Track the latest dynamics of southbound capital.

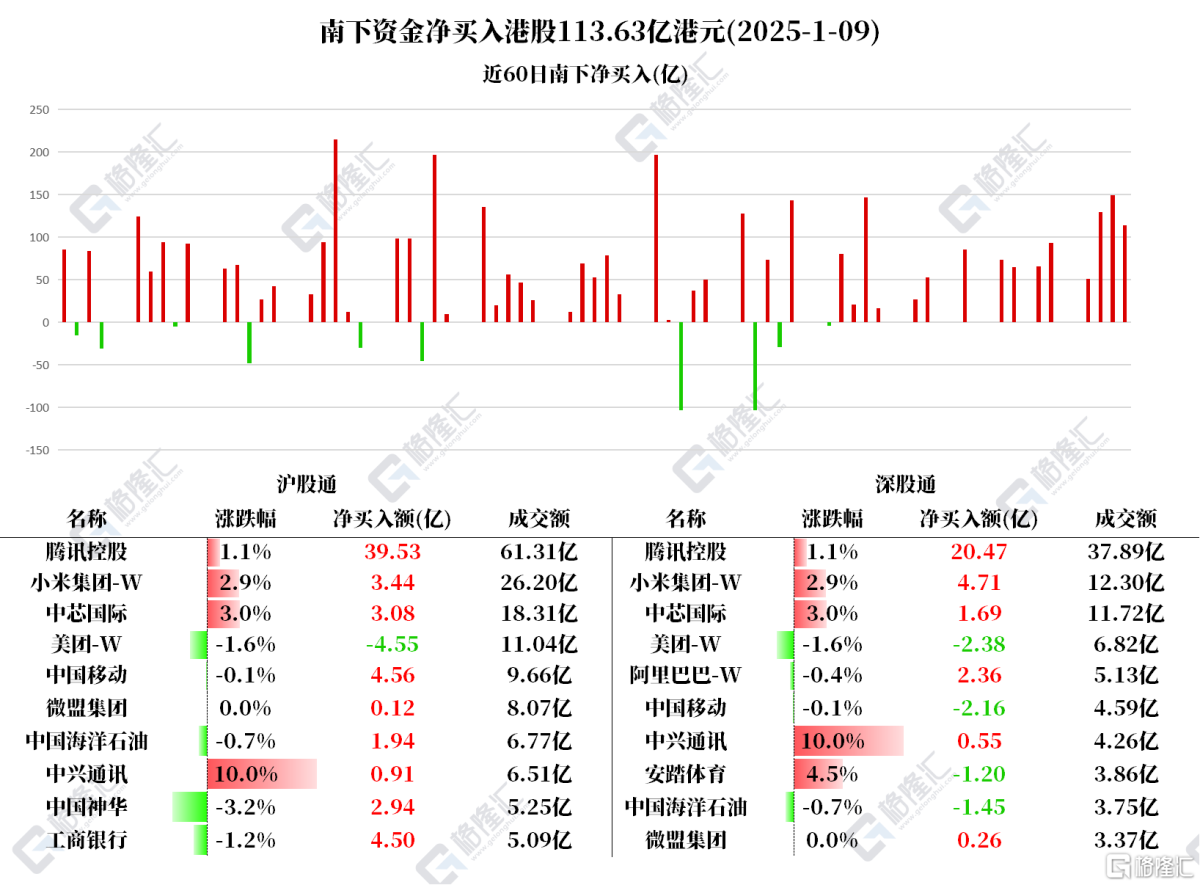

On January 9, southbound funds net bought 11.363 billion HKD of Hong Kong stocks.

Among them: net purchases of TENCENT 5.999 billion, XIAOMI-W 0.815 billion, Semiconductor Manufacturing International Corporation 0.477 billion, Industrial And Commercial Bank Of China 0.449 billion, China Shenhua Energy 0.294 billion, CHINA MOBILE 0.24 billion, Alibaba-W 0.235 billion, ZTE 0.146 billion; net sell of MEITUAN-W 0.693 billion, ANTA SPORTS 0.119 billion.

According to Statistics, southbound funds: net bought XIAOMI-W for 4 consecutive days, totaling 2.48657 billion HKD; net bought Semiconductor Manufacturing International Corporation for 5 consecutive days, totaling 1.67877 billion HKD; net bought TENCENT for 7 consecutive days, totaling 29.76285 billion HKD (southbound funds significantly increased their shareholding in TENCENT in the last 3 days, totaling 28.485 billion HKD); net bought CHINA MOBILE for 8 consecutive days, totaling 4.43856 billion HKD. Net sold MEITUAN for 3 consecutive days, totaling 2.24468 billion HKD. Since being included in the Stock Connect, southbound funds have cumulatively net bought Alibaba 81.1966 billion HKD over 76 trading days.

According to Statistics, southbound funds: net bought XIAOMI-W for 4 consecutive days, totaling 2.48657 billion HKD; net bought Semiconductor Manufacturing International Corporation for 5 consecutive days, totaling 1.67877 billion HKD; net bought TENCENT for 7 consecutive days, totaling 29.76285 billion HKD (southbound funds significantly increased their shareholding in TENCENT in the last 3 days, totaling 28.485 billion HKD); net bought CHINA MOBILE for 8 consecutive days, totaling 4.43856 billion HKD. Net sold MEITUAN for 3 consecutive days, totaling 2.24468 billion HKD. Since being included in the Stock Connect, southbound funds have cumulatively net bought Alibaba 81.1966 billion HKD over 76 trading days.

Northern funds focus on individual stocks.

TENCENT: According to HKEX documents, TENCENT has reduced its shareholding in UBTECH for two consecutive days, decreasing its shareholding percentage from 8.05% to 2.08%.

Semiconductor Manufacturing International Corporation: The Biden administration in the USA plans to implement a new round of restrictions on AI chip exports, including those from NVIDIA, before leaving office. Sources say the new regulations will set three tiers of restrictions on chip transactions, which may be announced as soon as Friday.

China Shenhua Energy: Statistics show that in the past six months, 7 brokerages recommended increasing Shareholding, 23 brokerages recommended Buy, and 2 brokerages gave Neutral recommendations.

Alibaba: Jefferies Financial raised the Target Price from 143 USD to 144 USD.

ZTE: According to the latest equity disclosure data from the Hong Kong Stock Exchange, on January 2, 2025, ZTE was increased by JPMORGANCHASECO by 6.7866 million shares at an average price of HKD 23.3085 per share, involving approximately HKD 0.158 billion. After the increase, the latest number of shares held by JPMORGANCHASECO is 47,219,986 shares, with the shareholding ratio rising from 5.35% to 6.25%.