Strengthening cooperation with Nvidia has brought investors' optimism about MediaTek's artificial intelligence (AI) growth potential to a new level, and MediaTek's stock price is expected to hit a seven-month high.

The Zhitong Finance App learned that strengthening cooperation with Nvidia (NVDA.US) has brought investors' optimism about MediaTek's artificial intelligence (AI) growth potential to a new level, and MediaTek's stock price is expected to hit a new high in seven months.

On January 8, MediaTek confirmed its participation in the design of the GB10 Superchip “superchip” for the Project DIGITS “personal AI supercomputer” released by Nvidia at CES 2025. According to reports, the GB10 Superchip is equipped with an Nvidia Blackwell architecture GPU with an FP4 AI computing power of up to 1 pflop and a Grace CPU with 20 energy-saving ARM architecture cores, and NVLink-C2C interconnection between the two. As an important ARM architecture SoC designer, MediaTek contributed to the energy efficiency, performance, and connectivity of the GB10 Superchip.

MediaTek shares have more than doubled in the past two years. Nvidia and MediaTek already have partnerships in the field of automotive technology. The latest collaboration has fueled expectations for a further rise in MediaTek's stock price. Investment manager Robert Mumford said MediaTek is known for its key role in the mobile phone supply chain and is now also “in a very favorable position in the development of artificial intelligence technology.” He added that the project with Nvidia and expectations for more projects in the future showed that “MediaTek has huge opportunities in diversified business areas.”

MediaTek shares have more than doubled in the past two years. Nvidia and MediaTek already have partnerships in the field of automotive technology. The latest collaboration has fueled expectations for a further rise in MediaTek's stock price. Investment manager Robert Mumford said MediaTek is known for its key role in the mobile phone supply chain and is now also “in a very favorable position in the development of artificial intelligence technology.” He added that the project with Nvidia and expectations for more projects in the future showed that “MediaTek has huge opportunities in diversified business areas.”

At the same time, MediaTek is also benefiting from improved smartphone chip prospects — smartphone chips still account for more than half of its revenue. This is an important factor driving the market's general expectation over the past few months for MediaTek's fourth quarter sales growth of around 5% in the fourth quarter of 2024.

Considering that the GB10 Superchip's customer base is niche, it's not expected to generate much sales for MediaTek in the short term, but overall expectations for the company's AI-related business are high. Robert Mumford said that much of the excitement relates to the potential of data center application-specific integrated circuits (ASICs).

Bank of America securities analysts, including Brad Lin, said in a report that MediaTek's expertise in low-power processors, Wi-Fi, and multimedia “perfectly complements Nvidia's capabilities” and “lays the foundation for a long-term rise in its stock price as MediaTek and Nvidia expand into a wider market.”

Analysts are also anxious to keep up with the rise in MediaTek's stock price, with the stock's average price target rising 47% over the past year. The stock's current expected price-earnings ratio is 20 times higher than the five-year average of 16 times, reflecting the growing optimism of investors. However, there is still a gap compared to the expected price-earnings ratio of companies such as Nvidia and Broadcom (AVGO.US), which is more than 30 times higher.

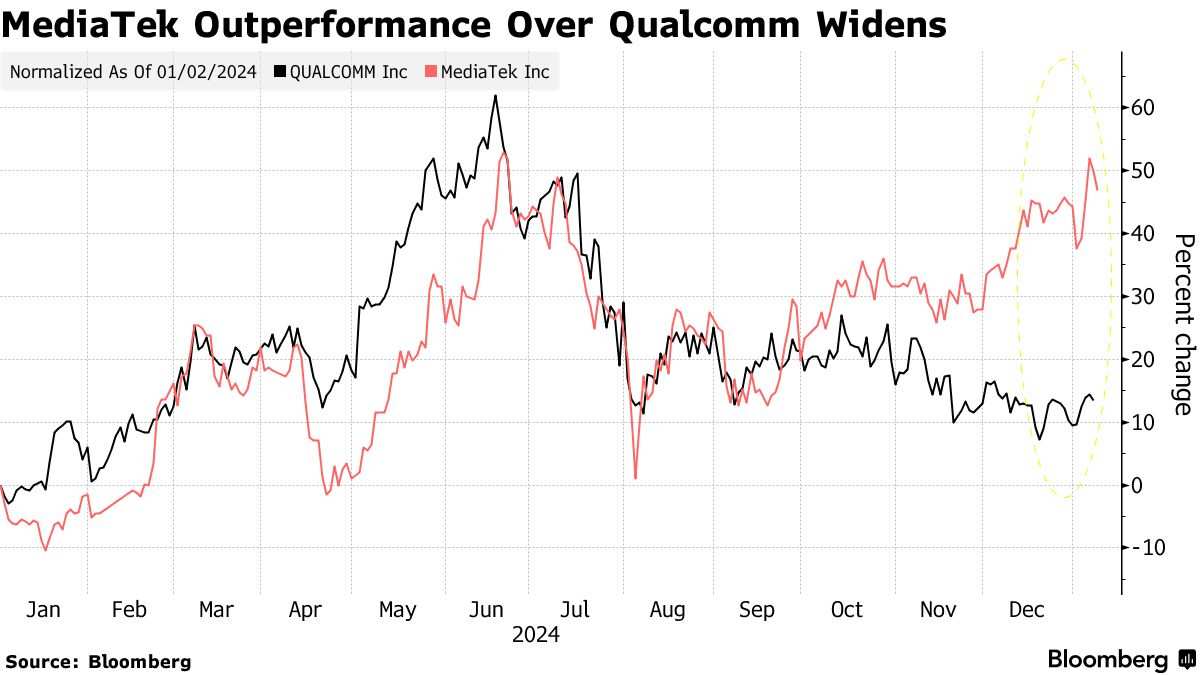

Edmond de Rothschild Asset Management fund manager Xiadong Bao said that compared to US tech giants, “MediaTek is still in the discovery stage for most of the artificial intelligence momentum.” He added that the company appears to be winning an artificial intelligence competition with phone chip rival Qualcomm (QCOM.US).

Morningstar analyst Phelix Lee said that MediaTek will release the Dimensity 8400 and other chips for high-end phones in the next few months. This will be a key catalyst worth watching, and news of further collaboration with Nvidia in the field of artificial intelligence may also push up stock prices.

Morgan Stanley analysts, including Charlie Chan, said in a report: “The next collaboration may be to launch an Arm-based Windows AI PC chip in May this year. “Given the greater sales potential of artificial intelligence PCs, we think this will be another positive catalyst for the stock.”

过去两年,联发科股价上涨了一倍多。英伟达与联发科在汽车技术领域已有合作伙伴关系。最新的合作助长了人们对联发科股价进一步上涨的预期。投资经理Robert Mumford表示,联发科以其在手机供应链中的关键作用而闻名,现在也“在人工智能技术的发展中处于非常有利的地位”。他补充称,与英伟达合作的项目以及对未来更多项目的预期表明,“联发科在多元化业务领域拥有巨大的机遇”。

过去两年,联发科股价上涨了一倍多。英伟达与联发科在汽车技术领域已有合作伙伴关系。最新的合作助长了人们对联发科股价进一步上涨的预期。投资经理Robert Mumford表示,联发科以其在手机供应链中的关键作用而闻名,现在也“在人工智能技术的发展中处于非常有利的地位”。他补充称,与英伟达合作的项目以及对未来更多项目的预期表明,“联发科在多元化业务领域拥有巨大的机遇”。