Welcome to the Markets Weekly Update, the column committed to delivering essential investing insights for the week and key events that could move markets in the week ahead.

Macro Matters

Dollar Index Holds Above 109 as Market Anticipates U.S. Jobs Report

The dollar index remained steady above 109 on Friday as investors braced for the December nonfarm payrolls report, seeking insights into the strength of the labor market. A strong jobs report could reinforce expectations for fewer interest rate cuts from the Federal Reserve this year. Minutes from the Fed’s December meeting, released earlier this week, suggested a potential slowdown in the pace of policy easing, driven by renewed concerns over inflation. Fed officials also expressed apprehension about the impact of potential changes in trade and immigration policy under the incoming Trump administration. Additionally, strong services activity and rising prices have intensified inflationary concerns. Meanwhile, Philadelphia Fed President Patrick Harker remarked on Thursday that he expects the Fed to eventually cut rates, but stressed that an immediate move is not necessary.

U.S. Job Cuts Drop to Five-Month Low in December, Yet Annual Totals Rise

U.S. Job Cuts Drop to Five-Month Low in December, Yet Annual Totals Rise

In December 2024, U.S. employers announced 38,792 job cuts, marking the lowest figure in five months and a significant decrease from November's 57,727. Despite this monthly decline, the total job cuts for 2024 reached 761,358, the highest since 2020 and a 5.5% increase from 2023. Technology led all sectors with 133,988 cuts, though this was 20.3% lower than the previous year. Conversely, the automotive sector saw a 43.2% increase in cuts, totaling 48,219. "2024 witnessed significant changes due to technological advancements and economic shifts, leading to cautious hiring and increased layoffs," explained Andrew Challenger, Senior Vice President of Challenger, Gray & Christmas, Inc.

Smart Money Flow

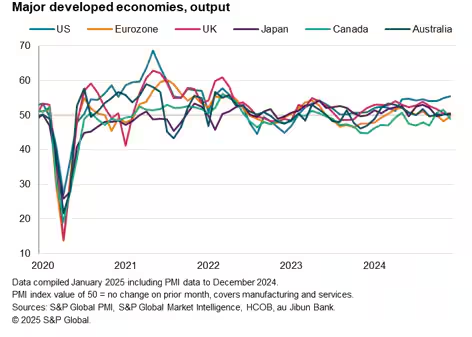

U.S. Leads Major Economies: Fastest Growth Since April 2022 in November

Among the major developed economies, the US saw the strongest expansion for an eighth successive month [in Nov], the rate of growth rising to the fastest since April 2022 as surging services growth (a 33-month high) offset a steepening manufacturing decline.

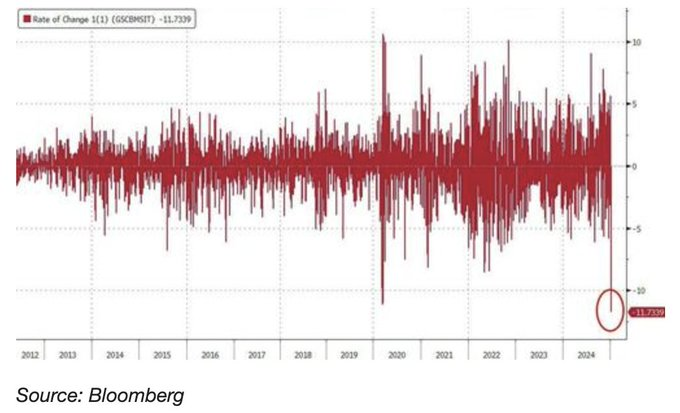

The Most Heavily-Shorted Tech Stocks Basket experienced its largest loss in history on Tuesday

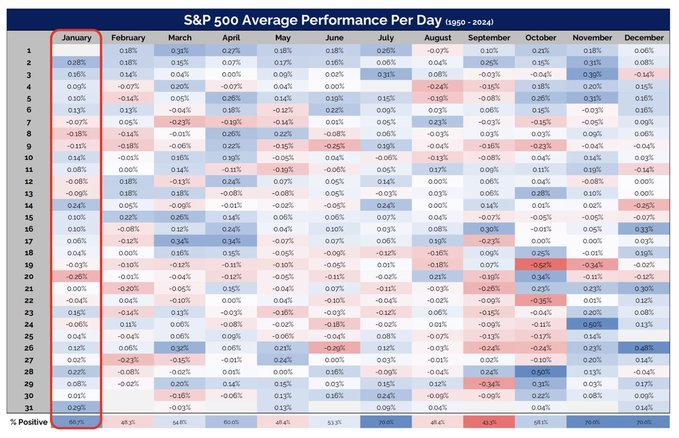

Here's the average daily performance of the S&P 500 during January. Up on 67% of days.

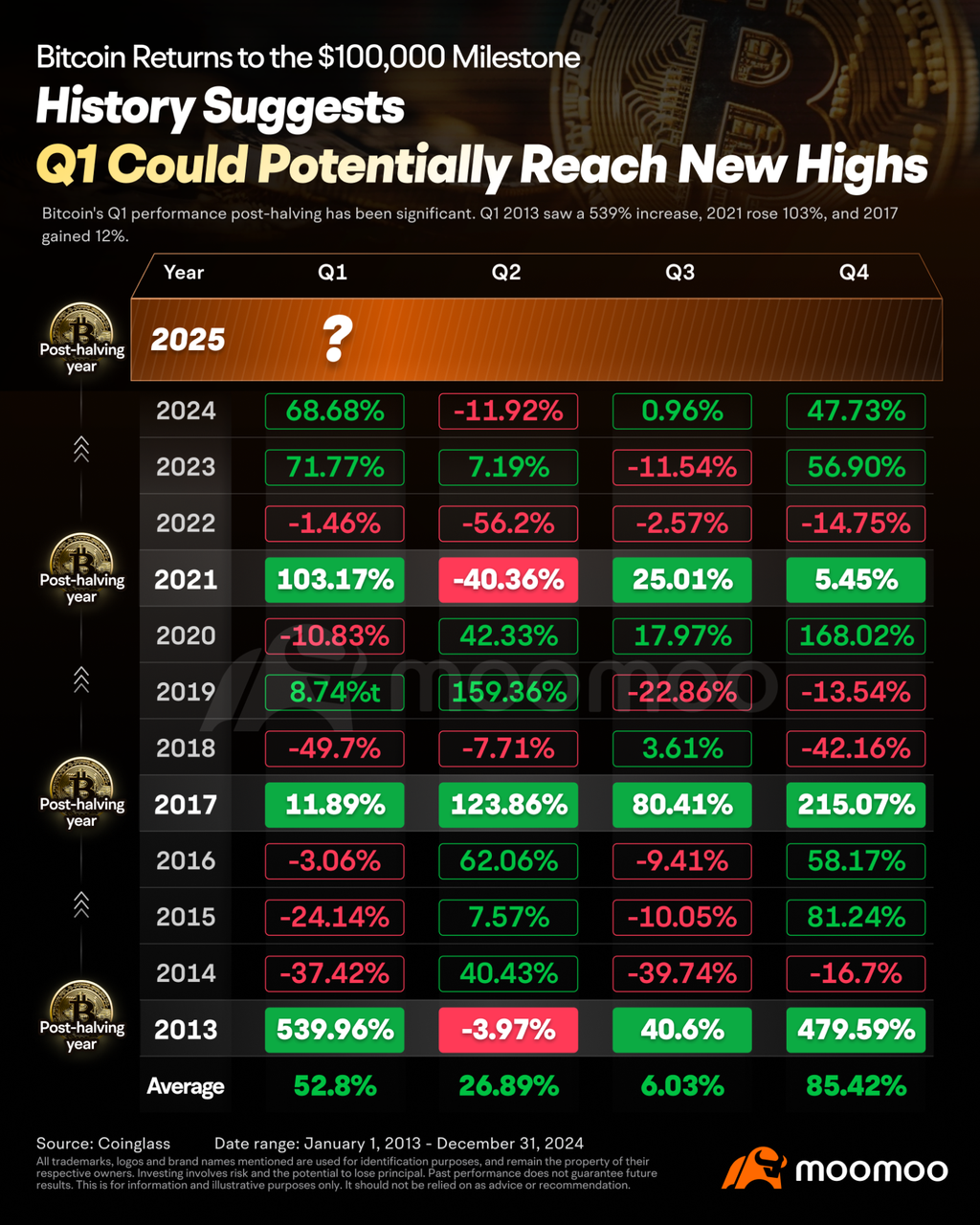

Bitcoin's Golden Moment: Will It Soar After Trump's Inauguration?

Top Corporate News

Tesla Launches Refreshed Model Y In China

Tesla introduced the updated Model Y crossover to its China website on Thursday. According to the website, the new Model Y boasts a "longer range, new design, and higher quality interior," among other changes. The launch series of this updated vehicle is priced at 263,500 yuan, which is nearly 5.4% more expensive than the previous model that started at 249,900 yuan. Tesla indicates that deliveries of the new Model Y are expected to start in March, while the exact timing of the first deliveries will be contingent upon regulatory approval.

"Nvidia Magic" Strikes Again! Exploring Nvidia's Latest AI Investment Landscape

Recently, the "Nvidia Magic" has been a prominent feature in the U.S. stock market. Shares of Cerence, an AI developer collaborating with major automakers, skyrocketed over 140% last Friday after announcing an AI partnership with Nvidia. Similarly, Arbe Robotics, a leader in Perception Radar solutions, saw its shares soar over 50% on Monday following news of its collaboration with Nvidia to enhance AI-driven automotive capabilities.

At CES 2025, Nvidia CEO Jensen Huang announced several collaborations: with Micron Technology for memory in AI-powered gaming chips, with Aurora Innovation and Continental for scaling self-driving trucks and with Toyota Motor to develop next-gen autonomous vehicles. Nvidia's influence extends beyond its own stock, frequently impacting the sectors and companies it partners with in the U.S. stock market.

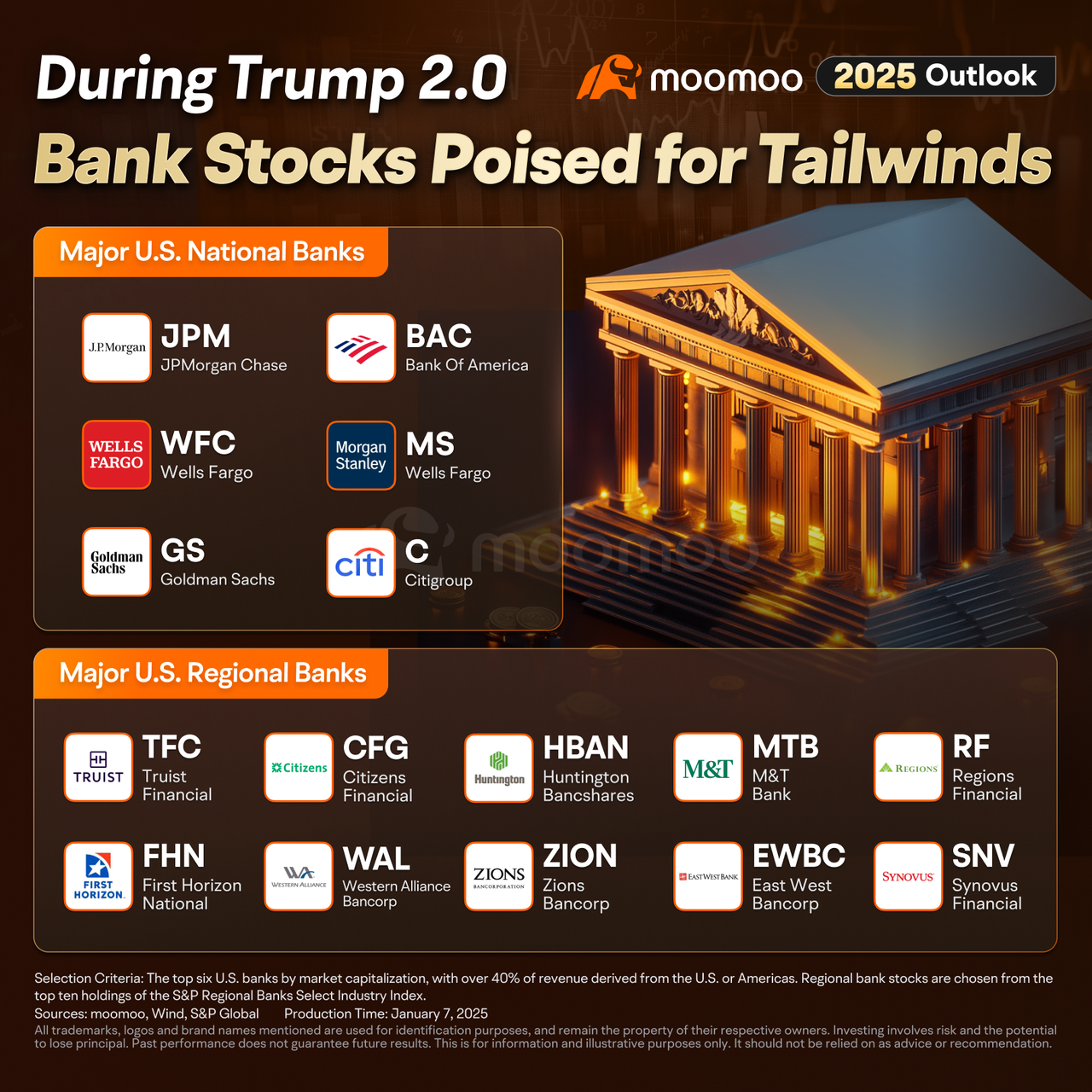

Barr to Step Down as Fed Vice Chair; Bank Stocks Poised for Gains in Trump 2.0

With Barr's resignation, the U.S. banking sector appears to have secured a concession from regulators. As Trump's January 20 inauguration approaches, his policy emphasis on deregulation could make the banking sector a primary beneficiary during his term.

Disclaimer: This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information having regard to your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal.

Moomoo is a financial information and trading app offered by Moomoo Technologies Inc. In the U.S., investment products and services on Moomoo are offered by Moomoo Financial Inc., Member FINRA/SIPC.