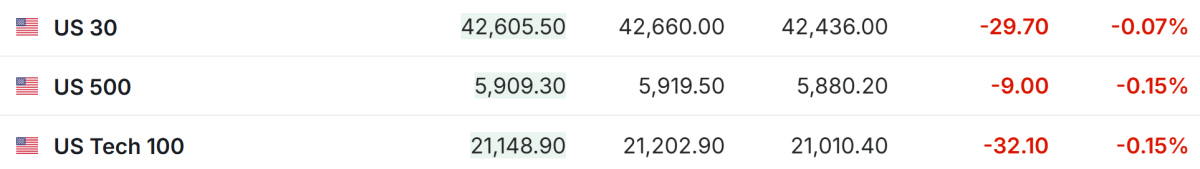

On January 10th (Friday) in Pre-Market Trading, the three major Equity Index futures of the U.S. stock market all experienced declines.

1. On January 10th (Friday) during Pre-Market Trading, all three major US Equity Index futures declined. As of the time of writing, Dow futures fell by 0.07%, S&P 500 Index futures fell by 0.15%, and Nasdaq futures fell by 0.15%.

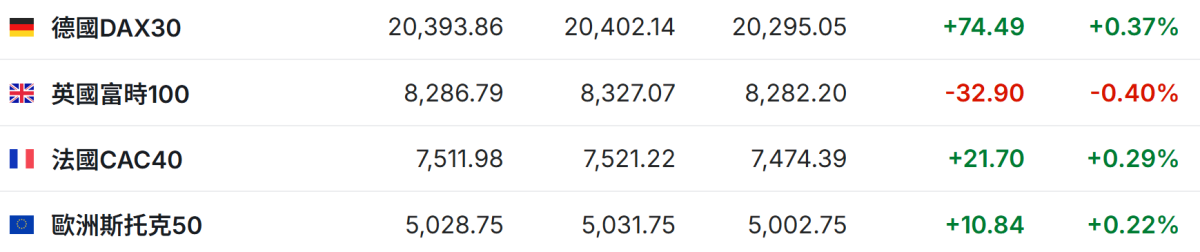

2. As of the time of writing, the DEGUODAXZHISHU rose by 0.37%, the UK FTSE100 Index fell by 0.40%, the France CAC40 Index rose by 0.29%, and the Europe STOXX 50 Index rose by 0.22%.

3. As of the time of writing, Crude Oil rose by 3.56%, trading at $76.55 per barrel. Brent Oil fell by 3.50%, trading at $79.61 per barrel.

3. As of the time of writing, Crude Oil rose by 3.56%, trading at $76.55 per barrel. Brent Oil fell by 3.50%, trading at $79.61 per barrel.

Market News

Tonight, will the non-farm payroll testify to the Federal Reserve's pause on interest rate cuts? The U.S. Bureau of Labor Statistics will release the monthly non-farm employment report on Friday. The December non-farm employment report is expected to show a healthy increase in new jobs and a stable unemployment rate, indicating that the labor market has once again defied expectations of a greater slowdown. According to economists, non-farm payrolls may have increased by 0.165 million last month. This figure would be a decline from November's 0.227 million. This data will support the Federal Reserve's intention to refocus on inflation. Last year, the Federal Reserve cut interest rates by a full percentage point to prevent the labor market from deteriorating rapidly. Following these measures, Fed Chair Powell stated that as long as the job market remains stable, officials can take a cautious approach to further interest rate cuts.

Multiple Federal Reserve officials hinted at a pause in interest rate cuts. Several Fed officials confirmed on Thursday that the Federal Reserve may keep rates at current levels for an extended period, only lowering rates again if inflation clearly cools. Boston Fed President Collins stated on Thursday that, due to substantial uncertainty about the U.S. economic outlook, adjustments to interest rates should slow down. Collins said at an event in Boston that the Fed's "policy is prepared to make necessary adjustments based on changing circumstances - if inflation does not progress further, rates will be maintained at current levels for a longer time." The Fed's preferred inflation measure rose 2.4% year-on-year as of November, with a 2.8% increase excluding food and energy, both exceeding the Fed's 2% target.

Goldman Sachs strategists warn: U.S. stocks are priced at a "perfect level," making a pullback likely. Goldman Sachs Chief Global Equity Strategist Peter Oppenheimer warned that as investors digest rising bond yields, overvaluation, and uncertainties around further rate cuts, the current "perfect" profit market environment may be difficult to sustain. Peter Oppenheimer stated: "The recent strong rebound in the U.S. stock market has pushed current equity market valuations to perfection. While we expect overall stock markets to continue to rise throughout the year—primarily driven by corporate earnings—the stock market is increasingly vulnerable to pullback, especially if bond yields rise further or economic data and earnings performance disappoint."

Concerns over Trump's tariffs escalate as U.S. silver and copper prices surge above international benchmarks. Copper and silver futures prices in New York soared above international benchmark prices as traders increased bets that President-elect Donald Trump will impose high import tariffs on these metals as part of his escalating global trade war. On Thursday, silver futures prices close on the COMEX were over $0.90 per ounce premium compared to London spot prices, nearing last December's highs, as traders reacted to Trump's commitment to impose universal tariffs on all goods from all countries. Financial market anxiety over Trump's trade policies intensified before his inauguration on January 20th. Media reports suggested that Trump's team planned to lower import tariffs on key commodities, potentially including copper, but Trump denied this.

Stock News

Delta Air Lines (DAL.US) exceeded expectations for Q4 2024 performance, optimistic outlook for 2025. Delta Air Lines reported profits in the last few months of 2024 exceeding Wall Street's expectations, driven by growth in international and business travel, with the company expecting strong demand to continue into the new year. Delta Air Lines stated in a release on Friday that adjusted profits for the quarter are expected to be between $0.70 and $1 per share, which also included financial performance for Q4 2024. Additionally, the company expects revenues to grow by 9% compared to the same period last year, while analysts expected a growth of 5.75%. Delta Air Lines' adjusted EPS for Q4 was $1.85, above the analysts' average expectation of $1.76. Revenue was $14.44 billion, surpassing Wall Street's expectation of $14.16 billion. The company anticipates that adjusted EPS for the entire year will "exceed" $7.35, while the analysts' average EPS expectation is $7.45.

Is Wall Street's investment banking business seeing a revival? Reports suggest bonuses at major banks will grow in double digits. People familiar with the plans revealed that executives at several of Wall Street's largest investment banks are crafting plans to award traders and dealmakers with the highest bonuses since the pandemic began, with many departments seeing bonuses increase by 10% or more. Insiders indicated that this is the average pay rise for bankers and traders in equity and fixed income products at Bank of America (BAC.US). Additionally, it was noted that traders at Morgan Stanley (MS.US) and its larger competitor JPMorgan (JPM.US) will see bonuses increase by over 10%. JPMorgan bankers' bonuses are expected to rise by about 15%. Goldman Sachs Group (GS.US) will offer even greater rewards for some trading departments.

Tensions escalate! Starbucks (SBUX.US) union files 34 federal complaints. This week, the Starbucks (SBUX.US) union submitted 34 complaints against the company to the U.S. Labor Board, indicating that tensions between Starbucks and the union are intensifying. These complaints, filed by the Starbucks Workers Union, allege that Starbucks violated federal labor laws in stores across 16 states by selectively dismissing employees due to union activities over the past few months. It is reported that the union had previously filed a complaint on December 20, claiming that Starbucks refused to negotiate fairly and held a five-day strike in hundreds of Starbucks stores before Christmas. Starbucks stated that these union allegations are baseless. A Starbucks spokesperson, Phil Gee, said in an email statement, "Taking the time to file such complaints is a strategy that will distract us from progress we could make."

Tesla (TSLA.US) resolves recall issue for 239,000 vehicles through software update. As part of the National Highway Traffic Safety Administration (NHTSA) recalling 239,382 vehicles, Tesla conducted a wireless software update. The update addresses an issue where the computer circuit board "may short circuit, causing the rearview camera image loss." The recall covers the Model 3, Model S from 2024-2025, and Model X and Model Y from 2023-2025. Notably, Tesla's website shows that the company officially launched the new Model Y SUV in China on Friday and began accepting Orders, with the standard version starting at 263,500 yuan (approximately $35,900).

Taiwan Semiconductor (TSM.US) exceeds sales expectations in Q4, AI boom expected to continue through 2025. Semiconductor manufacturing giant Taiwan Semiconductor (TSM.US) exceeded sales expectations for Q4 2024, boosting investor hopes that the momentum in AI hardware spending will continue into 2025. Data released by Taiwan Semiconductor showed a 39% revenue increase from October to December, reaching NT$868.5 billion (approximately $26.3 billion). In comparison, the average expectation was NT$854.7 billion. Taiwan Semiconductor experienced accelerated growth in December, with an upper limit of 34% revenue growth projected for 2024. In contrast, the company's official target is 30% annual growth, although this expectation is calculated in U.S. dollars. As the world's largest advanced chip manufacturer, it has become one of the biggest beneficiaries in the global AI development race.

Disputes escalate again! Musk demands U.S. judges auction off OpenAI shares. Reports indicate that Elon Musk and his lawyers have asked judges in California and Delaware to auction off shares of OpenAI, which could allow external investors to control OpenAI even if it successfully transforms. Sources say OpenAI has no plans for an auction, and Musk and his team "want to create more chaos." Musk's grievances with OpenAI have a long history. In November 2024, Musk and his lawyers filed an injunction attempting to prevent OpenAI from transitioning into a for-profit organization. The injunction also aimed to prevent OpenAI from engaging in what Musk's lawyers described as anti-competitive practices.

Robinhood (HOOD.US) executives: Plan to continue expanding crypto products to build a new financial system for the future. Robinhood (HOOD.US) executives recently stated in an interview that the company will continue to expand its crypto products and emphasize the accessibility and innovation of its platform. Robinhood crypto head Johann Kerbrat discussed the platform's progress, including its $38 billion in managed Assets and the growing demand from retail investors for crypto products. Kerbrat emphasized Robinhood's focus on meeting the needs of everyday investors, stating: "We are a leading retail platform in the USA, and last November was a month (we performed) very well, with our national trading volume exceeding $30 billion."

Important economic data and event forecasts.

Beijing time 21:30: Adjusted change in U.S. non-farm payrolls for December (10,000).

Beijing time 23:00: Preliminary value of U.S. January University of Michigan Consumer Sentiment Index.

At 2:00 AM Beijing time the following day: the total number of active rigs in the USA for the week ending January 10.

At 4:30 AM Beijing time the following day: CFTC releases the weekly holding report.

3. 截至发稿,WTI原油涨3.56%,报76.55美元/桶。布伦特原油跌3.50%,报79.61美元/桶。

3. 截至发稿,WTI原油涨3.56%,报76.55美元/桶。布伦特原油跌3.50%,报79.61美元/桶。