AEM Holdings Ltd. (SGX:AWX) shareholders have had their patience rewarded with a 28% share price jump in the last month. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 48% over that time.

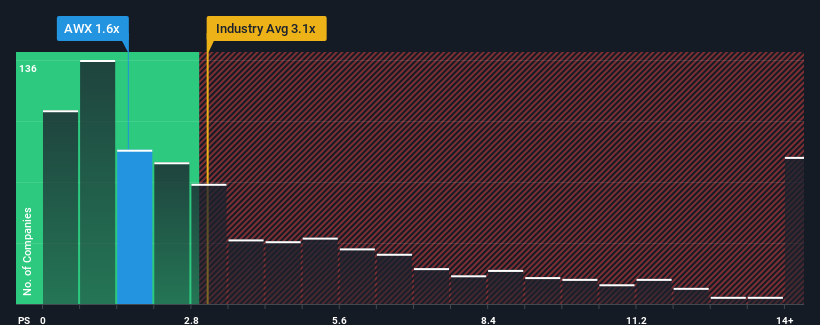

Following the firm bounce in price, you could be forgiven for thinking AEM Holdings is a stock not worth researching with a price-to-sales ratios (or "P/S") of 1.6x, considering almost half the companies in Singapore's Semiconductor industry have P/S ratios below 1.1x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

What Does AEM Holdings' Recent Performance Look Like?

Recent times haven't been great for AEM Holdings as its revenue has been falling quicker than most other companies. One possibility is that the P/S ratio is high because investors think the company will turn things around completely and accelerate past most others in the industry. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think AEM Holdings' future stacks up against the industry? In that case, our free report is a great place to start.How Is AEM Holdings' Revenue Growth Trending?

There's an inherent assumption that a company should outperform the industry for P/S ratios like AEM Holdings' to be considered reasonable.

There's an inherent assumption that a company should outperform the industry for P/S ratios like AEM Holdings' to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 33%. The last three years don't look nice either as the company has shrunk revenue by 19% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 32% during the coming year according to the six analysts following the company. That's shaping up to be materially lower than the 8,091% growth forecast for the broader industry.

In light of this, it's alarming that AEM Holdings' P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Bottom Line On AEM Holdings' P/S

The large bounce in AEM Holdings' shares has lifted the company's P/S handsomely. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've concluded that AEM Holdings currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. At these price levels, investors should remain cautious, particularly if things don't improve.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for AEM Holdings with six simple checks.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.