The stock price doubled in 18 trading days, and with the support of AI glasses, the market value of Connett Optics (02276), a leading lens manufacturer, continued to soar.

The stock price doubled in 18 trading days, and with the support of AI glasses, the market value of Connett Optics (02276), a leading lens manufacturer, continued to soar.

The Zhitong Finance App observed that Connett Optics rose from HK$12.94 on December 11 to a maximum of HK$28.1 over 17 trading days, an increase of more than 110%. The sharp rise during this period may have three major driving factors: first, the AI glasses concept continued to explode, and capital inflows were crazy; second, the company placed shares, which raised about HK$0.828 billion net to develop lenses and vision solutions for smart glasses and XR headsets; and third, the majority shareholders increased their holdings and received an increase in Goertek's holdings of HK$0.679 billion through placement.

In fact, not only has the company surged recently. If you look at the extended cycle, it has continued to be bullish since its listing. It was less than HK$4 in December 2021, and now it has exceeded HK$24, with a cumulative increase of more than 5 times over the period.

In fact, not only has the company surged recently. If you look at the extended cycle, it has continued to be bullish since its listing. It was less than HK$4 in December 2021, and now it has exceeded HK$24, with a cumulative increase of more than 5 times over the period.

This is mainly due to value drivers. The persistence of long-term investors has driven the market value of Connett Optics to break new highs year after year. The company has strong fundamentals. The compound revenue and net profit growth rates in the past five years were 13.54% and 30.72%, respectively. In 2024, it continued to maintain double-digit growth, achieving 17.5% and 31.6% growth respectively. Under the annual dividend policy, core shareholders continue to increase their holdings, holding institutions are reluctant to sell, and multiple factors drive the bullish trend.

AI glasses are booming this time, and smart glasses are on the rise, and many manufacturers have increased their layout. For example, on January 2, Thunderbird Innovation RayNeo and Alibaba Cloud announced that they have reached a strategic cooperation in the field of AI glasses. The Tongyi series of large models will provide exclusive customized technical support for Thunderbird's AI glasses. As a leader in lens manufacturing, Conet Optics will also benefit from a wave of industry investment and maintain high performance growth.

AI glasses expand the industrial chain, and the market prospects are high

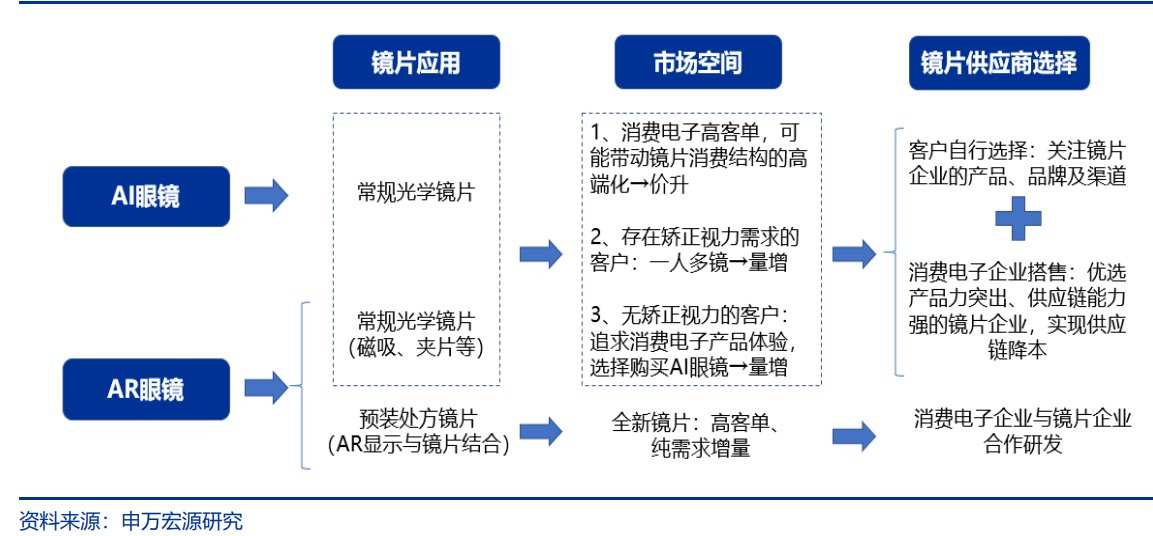

Smart glasses are an ideal AI landing carrier. AI smart glasses mainly perform audio, camera, and AI functions on the frame, but they still use traditional optical lenses and can be divided into camera-less smart glasses, smart glasses with cameras, and smart glasses with a display. Among them, camera-less smart glasses and smart glasses with cameras are relatively mature, while smart glasses with displays are not that mature in technology, and there are few products on the market.

Looking at the corporate layout, Meta released the second-generation Ray-Ban Meta product in September 2023. This year, it became a million-level hit product, sparking an industry boom. Technology companies such as Apple, Huawei, Xiaomi, and Meizu at home and abroad, as well as the comprehensive layout of AI glasses such as Connett, Thunderbird, and NReal. The unit price for AI glasses is not that high. For example, Meta's Ray-Ban Meta smart glasses cost 299 US dollars/pair, which is highly acceptable to the public.

Moreover, on the one hand, AI glasses have expanded the industrial chain and greatly enhanced the market cake of the industrial chain; on the other hand, they have accelerated product iteration, shortened replacement cycles, and released incremental markets. Currently, the industry is in a stage of rapid growth. As the application of AI large model technology matures, AI glasses will fully explode. According to Wellsenn XR Weishen's forecast, global AR glasses sales will be 0.51 million units in 2023, and are expected to reach 1.8 million units by 2027, with a compound growth rate of 37%, and a significant increase to 80 million units by 2030.

The AI glasses sector has ushered in an investment trend. Judging from the Hong Kong stock market, Connett Optics is a leading Hong Kong domestic lens manufacturer. It has 20 years of R&D and operation experience. Its optical factory sales market share is stable at the top of the country, at 9%, which is 3.1 percentage points higher than the second place. As a leader in the industry, the company has always been favored by capital, and its performance and market value have maintained an upward channel since its listing.

The basic market is stable, and AI glasses create a growth point

Connett Optics' main products include standardized lenses and customized lenses. Both products maintained a steady growth trend. Revenue for the first half of 2024 was 0.78 billion yuan and 0.194 billion yuan, respectively, up 18.4% and 13.5% year over year, with revenue shares of 79.7% and 19.9% respectively. Its revenue covers the world, with Asia, Europe and America as the core markets, contributing 30.9%, 24.7% and 23% respectively, contributing 78.6% in total.

The company attaches importance to research and development. It has R&D centers in Shanghai and Jiangsu. The lens products cover all age groups to meet the needs and scenarios of different customer groups, such as panoramic polarized sunglasses, instantaneous non-film chromic film, 3D 6K optimized progressive first-class impact-resistant lenses, etc., and continues to promote high-end product strategies and achieve good results. In 2018-2023, the growth rate of high-end lenses was higher than that of ordinary lenses, driving the unit price of lenses to increase by 33.7% and lens gross margin by 6.3 percentage points.

Conet Optics has adopted different strategies for the two major products. Standardized lenses adopt a high-end strategy and an omni-channel strategy, while customized lenses innovate the C2M business delivery model. The unit price of custom lenses is high, and the gross margin can reach 60%, which is far higher than standardized lenses. Product strategy led to an increase in overall gross margin. The company's gross margin for the first half of 2024 was 39.14%, up 5.22 percentage points from 2021.

In terms of production capacity, the company has three production bases in Shanghai, Jiangsu, and Japan, and is actively expanding overseas production capacity. In July 2024, the company announced that it plans to use 0.196 billion baht to acquire Thai land to build a production base for high refractive index lenses in Thailand.

In fact, although the main business of Connet Optics is lens manufacturing, it also continues to make efforts in AI eyewear research and development. It was announced in December 2024 that various R&D projects of many of the world's leading technology and consumer electronics companies, including many leading US companies, are progressing smoothly. According to signed purchase orders, the company has successively received payments including R&D expenses and small test orders.

At the end of the day, AI glasses are consumer electronics products, and lenses are the core upstream supply chain, and joint research and development is a trend in AI glasses. According to Shenwan Hongyuan Securities Research Report, pre-packaged prescription lenses combining AR displays and optical lenses rely on joint research and development between consumer electronics and lens companies, which place higher demands on lens companies' product development capabilities. Lens manufacturers with leading product technology are expected to stand out and accelerate industry pattern optimization.

Positive returns to shareholders, improving the valuation of leading lens companies

Benefiting from the huge market prospects of AI glasses, Connett Optics is expected to rapidly expand the market with downstream consumer electronics companies with its leading advantages in lens manufacturing, global layout advantages, and production capacity advantages. The capital raised in the December 2024 sale will be used for the R&D, design and manufacture of lenses and vision solutions for smart glasses and XR headsets, and the undertaker is an indirect wholly-owned subsidiary of Goertek, which means that upstream and downstream supply is deeply tied.

Notably, the company announced in November 2024 that it intends to award 11.93 million shares to 7 executives and 148 employees through intense shareholding. The incentives will be unlocked in three installments of 33%/33%/34% year by year. The assessment condition is that net profit returned to mother increased by no less than 21%, 17, and 15% year-on-year in 25-27. This round of incentives fully covers executives and core employees to achieve deep binding of the interests of all parties. In December, a new round of equity incentive plans for 2025 was announced. It is proposed to grant no more than 3% of the company's shares to further bind employees' interests.

Connett's optical base is stable, the two major lens products are steadily expanding the global market, and the AI glasses boom has provided new growth points. This is probably the core reason for its recent acceleration. A number of brokerage investment banks are optimistic about the company's smart glasses business. According to China's Taijunan Research Report, several R&D projects between the company and the world's leading technology and consumer electronics companies are progressing smoothly, and they are optimistic that the smart glasses business will accelerate.

The company also actively rewards shareholders. The annual dividend ratio is around 20%, but since the increase in market capitalization is much higher than performance, the dividend rate is not attractive; it is only 1%. The company has growth expectations, including steady growth in the lens manufacturing business, the acceleration of global expansion after the implementation of production capacity in Thailand, and the rapid expansion of new businesses under the demand for AI glasses. Existing product demand will create a new growth curve under the joint R&D model.

Connett Optics has a large short-term profit market, and there is some pullback pressure. However, the company received the optimism of important shareholders and investment banks, which resonate with market hot spots. Combined with strong fundamentals and growth expectations for new businesses, it is still expected to rise further in the medium to long term, driven by multiple factors.

其实该公司不仅在近期大涨,如果拉长周期看,自上市以来持续走牛,2021年12月份还不到4港元,现如今已超过24港元,期间累计涨幅超5倍。

其实该公司不仅在近期大涨,如果拉长周期看,自上市以来持续走牛,2021年12月份还不到4港元,现如今已超过24港元,期间累计涨幅超5倍。