Tandem Diabetes Care, Inc. (NASDAQ:TNDM) shareholders should be happy to see the share price up 23% in the last month. But that is meagre solace in the face of the shocking decline over three years. In that time the share price has melted like a snowball in the desert, down 71%. So it's about time shareholders saw some gains. Only time will tell if the company can sustain the turnaround.

So let's have a look and see if the longer term performance of the company has been in line with the underlying business' progress.

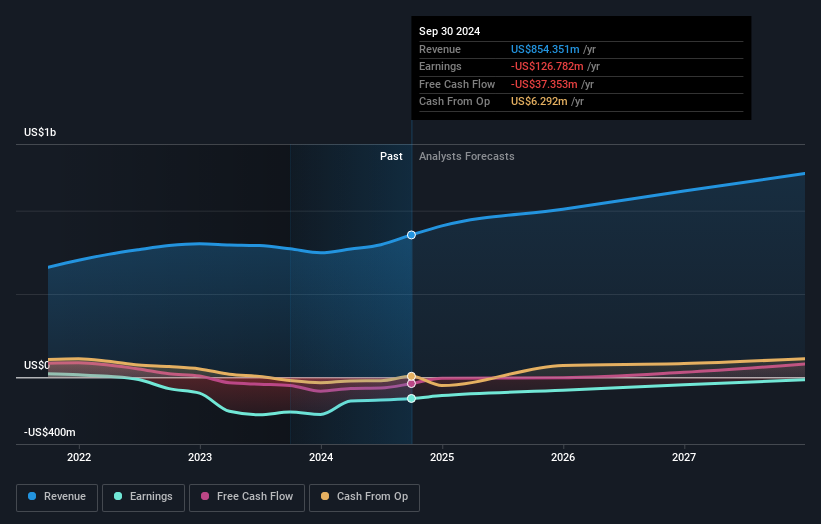

Tandem Diabetes Care isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually desire strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over three years, Tandem Diabetes Care grew revenue at 4.7% per year. Given it's losing money in pursuit of growth, we are not really impressed with that. But the share price crash at 20% per year does seem a bit harsh! While we're definitely wary of the stock, after that kind of performance, it could be an over-reaction. Before considering a purchase, take a look at the losses the company is racking up.

Over three years, Tandem Diabetes Care grew revenue at 4.7% per year. Given it's losing money in pursuit of growth, we are not really impressed with that. But the share price crash at 20% per year does seem a bit harsh! While we're definitely wary of the stock, after that kind of performance, it could be an over-reaction. Before considering a purchase, take a look at the losses the company is racking up.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Tandem Diabetes Care is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. You can see what analysts are predicting for Tandem Diabetes Care in this interactive graph of future profit estimates.

A Different Perspective

It's good to see that Tandem Diabetes Care has rewarded shareholders with a total shareholder return of 32% in the last twelve months. Notably the five-year annualised TSR loss of 8% per year compares very unfavourably with the recent share price performance. This makes us a little wary, but the business might have turned around its fortunes. It's always interesting to track share price performance over the longer term. But to understand Tandem Diabetes Care better, we need to consider many other factors. For example, we've discovered 2 warning signs for Tandem Diabetes Care that you should be aware of before investing here.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.