If there is a deep understanding of the fundamentals and valuation of Hai Luo Material Technology, then the performance on its first day of trading will not come as a surprise.

Since December 2024, the sentiment in the Hong Kong IPO market has improved, with the 10 new stocks listed this month, only Multi-Point Intelligence (02586) falling below its issue price on the first day, resulting in a first-day break rate of just 10%.

Furthermore, entering 2025, the recovering market sentiment has continued, with Aurora Mobile-B (06681) listed on January 8 and Huige Eco-friendly Concept (02613) listed on January 9 both experiencing a rise on their first day of trading. However, despite such market sentiment, CONCH CEMENT (02560) made its debut in the capital markets with a sharp decline.

According to the Zhitong Finance APP, CONCH CEMENT, which had already fallen 31.33% during the dark market phase, officially listed for trading on January 9 with a 40% drop at the opening price. Although there was a slight rise within the first minute of trading, heavy selling pressure soon emerged, pushing the stock price down to 1.64 HKD, a decrease of 45.33% from the 3 HKD issue price.

According to the Zhitong Finance APP, CONCH CEMENT, which had already fallen 31.33% during the dark market phase, officially listed for trading on January 9 with a 40% drop at the opening price. Although there was a slight rise within the first minute of trading, heavy selling pressure soon emerged, pushing the stock price down to 1.64 HKD, a decrease of 45.33% from the 3 HKD issue price.

Afterward, the stock price of CONCH CEMENT remained stagnant at a low level, but by the afternoon, funds began a new round of speculation, resulting in a downward trend throughout the entire afternoon. Ultimately, it closed at the day’s lowest point with a 'big bearish candlestick', closing at 1.57 HKD, down 47.67% from the issue price, with a total trading volume of 86.8073 million HKD; investors who had participated in the IPO were left lamenting.

In fact, a deep understanding of CONCH CEMENT's fundamentals and valuation would suggest that the performance on its first day of listing should not come as a surprise.

The cornerstone investors fully subscribed to the national allocation, forcing retail investors to reluctantly exit.

Sufficient preparations were made for the listing of CONCH CEMENT Technology, with six cornerstone investors completely subscribing to the internationally allocated shares. Such a lavish scene is rare, but in terms of stock price performance, the effect appears minimal.

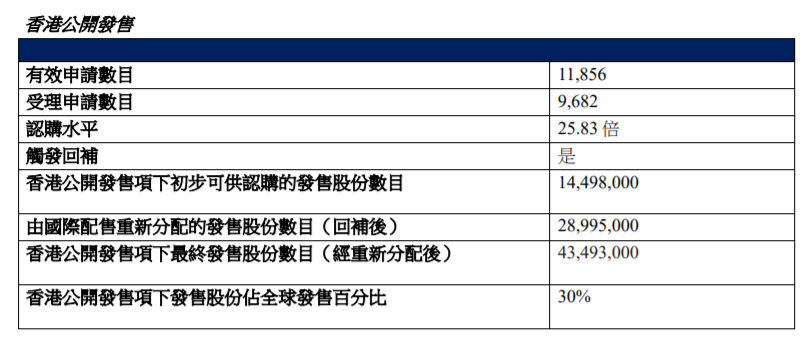

According to the prospectus, CONCH CEMENT Technology issued a total of 144,974,000 H shares during this IPO, which accounts for 25% of the company's total equity, raising approximately 0.4 billion Hong Kong dollars in net funds. The public offering was oversubscribed by 25.83 times, triggering a reallocation mechanism, raising the proportion of shares in the public offering from 10% to 30%, resulting in a public offering of 43,493,000 H shares.

In terms of international allocation, CONCH CEMENT Technology issued 101,481,000 H shares, accounting for 70% of the global offering shares. The underwriters in the international allocation can be said to have been entirely the cornerstone investors. According to the allocation results announcement, the cornerstone investors of CONCH CEMENT Technology are Gotion High-tech, Anhui Shengchang Chemical, Wuhu Atech Biotechnology, SCGC Capital, Guangdong Zongxing Technology, and Shenzhen Gaodeng Computer Technology, with their subscribed shares accounting for 12.1%, 16.1%, 12.19%, 10.83%, 4.66%, and 14.04% respectively, totaling 69.92%, nearly close to the 70% share in the international allocation.

Undoubtedly, by the end of the first trading day of CONCH CEMENT Technology's listing, the six cornerstone investors had suffered substantial losses, collectively subscribing for shares worth over 0.3 billion Hong Kong dollars, with their current market cap almost cut in half. Perhaps even more devastated than the cornerstone investors are the initial pre-IPO investors.

According to the prospectus, CONCH CEMENT Technology introduced six investors on January 13, 2023, based on a pre-IPO investment agreement, with these investors collectively subscribing for approximately 73.36 million shares at a price of 2.77 Chinese yuan per share, amounting to over 0.2 billion Chinese yuan. From a cost perspective, the subscription price of 2.77 Chinese yuan is close to the issuance price of 3 Hong Kong dollars for CONCH CEMENT Technology, yet after waiting a year, the IPO seems to have not delivered sufficient surprises for the investors.

However, surprisingly, among the six investors mentioned above, KeGai CeYuan Limited Partnership and Anhui ZhongAn Limited Partnership chose to exit before the IPO. On August 16, 2023, KeGai CeYuan Limited Partnership resold its 4.15% shares to the controlling shareholder of CONCH CEMENT Technology, CONCH KeChuang, for a total consideration of 52.1496 million yuan, which is 4.35% higher than the cost of 49.9762 million yuan. On October 16, 2023, Anhui ZhongAn Limited Partnership resold its 2.3% equity to CONCH KeChuang for a total consideration of 29.948 million yuan, which is 8.28% higher than the cost price of 27.657 million yuan.

Thus, all types of investors that CONCH CEMENT Technology introduced since 2023, except for KeGai CeYuan Limited Partnership and Anhui ZhongAn Limited Partnership which exited in time, are deeply trapped. Since the international allocation is basically monopolized by cornerstone investors, who have a six-month lock-up period, the collapse on the first day of CONCH CEMENT Technology's listing is actually caused by retail investors in the public offering. Considering the fundamentals of CONCH CEMENT Technology, it seems bleak for public offering investors and cornerstone investors to break even.

Business operations face multiple potential challenges, and inflated valuations are a trigger for the crash.

CONCH CEMENT Technology was established by CONCH Group, a Fortune China 500 company, and subsequently developed through acquisitions of ShanDong Hongyi, Meishan CONCH, and Xiangyang CONCH in 2018. CONCH Group is the parent company of the first A+H listed company in the Cement industry, CONCH CEMENT (600585.SH, 0914.HK), and CONCH CEMENT Technology has developed relying on CONCH CEMENT.

According to the prospectus, CONCH CEMENT Technology is a fine chemical material supplier that produces and sells Cement additives, concrete additives, and related upstream raw materials. The company's products mainly include various types of Cement additives and concrete additives, intermediates in the production of Cement additives (i.e., alkanolamine), and intermediates in the production of concrete additives (i.e., polyether monomers and polycarboxylic acid mother liquor).

From a market position perspective, as of 2023, the top five market participants in Cement grinding aids account for about 49.6%, with CONCH CEMENT Technology ranking first, holding a market share of about 34.6%. Additionally, in terms of Cement additives sales in 2023, the top five market participants in China account for about 41.2%, with CONCH CEMENT Technology ranking first in China, holding a market share of about 28.3%.

Clearly, CONCH CEMENT Technology is a leading company in both the Cement grinding aids and Cement additives markets, and the company has achieved countercyclical growth in recent years. Due to the continued downturn in the Real Estate industry, the Cement market has been shrinking in recent years. From 2019 to 2023, the compound annual growth rate of the market size of Cement production in China was -3.5%, and according to data from the National Bureau of Statistics, the national Cement output from January to November 2024 was 1670.68 million tons, a year-on-year decrease of 10.1%.

Compared to the continuous shrinkage of the national Cement market, CONCH CEMENT has achieved steady revenue growth. Data shows that from 2021 to 2023, the revenue of CONCH CEMENT was 1.538 billion yuan (RMB, the same below), 1.84 billion yuan, and 2.396 billion yuan, with a compound annual growth rate of 24.82%. In the first half of 2024, its total revenue grew by 6.56% to 1.103 billion yuan.

The steady growth in total revenue is mainly attributed to the rapid increase in revenue from third-party customers for CONCH CEMENT. According to the prospectus, the revenue from related parties for CONCH CEMENT shows a significant downward trend year by year, while the proportion of revenue from third parties rose from 44.7% in 2021 to 67.5% in 2023. Third-party customers have become the core driving force behind the continued revenue growth of CONCH CEMENT.

However, compared to the continuous growth on the revenue side, the profit performance of CONCH CEMENT is relatively lacking. According to the prospectus, from 2021 to the first half of 2024, the net income of CONCH CEMENT was 0.127 billion yuan, 92.4 million yuan, 0.144 billion yuan, and 60.2 million yuan, with significant fluctuations. The corresponding net profit margins were 8.25%, 5.02%, 6.01%, and 5.46%, showing an overall downward trend.

In addition to the hindered release of net income, CONCH CEMENT still faces several potential operational challenges or risks. One is that market demand may continue to remain in a contraction state. The market expects that in 2025, under the backdrop of the real estate not yet stabilizing and limited Infrastructure support, Cement demand may continue to decline. In the long term, Cement demand could maintain at a lower level of 1.5 to 1.7 billion tons. Although CONCH CEMENT can achieve a dual-driven model through related parties and third parties, the difficulty in expanding the company's business will also increase in response to the industry's declining demand.

Secondly, the higher the proportion of third-party customers, the more it may affect the profitability of CONCH CEMENT. According to the prospectus, from 2021 to the first half of 2024, the gross margin for CONCH CEMENT from related party customers was 32.7%, 36.5%, 42.1%, and 45.4%; while for the same period, the gross margins for sales to third-party customers were 23.1%, 31.7%, 34.0%, and 40.2%.

It can be seen that while expanding its third-party customer base, CONCH CEMENT is sacrificing product profit margins, reflecting the intense market competition. Additionally, the entire Cement industry currently faces significant overcapacity pressure, and if competition continues to intensify in the future, it will inevitably cause considerable challenges for CONCH CEMENT in expanding its third-party customer base.

Thirdly, customer concentration remains relatively high. According to the prospectus, from 2021 to the first half of 2024, the revenue proportion from the top five customers for CONCH CEMENT was 66.8%, 54.3%, 49.7%, and 44.4%, with the largest customer, CONCH Group, accounting for approximately 52.5%, 41.6%, 31.8%, and 30.7%, respectively. Although customer concentration has shown a decreasing trend, it is still at a relatively high level, which may lead to significant performance fluctuations and concentrated financial credit risks.

Fourthly, the continuous increase in accounts receivable poses a risk of impairment. According to the prospectus, from 2021 to the first half of 2024, the trade receivables of CONCH CEMENT Technology have steadily risen, amounting to approximately 0.301 billion yuan, 0.557 billion yuan, 0.756 billion yuan, and 0.787 billion yuan respectively, accounting for about 19.6%, 30.3%, 31.6%, and 71.4% of total revenue, with the average turnover days for trade receivables increasing from 68.8 days, 73.0 days, 82.2 days to 99.7 days during the same period.

The continuously rising accounts receivable may exacerbate the company's operational risks and financial costs, and uncollected receivables could affect the company's net income. The increasing turnover days for accounts receivable will also intensify the company's financial pressure.

Fifthly, the valuation is too high. After the IPO of CONCH CEMENT Technology, its total share capital approached 0.58 billion shares, and with an issue price of 3 Hong Kong dollars per share, its IPO market cap reached approximately 1.74 billion Hong Kong dollars. However, its net income for 2023 was only 0.144 billion yuan, corresponding to a PE ratio of about 11.4 times. Furthermore, from the perspective of PB valuation, as of June 30, 2024, CONCH CEMENT Technology's total assets were 2.416 billion yuan, total liabilities were 1.407 billion yuan, and net assets were 1 billion yuan, resulting in a PB valuation corresponding to the IPO market cap of as high as 1.64 times.

Looking at the cement stocks already listed in Hong Kong, most have a PB valuation below 0.5 times, with even industry leader CONCH CEMENT only at 0.509 times PB.

In summary, although CONCH CEMENT Technology has achieved contrary growth in revenue through the rapid expansion of third-party clients, its profit release has not been significant. Moreover, the company faces potential operational challenges such as continued contraction in industry demand, intensifying market competition, and high customer concentration as well as accounts receivable. Meanwhile, the relatively high PB valuation compared to its peers may also become a "barometer" for CONCH CEMENT Technology's performance in the secondary market.

智通财经APP观察到,在暗盘阶段便已大跌31.33%的海螺材料科技,于1月9日以暴跌40%的开盘价正式上市交易。开盘一分钟内虽有小幅拉升,但随后抛压汹涌而出,直接将股价砸至1.64港元,较3港元发行价跌45.33%。

智通财经APP观察到,在暗盘阶段便已大跌31.33%的海螺材料科技,于1月9日以暴跌40%的开盘价正式上市交易。开盘一分钟内虽有小幅拉升,但随后抛压汹涌而出,直接将股价砸至1.64港元,较3港元发行价跌45.33%。