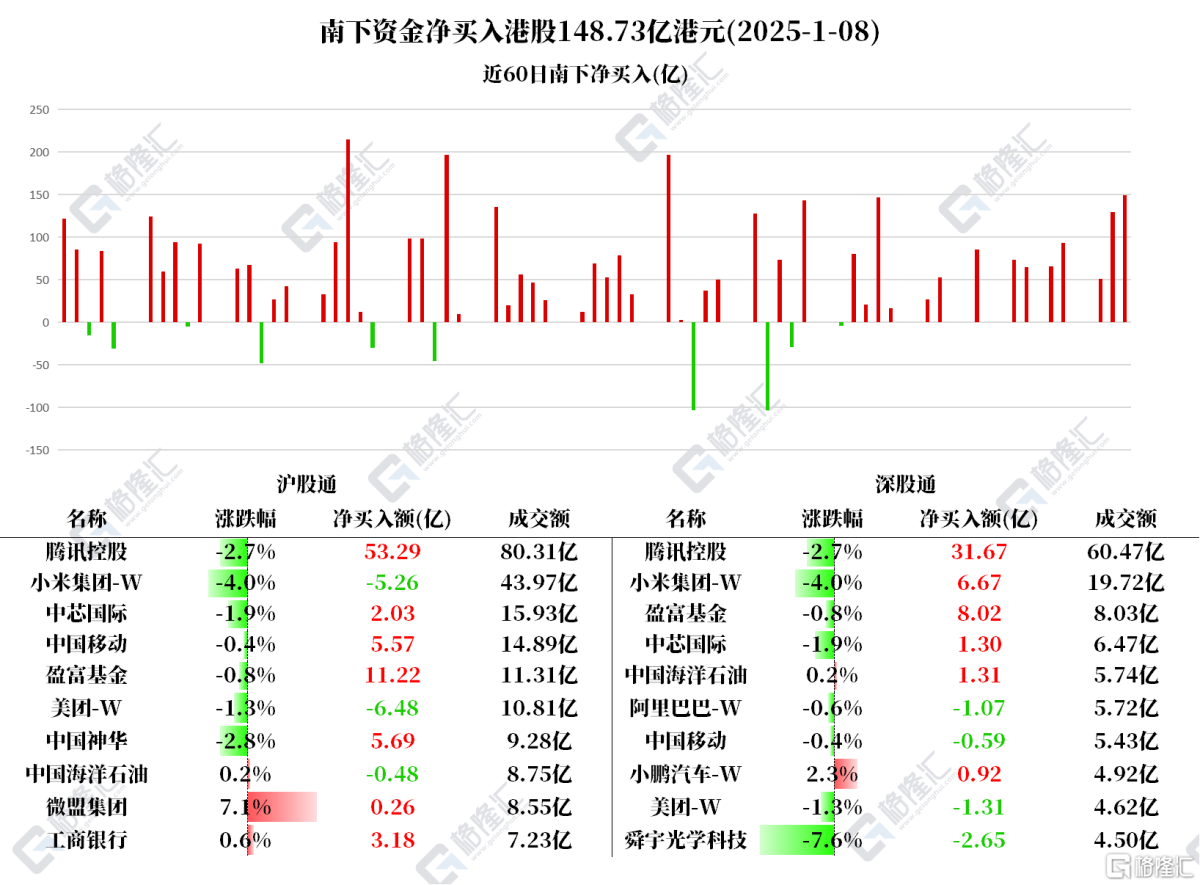

On January 8, Southbound made a net purchase of HK$14.873 billion in Hong Kong stocks.

Among them: net purchases of Tencent Holdings 8.496 billion, Yingfu Fund 1.924 billion, China Shenhua 0.569 billion, China Mobile 0.497 billion, SMIC 0.332 billion, ICBC 0.318 billion, Xiaomi Group-W 0.141 billion; net sales of Meituan-W 0.778 billion and Shunyu Optical Technology 0.265 billion. Tencent fell for two consecutive days from HK$409.4 to HK$369.2 due to US inclusion in the military enterprise list, falling 9.82% on the 2nd. At a time when the stock price fell, Southwest Capital increased its Tencent position by HK$22.486 billion over the past 2 trading days.

According to statistics, Southbound made net purchases of SMIC for 4 consecutive days, totaling HK$1.20129 billion; net purchases of Tencent for 6 consecutive days, totaling HK$23.76,385 billion; and net purchases of China Mobile for 7 consecutive days, totaling HK$4.1985 billion.

According to statistics, Southbound made net purchases of SMIC for 4 consecutive days, totaling HK$1.20129 billion; net purchases of Tencent for 6 consecutive days, totaling HK$23.76,385 billion; and net purchases of China Mobile for 7 consecutive days, totaling HK$4.1985 billion.

Beishui focuses on individual stocks

Tencent Holdings: On January 8, it repurchased 4.05 million shares for HK$1.5 billion, and yesterday it repurchased 3.93 million shares for HK$1.5 billion.

China Shenhua: Bank of America Securities released a research report saying that the coal industry and China's Shenhua were underestimated in 2025 due to limited growth in demand for coal, inventories at historically high levels, and the need to face continued import threats.

China Mobile: Li Pizheng resigned as an executive director of the company due to age, effective January 8, 2025. Wang Limin has been appointed as the company's executive director with effect from January 8, 2025.

SMIC: Bank of China International released a research report saying that looking ahead to 2025, the growth of China's semiconductors will return to average based on the level of 2024. However, thanks to artificial intelligence and the rise of the domestic semiconductor supply chain, the industry is still expected to achieve excellent market performance in 2025.

ICBC: J.P. Morgan Chase upgraded ICBC's rating from “neutral” to “overweight” and raised the target price from HK$5.1 to HK$5.8.