Former members of the Board of Directors of the Bank of Japan believe that the likelihood of an interest rate hike in March has increased.

According to Zhitong Finance, a former member of the Board of Directors of the Bank of Japan stated that, in light of the increasing uncertainty brought by the USA President Trump, the likelihood of the Bank of Japan postponing interest rate hikes until March is growing. Makoto Sakurai, a former member of the monetary policy committee, said in an interview on Wednesday, "There seems to be too much uncertainty when Trump comments on various issues. There may not be sufficient reason to support a rate hike in January."

As Makoto Sakurai spoke, observers of the Bank of Japan were looking for hints regarding rate hikes later this month or in the future. He believes the probability of a hike in March is as high as 70%, as the Bank of Japan would best wait at least until a few months after Trump's new government takes office before taking action.

Shortly before the interview, Trump called for integrating Canada into the USA. He mentioned that he does not rule out the possibility of "controlling the Panama Canal and Greenland through military or economic coercion," and stated that he would soon rename the Gulf of Mexico to "USA Gulf." This series of statements undoubtedly indicates that he plans to elevate foreign policy to a new level of breaking precedents after taking office in less than two weeks.

Shortly before the interview, Trump called for integrating Canada into the USA. He mentioned that he does not rule out the possibility of "controlling the Panama Canal and Greenland through military or economic coercion," and stated that he would soon rename the Gulf of Mexico to "USA Gulf." This series of statements undoubtedly indicates that he plans to elevate foreign policy to a new level of breaking precedents after taking office in less than two weeks.

Makoto Sakurai pointed out that the timing of the next interest rate hike might be in January or March, with the last hike occurring in July due to the rapid depreciation of the yen. The yen has fallen to a near six-month low this week, with the dollar approaching the crucial level of 160 against the yen.

Since completing a five-year term in March 2021, Makoto Sakurai has maintained close contact with officials from the Bank of Japan. He said he does not believe that the current level of the yen alone would prompt the Bank of Japan to raise rates this month. He indicated that if the Bank of Japan keeps interest rates unchanged in January, "the dollar against the yen may surpass 160, but this would make it easier for us to make a decision on action in March."

The Governor of the Bank of Japan, Kazuo Ueda, emphasized the need to closely monitor the economic policies of the USA during the new president's term, but declined to disclose how long he needed to keep an eye on them. This leaves room for different interpretations among those observing the Bank of Japan.

Makoto Sakurai believes that the risks surrounding Trump serve as a reason to wait; however, many economists think the Bank of Japan should adjust its policy before risks become reality. They point out that Japan's economic conditions have consistently aligned with the central bank's viewpoints.

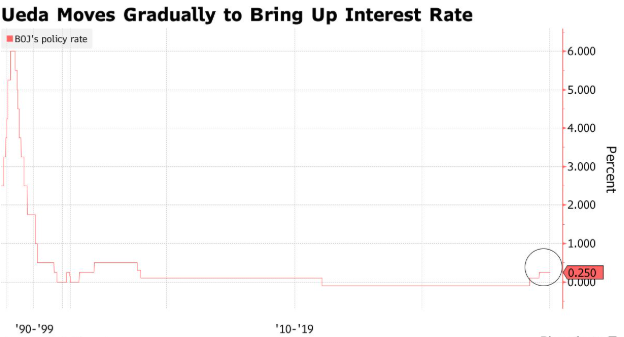

Kazuo Ueda reiterated earlier this week that if economic conditions continue to improve, the Bank of Japan will raise interest rates. Traders estimate the likelihood of the Bank of Japan increasing rates at the conclusion of its January 24 meeting to be about 50%. As of Wednesday, this probability is expected to rise to around 80% by the March meeting.

In addition to the US economy, the momentum of the spring wage negotiations is another key point emphasized by Kazuo Ueda. Makoto Sakurai stated that if there are no global economic shocks, the preliminary results of the wage negotiations announced in March could act as a catalyst for an interest rate hike that month, similar to last year.

Makoto Sakurai expects a slow increase in interest rates over the next few years, saying, "The Bank of Japan may raise rates about twice a year, with the pace varying according to current economic conditions, potentially faster or slower. There is no need to rush."

The Bank of Japan has repeatedly stated that it is difficult to determine the correct level of policy interest rates before making a decision, especially considering Japan's borrowing costs have been at extremely low levels for a long time. A document from the Bank of Japan suggests that the nominal neutral interest rate lies between 1% and 2.5%. Makoto Sakurai believes this merely reflects the Bank of Japan's desire to maintain flexibility.

Makoto Sakurai stated, "They certainly already have target rates in mind. They just do not want to tie their own hands." He added that he expects rates to be increased to nearly 2% by the end of Kazuo Ueda's term in April 2028.

在接受采访前不久,特朗普呼吁将加拿大并入美国,特朗普称不排除“以军事或经济胁迫手段控制巴拿马运河和格陵兰岛”的可能性,还称将在不久后把墨西哥湾改名为“美国湾”。这一系列言论毫无疑问地表明,他计划在不到两周的时间内入主白宫后,将外交政策提升到打破先例的新水平。

在接受采访前不久,特朗普呼吁将加拿大并入美国,特朗普称不排除“以军事或经济胁迫手段控制巴拿马运河和格陵兰岛”的可能性,还称将在不久后把墨西哥湾改名为“美国湾”。这一系列言论毫无疑问地表明,他计划在不到两周的时间内入主白宫后,将外交政策提升到打破先例的新水平。