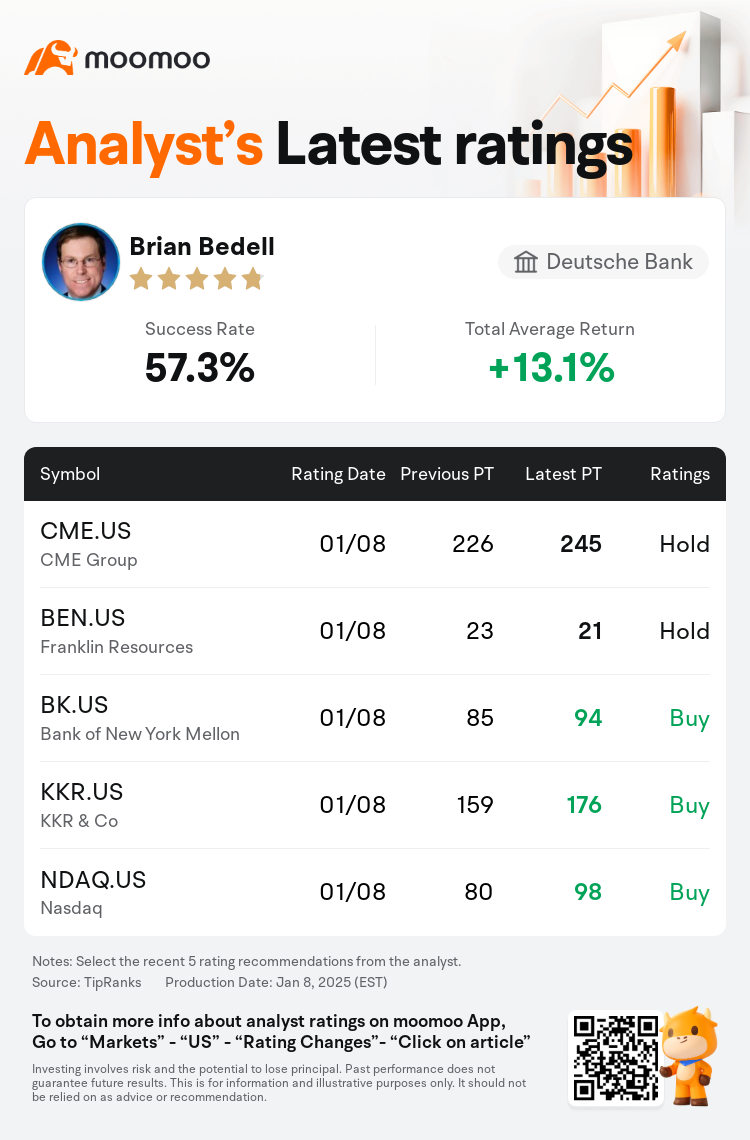

Deutsche Bank analyst Brian Bedell maintains $Franklin Resources (BEN.US)$ with a hold rating, and adjusts the target price from $23 to $21.

According to TipRanks data, the analyst has a success rate of 57.3% and a total average return of 13.1% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Franklin Resources (BEN.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Franklin Resources (BEN.US)$'s main analysts recently are as follows:

The outlook for the brokers, asset managers, and exchanges sector in 2025 appears relatively positive, with the potential for a third consecutive year of 20% or more in total returns in the U.S. equity markets. Key thematic drivers include likely increases in capital markets activity, the possibilities of lighter regulation fostering product innovation and greater capital deployment, and the potential reduction of individual and corporate taxes.

Franklin Resources has seen significant organic decay over the years, which has contributed to earnings downside, multiple compression, and substantial share price underperformance. While outflows are expected to continue, the pace of deterioration may lessen as we approach 2025. The valuation of the stock suggests a limited potential for further downside.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

德意志銀行分析師Brian Bedell維持$Franklin Resources (BEN.US)$持有評級,並將目標價從23美元下調至21美元。

根據TipRanks數據顯示,該分析師近一年總勝率為57.3%,總平均回報率為13.1%。

此外,綜合報道,$Franklin Resources (BEN.US)$近期主要分析師觀點如下:

此外,綜合報道,$Franklin Resources (BEN.US)$近期主要分析師觀點如下:

2025年,券商、資產管理者和交易所的板塊前景相對積極,美國股票市場有可能連續第三年實現20%以上的總回報。關鍵的主題驅動因素包括資本市場活動可能增加、較輕的監管可能促進產品創新與資本更大配置,以及個人和企業稅收潛在減免。

Franklin Resources多年來經歷了顯著的有機衰退,這導致了收益下滑、市盈率壓縮和股價顯著表現不佳。儘管預計資金外流將持續,但隨着2025年的臨近,惡化的速度可能會減緩。該股票的估值表明進一步下行的潛力有限。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$Franklin Resources (BEN.US)$近期主要分析師觀點如下:

此外,綜合報道,$Franklin Resources (BEN.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of