COSCO Shipping Holdings' container shipping business achieved an increase in both volume and price year-on-year, with Net income for the parent company expected to rise 105.71% in 2024. The uncertainty in the 2025 container shipping market regarding the East Coast dock strike in the USA has been avoided, and freight rates on the USA routes have already decreased.

According to the Financial Associated Press on January 10 (Reporter Hu Haoqiong), the Red Sea incident has pushed up container shipping rates. COSCO Shipping Holdings (601919.SH) expects to achieve a Net income of approximately 49.082 billion yuan for its shareholders in 2024, an increase of about 105.71% year-on-year.

This evening, COSCO Shipping Holdings announced its performance forecast for 2024. According to the announcement, COSCO Shipping Holdings is expected to achieve EBIT of approximately 69.926 billion yuan in 2024, an increase of about 90.67% year-on-year; and a Net income of approximately 55.372 billion yuan, an increase of about 94.99% year-on-year.

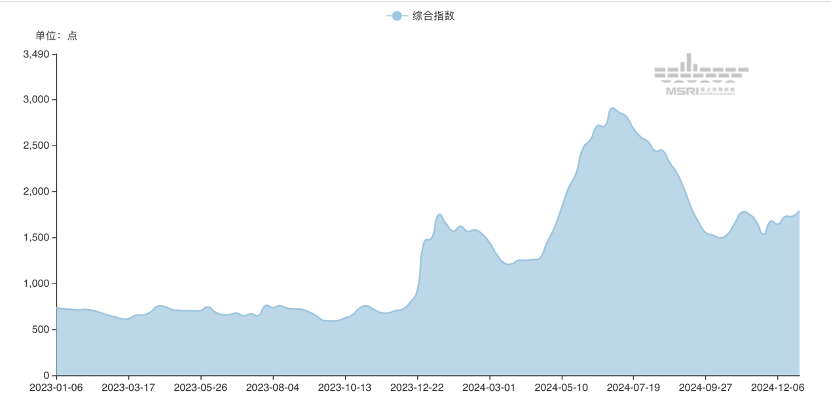

From the perspective of the industry to which COSCO Shipping Holdings belongs, the container shipping market in 2024, influenced by the Red Sea incident, has seen ships mainly diverting around the Cape of Good Hope, leading to increased sailing distances and decreased effective capacity, thus supporting freight rates. From the NCFI index trend of the Ningbo Shipping Exchange, the composite NCFI index is expected to peak at 2905.4 points on June 28, 2024, significantly higher than the freight rate levels of 2023.

From the perspective of the industry to which COSCO Shipping Holdings belongs, the container shipping market in 2024, influenced by the Red Sea incident, has seen ships mainly diverting around the Cape of Good Hope, leading to increased sailing distances and decreased effective capacity, thus supporting freight rates. From the NCFI index trend of the Ningbo Shipping Exchange, the composite NCFI index is expected to peak at 2905.4 points on June 28, 2024, significantly higher than the freight rate levels of 2023.

NCFI Composite Index Trend from 2023 to 2024 (Source: Ningbo Shipping Exchange)

Ningbo Shipping Exchange Analyst Qian Hanglu indicated that in the first half of 2024, container shipping line freight rates are expected to rise rapidly post-seasonal adjustment due to the inability of capacity supply to meet supply chain operational needs, leading shipping companies to take advantage of this situation to quickly increase rates, with the rise speed exceeding that during the 2021 pandemic. The container shipping market is set to enter a peak season early; however, since the third quarter, market demand has weakened, easing the tight capacity situation, making it difficult to sustain high freight rates, and the composite index has reached its peak and started to decline, transitioning between peak and off-peak smoothly.

COSCO Shipping Holdings' performance is also largely consistent with freight rate trends. In addition to the factors related to the Red Sea incident, COSCO Shipping Holdings stated in its announcement that the main reason for its performance forecast is: in response to the complex and changing Global economic and trade situation, COSCO Shipping Holdings adheres to leveraging its own development certainties to counter external uncertainties, continuously building an integrated full-chain service brand of "container shipping + port + related Logistics," effectively enhancing the company’s core competitiveness. In 2024, the company’s container shipping business is expected to achieve increases in both volume and price year-on-year.

It is worth noting that one of the uncertainties facing the container shipping market in 2025—the crisis of the East Coast dock workers' strike in the USA—was avoided after the International Longshoremen's Association (ILA) and the USA Maritime Alliance (USMX) announced a preliminary agreement on January 8 local time.

In response, multiple Analysts indicated to the Financial Association reporter that the freight rates on the USA West Coast will be affected, opening a path for price reductions. The decline in freight rates will subsequently impact the profitability of shipping companies.

Currently, the price reduction situation on the USA route has already been reflected. According to the latest NCFI index, this week, the USA East route freight rate index reported 2090.1 points, down 4.0% from last week; the USA West route freight rate index is 2728.8 points, down 9.5% from last week.

从中远海控所属行业来看,2024年集运市场在红海事件影响下,由于船舶基本绕行好望角,运距增加,使得有效运力减少,运价得到支撑。从宁波航运交易所NCFI指数走势来看,2024年NCFI综合指数在2024年6月28日达到顶峰,为2905.4点,明显高于2023年的运价水平。

从中远海控所属行业来看,2024年集运市场在红海事件影响下,由于船舶基本绕行好望角,运距增加,使得有效运力减少,运价得到支撑。从宁波航运交易所NCFI指数走势来看,2024年NCFI综合指数在2024年6月28日达到顶峰,为2905.4点,明显高于2023年的运价水平。