On January 10, Tesla China announced the launch of the refreshed Model Y, expected to begin deliveries in March; at the same time, the Tesla official website launched the new rear-wheel drive version of the Model 3, priced from 0.2355 million yuan, an increase of 3600 yuan compared to the previous rear-wheel drive version.

On January 10, Caijing News reported (Reporter Liu Yang) that the long-awaited new Model Y from Tesla has finally gone live.

On January 10, Tesla China announced the launch of the refreshed Model Y, expected to begin deliveries in March. This Model Y offers two versions: the rear-wheel drive launch edition and the long-range all-wheel drive launch edition, priced at 0.2635 million yuan and 303,500 yuan respectively. In terms of autonomous driving hardware, the refreshed Model Y has also been upgraded to AI 4 (HW 4.0).

As soon as the news broke, the term 'Tesla Model Y' immediately topped the trending searches. Tesla Vice President Tao Lin stated that the reads on the WeChat official announcement about the refreshed Model Y exceeded 0.1 million within five minutes. Additionally, Lei Jun, founder, director, and CEO of Xiaomi, promptly responded to Tesla's Weibo post about the refreshed Model Y, saying 'Okay.'

As soon as the news broke, the term 'Tesla Model Y' immediately topped the trending searches. Tesla Vice President Tao Lin stated that the reads on the WeChat official announcement about the refreshed Model Y exceeded 0.1 million within five minutes. Additionally, Lei Jun, founder, director, and CEO of Xiaomi, promptly responded to Tesla's Weibo post about the refreshed Model Y, saying 'Okay.'

‘Today's (new Model Y) orders are booming.’ A Tesla salesperson told Caijing News that the price of the old Model Y was over 0.24 million yuan, currently offering a discount of 0.01 million yuan with five years of interest-free financing. In comparison, the price of the new Model Y has increased by nearly 0.02 million yuan, 'but today there are still more customers who are placing orders for the new model.'

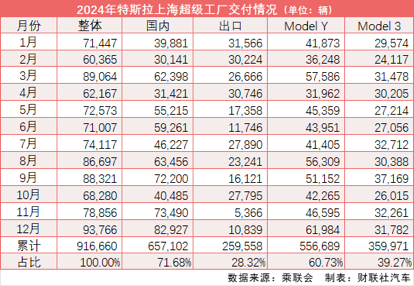

As the first market in the world to sell the refreshed Model Y, the importance of the Chinese market is evident. Latest data from the Passenger Vehicle Association shows that Tesla's Shanghai Gigafactory is expected to deliver over 0.916 million vehicles in 2024, accounting for half of Tesla's global deliveries. Among them, Tesla's total sales in China for 2024 are expected to exceed 0.657 million vehicles, a year-on-year increase of 8.8%; Model Y continues to lead with a cumulative sales figure of 0.48 million for the year.

At the same time as launching the new Model Y, the Tesla official website also launched the new rear-wheel drive version of the Model 3, priced from 0.2355 million yuan, which is an increase of 3600 yuan compared to the previous rear-wheel drive version; however, the CLTC range has increased from 606 km to 634 km.

‘Although the price increase may affect sales to some extent, Tesla's brand influence and technical advantages can still attract a large number of Consumers.’ Industry insiders believe that Tesla has always adjusted pricing in accordance with material price fluctuations, so the price increase of Tesla's two main models is likely due to rising material costs at the end of the year. ‘Price fluctuations for new cars are relatively common for Tesla as a car company.’

In fact, Tesla's "sales-boosting" pricing strategy in the Chinese market has been very apparent since the second half of last year. In July 2024, Tesla introduced a five-year zero-interest welfare policy for the first time, with a discount period of one month, but it has since been extended multiple times, remaining effective until January 2025; on December 24, Tesla China released another significant offer, allowing a direct reduction of 0.01 million yuan on the final payment when purchasing a Model Y in stock, which can be combined with national subsidies, and after the double "subsidy," the actual purchase price of Tesla has reached the lowest in history.

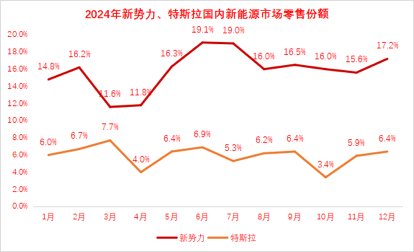

Aside from BOM costs, the competition from numerous independent brands is also a major reason for Tesla’s price adjustments. According to incomplete statistics by reporters, throughout 2024, new products released by companies including Xiaomi SU7, Leloud L60, ZEEKR, Zhijie, Zhiji, Avita, and Lantu have positioned Model Y as their competitor. Data from the Passenger Car Association shows that in the domestic new energy passenger vehicle retail market, Tesla’s market share dropped by 0.8 percentage points in 2024 compared to 2023.

"As the electric vehicle market matures and competition intensifies, Tesla needs to continuously adjust its product lines, pricing strategies, and marketing strategies to better meet Consumer demands in order to maintain its leading position," said an industry insider. Moreover, Tesla needs to closely monitor market dynamics and changes in Consumer demand to formulate reasonable market strategies. Especially in the Chinese market, Tesla needs to gain a deeper understanding of Chinese Consumers' demands and cultural backgrounds and launch products and services that better suit the characteristics of the Chinese market."

On January 9, Cui Dongshu, Secretary-General of the Passenger Car Association, stated at the annual national passenger car market analysis conference that Tesla's delivery volume from the Shanghai Super Factory is expected to decline by 3% in 2024, but this does not signify much, "Its production capacity and profit margin are already at a high level, but the lack of an inventory reserve mechanism for Dealers to cope with market fluctuations is a concern."

消息一出,“特斯拉Model Y”词条便立即登上热搜榜前列。特斯拉副总裁陶琳称,关于焕新Model Y的微信官方推文在5分钟内阅读量超过10万。而小米创办人、董事长兼CEO雷军针对特斯拉“焕新Model Y,尽管对比”的微博内容第一时间回应称“好的”。

消息一出,“特斯拉Model Y”词条便立即登上热搜榜前列。特斯拉副总裁陶琳称,关于焕新Model Y的微信官方推文在5分钟内阅读量超过10万。而小米创办人、董事长兼CEO雷军针对特斯拉“焕新Model Y,尽管对比”的微博内容第一时间回应称“好的”。