Trump Media Stock Climbs 104%: Bullish Technicals, Inauguration Rally Drive Volatility

Trump Media Stock Climbs 104%: Bullish Technicals, Inauguration Rally Drive Volatility

Is Trump Media & Technology Group Corp. (NASDAQ:DJT) stock climbing on optimism or concrete signals? The stock has surged 104% over the past year, with its rally appearing to align with President-elect Donald Trump's upcoming return to the White House.

特朗普媒體與科技集團公司(納斯達克股票代碼:DJT)股價是否因樂觀情緒或具體信號而上漲?該股在過去一年中飆升了104%,其漲勢似乎與當選總統唐納德·特朗普即將重返白宮一致。

But will the momentum last?

但是這種勢頭會持續嗎?

Technical Tea Leaves: Bullish, With A Dash Of Bear Risk

技術茶葉:看漲,有一點空頭風險

DJT's current trend is technically strong.

DJT目前的趨勢在技術上很強勁。

Chart created using Benzinga Pro

使用 Benzinga Pro 創建的圖表

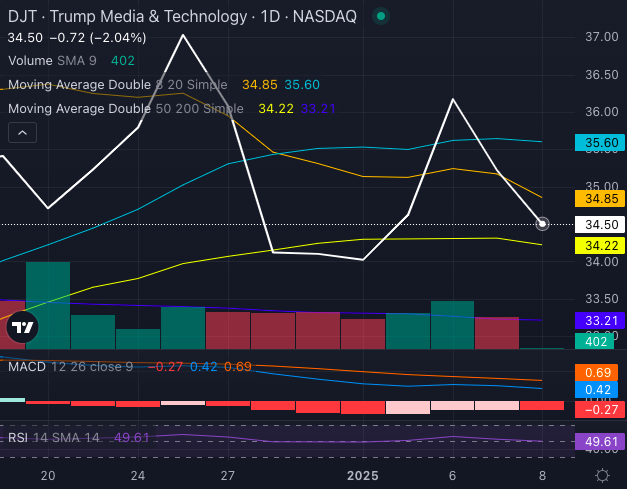

DJT stock, at $34.50, trades above its five, 20 and 50-day exponential moving averages, signaling a bullish outlook. Key indicators paint a mixed picture:

DjT股票價格爲34.50美元,交易價格高於其五、20和50天指數移動平均線,表明前景看漲。關鍵指標描繪了一幅喜憂參半的局面:

- Eight-Day SMA (simple moving average) Bearish Signal: At $34.85, it's just above the stock price, hinting at short-term bearishness.

- 20-Day SMA Bearish Signal: DJT is trading below the $35.60 level, sparking concerns about overextension.

- 50 and 200-Day SMA Bullish: At $34.22 and $33.21 respectively, these moving averages support the bullish case.

- MACD at 0.42: Another bullish indicator, showing positive momentum.

- RSI at 49.61: The stock isn't overheated but inching toward neutral territory, reflecting a balance of buying and selling pressure.

- 八天均線(簡單移動平均線)看跌信號:34.85美元,略高於股價,暗示短期看跌。

- 20日均線看跌信號:DjT的交易價格低於35.60美元,引發了人們對過度擴張的擔憂。

- 50日和200日均線看漲:這些移動平均線分別爲34.22美元和33.21美元,支持看漲勢頭。

- MACD位於0.42:另一個看漲指標,顯示出積極勢頭。

- 相對強弱指數爲49.61:該股沒有過熱,而是小幅走向中性區間,反映了買入和賣出壓力的平衡。

Still, selling pressure could soon weigh on DJT, indicating a risk of bearish movement ahead.

儘管如此,拋售壓力可能很快就會打壓DjT,這表明未來存在看跌走勢的風險。

Impact Of Courtroom Battles

法庭之戰的影響

Tuesday saw DJT stock dip slightly, following a New York court denying Trump's immunity plea in his felony case. The judge's ruling solidified Trump's Jan. 10 sentencing date, just days before his presidential inauguration on Jan. 20.

週二,紐約法院駁回了特朗普在重罪案中的豁免請求,此後,DjT股價小幅下跌。法官的裁決鞏固了特朗普1月10日的宣判日期,就在1月20日總統就職前幾天。

The case stems from a $130,000 hush money payment in the 2016 election cycle, with Trump already convicted of 34 felony counts for falsifying business records.

該案源於2016年大選週期中支付的13萬美元隱性款項,特朗普已經因僞造商業記錄而被判犯有34項重罪。

Despite legal hurdles, Trump Media's parent stock has remained resilient, buoyed by advertising revenue on its Truth Social platform and investor optimism about Trump's 2025 inauguration.

儘管存在法律障礙,但受Truth Social平台廣告收入以及投資者對特朗普2025年就職典禮的樂觀情緒的推動,特朗普媒體的母股仍保持彈性。

Is DJT Stock's Rally Worth Watching?

DjT 股票的漲勢值得關注嗎?

DJT's performance might feel like a rally in lockstep with Trump's political fortunes. While technical indicators lean bullish, the stock faces headwinds—court rulings, selling pressure, and recent dips hint at volatility ahead.

DJT的表現可能感覺像是一場與特朗普政治命運同步的反彈。儘管技術指標傾向於看漲,但該股面臨阻力——法院裁決、拋售壓力和最近的下跌暗示未來將出現波動。

For investors, DJT presents a speculative opportunity worth monitoring closely, trading above key averages amid its inauguration rally, though ongoing legal and political developments add uncertainty to its trajectory.

對於投資者而言,儘管持續的法律和政治事態發展增加了其軌跡的不確定性,但DjT提供了值得密切關注的投機機會,在就職典禮上漲期間的交易價格高於關鍵平均水平。

- Trump Jr. Partners With GrabAGun: What Investors Should Know About E-Commerce Company Set To Trade As 'PEW'

- 小特朗普與GrabaGun合作:對於將以 「PEW」 身份進行交易的電子商務公司,投資者應該了解什麼

Image created using photos from Shutterstock.

使用來自 Shutterstock 的照片創建的圖像。