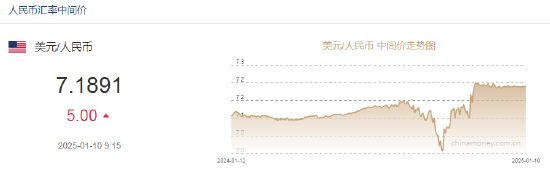

On January 10, the midpoint exchange rate of the yuan against the dollar was reported at 7.1891, a decrease of 5 points.

Issuing offshore RMB central bank bills helps stabilize market expectations.

Zhou Maohua, a macro researcher at the financial market department of China Everbright Bank, stated that the People's Bank of China is increasing the supply of offshore high-grade RMB Bonds, helping to meet the demand of overseas investors for quality Assets. Issuing offshore central bank bills helps to regulate offshore market liquidity, thereby impacting the supply and demand in the offshore Forex market. At specific times, the People's Bank of China, by issuing offshore RMB central bank bills, is also communicating with the market and releasing policy signals, which helps stabilize market expectations.

Experts say that the People's Bank of China has ample tools and rich experience to deal with RMB exchange rate depreciation and has the capability to maintain the RMB exchange rate at a basically stable and reasonable equilibrium level. Senior macro Analyst Zhong Linan from GF SEC analyzed that the central bank's toolbox is rich, including increasing the use of counter-cyclical Indicators, and enhancing the offshore central bank bill issuance scale to stabilize offshore market liquidity, etc. (Shanghai Securities News)

Experts say that the People's Bank of China has ample tools and rich experience to deal with RMB exchange rate depreciation and has the capability to maintain the RMB exchange rate at a basically stable and reasonable equilibrium level. Senior macro Analyst Zhong Linan from GF SEC analyzed that the central bank's toolbox is rich, including increasing the use of counter-cyclical Indicators, and enhancing the offshore central bank bill issuance scale to stabilize offshore market liquidity, etc. (Shanghai Securities News)

Federal Reserve Governor Bowman: The rate cut in December should be the last one.

Federal Reserve Governor Michelle Bowman said on Thursday that she supports the recent rate cuts, but believes there is no need for further rate cuts.

Bowman delivered a speech to bankers in California, partly on monetary policy and partly on regulation. She expressed concern that inflation rates are 'uncomfortably above' the Federal Reserve's 2% target, leading her to believe that the 25 basis point rate cut in December should be the last rate cut of the current cycle.

专家表示,中国人民银行有充足的工具箱、丰富的经验应对人民币汇率贬值,有能力保持人民币汇率在合理均衡水平上基本稳定。广发证券资深宏观分析师钟林楠分析称,央行的政策工具箱丰富,包括加大逆周期调节因子使用、增加离岸央票发行规模收敛离岸市场流动性等。(上海证券报)

专家表示,中国人民银行有充足的工具箱、丰富的经验应对人民币汇率贬值,有能力保持人民币汇率在合理均衡水平上基本稳定。广发证券资深宏观分析师钟林楠分析称,央行的政策工具箱丰富,包括加大逆周期调节因子使用、增加离岸央票发行规模收敛离岸市场流动性等。(上海证券报)