Regarding the establishment of "Resona Private REIT Investment Corporation".

January 8, 2025.

Resona Real Estate Investment Advisors Co., Ltd.

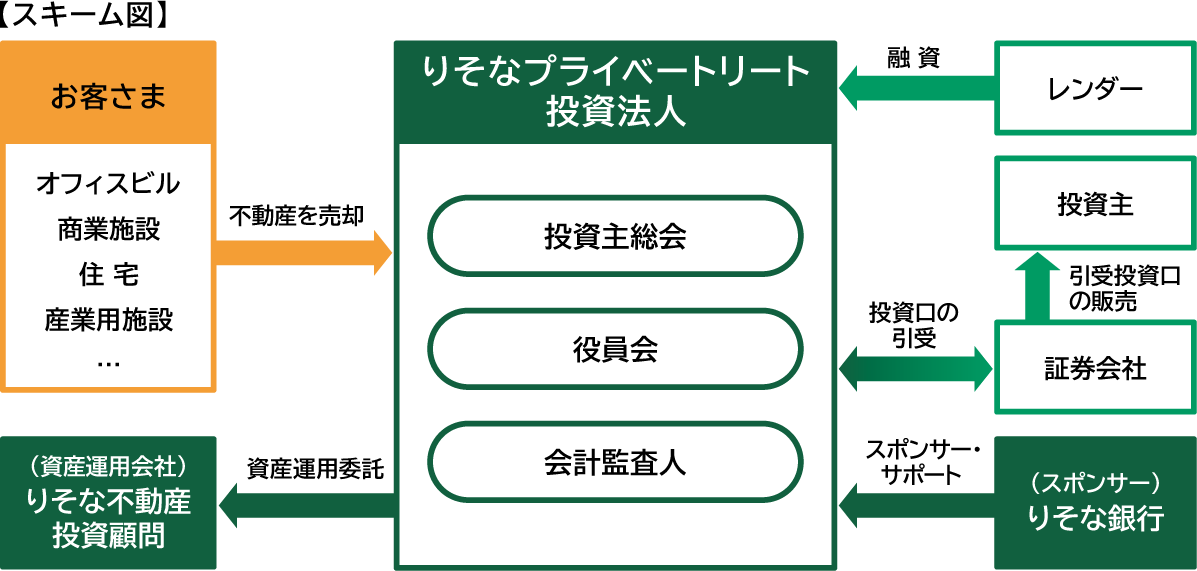

Resona Group's Resona Real Estate Investment Advisors (President Shuhei Fukuda) has established the group's first private REIT, the "Resona Private REIT Investment Corporation," today. It is scheduled to begin operations of this private REIT from March 2025.

- This is a type of Commercial Reits that establishes an investment corporation, issues investment shares in the form of a private offering, raises funds, and engages in the operation of real estate, etc.

It provides medium- to long-term stable investment opportunities to Institutions.

The roles required in the real estate market and for real estate are changing with the times, and the needs for real estate investment are diversifying. Resona Bank established the Real Estate Asset Management Office in 2018 and has accumulated know-how in the management and consulting of private Funds. The know-how cultivated to date will be utilized in the operation of the private REIT, providing Institutions with stable real estate investment opportunities over the medium and long term.

The roles required in the real estate market and for real estate are changing with the times, and the needs for real estate investment are diversifying. Resona Bank established the Real Estate Asset Management Office in 2018 and has accumulated know-how in the management and consulting of private Funds. The know-how cultivated to date will be utilized in the operation of the private REIT, providing Institutions with stable real estate investment opportunities over the medium and long term.

- Resona Real Estate Investment Advisors plans to inherit the operations of the Real Estate Asset Management Office through an absorption-type company split on February 1, 2025.

We will acquire customers' Real Estate and expand business opportunities for small and medium-sized enterprises.

"Resona Private REIT Investment Corporation" aims to acquire various types of Real Estate not only from large corporations but also from small and medium-sized enterprise customers in order to support the fundraising of retail customers in the Resona Group. Private REITs can hold Real Estate without a defined management period, allowing customers to sell their owned Real Estate to this private REIT for off-balance-sheet treatment. It provides new options to improve the finances and diversify fundraising for a wide range of customers, including small and medium-sized enterprises, over the medium to long term, thereby expanding business opportunities.

[Overview of Resona Private REIT Investment Corporation]

| Name | Resona Private REIT Investment Corporation |

|---|---|

| Headquarters location. | 1-5-25 Kiba, Koto-ku, Tokyo. |

| Representative | Company Executive Shuhei Fukuda. |

| Investment targets | A comprehensive type focusing on office buildings, commercial facilities, residences, and industrial facilities. |

| Investment region | The investment areas prioritize the Tokyo metropolitan area and the Kansai region, as well as properties located in other urban areas (Chukyo region and Fukuoka Prefecture), designated cities, and core cities. |

| The form of募集 for investment units. | Private placement targeting Institutions under the Special Tax Measures Law. |

| Date of Establishment | January 8, 2025 (Reiwa 7). |

| Fiscal period. | February and August. |

| Start of Operation. | Scheduled for March 2025. |

- This refers to logistics facilities, factories and research facilities, infrastructure facilities, etc., which are the foundation of industrial activities.

- ※4 Tokyo, Kanagawa Prefecture, Saitama Prefecture, Chiba Prefecture

- ※5 Osaka Prefecture, Kyoto Prefecture, Hyogo Prefecture, Shiga Prefecture, Nara Prefecture

- ※6 Aichi Prefecture, Gifu Prefecture, Mie Prefecture

【Overview of Resona Real Estate Investment Advisory】

| Name | Resona Real Estate Investment Advisory Co., Ltd. |

|---|---|

| Headquarters location. | 14th floor, Fukagawa Gatharia Tower S, 1-5-25 Kiba, Koto-ku, Tokyo |

| Representative | Representative Director and President Shuhei Fukuda |

| Business Contents |

|

| Capital | 0.3 billion yen |

| Date of Establishment | April 1, 2024 (Reiwa 6) |

| Fiscal Period | March |

| Number of employees | 16 people |

| Shareholder Holdings | Resona Bank, Ltd. 100%. |

| Registration and approval, etc. | Financial Instruments Business (Investment Management, Investment Advisory and Agency) Kanto Finance Bureau Director (Financial Instruments Business) No. 3449. Real Estate Transaction Business Tokyo Governor (1) No. 110985. Authorization for discretionary trading, etc. Minister of Land, Infrastructure, Transport and Tourism approval No. 161. |

| Affiliated associations. | General Incorporated Association Japan Investment Advisers Association (planned). General Incorporated Association Investment Trust Association (planned). General Incorporated Association Real Estate Securitization Association (planned) |

不動産市場や不動産に求められる役割は時代とともに変化し、不動産投資のニーズも多様化しています。りそな銀行は2018年に不動産アセットマネジメント室

不動産市場や不動産に求められる役割は時代とともに変化し、不動産投資のニーズも多様化しています。りそな銀行は2018年に不動産アセットマネジメント室