Elon Musk's Tesla Is Over 4X More Expensive Than Industry Average Despite Weak Delivery Volumes In 2024

Elon Musk's Tesla Is Over 4X More Expensive Than Industry Average Despite Weak Delivery Volumes In 2024

Despite falling 4.51% over the last five days, Elon Musk's Tesla Inc. (NASDAQ:TSLA) has surged 108.50% over the last year, making it over four times more expensive as compared to the industry average according to Benzinga Pro data.

尽管在过去五天中下跌了4.51%,但埃隆·马斯克的特斯拉公司(纳斯达克:TSLA)在过去一年中上涨了108.50%,根据Benzinga Pro的数据,其价格是行业平均水平的四倍以上。

What Happened: With a price-to-earnings ratio of nearly 117.647 based on forward earnings, Tesla's stock is significantly overvalued compared to its peers, whose average P/E ratio is only 26.7795. This implies that Tesla's stock is over 4.39 times more expensive than the industry average.

发生了什么:以即期收益为基础,特斯拉的市盈率接近117.647,远高于同行的平均市盈率仅为26.7795。这意味着特斯拉的股票比行业平均价值贵4.39倍以上。

Compared to other automobile stocks, Tesla shares are the most expensive and it has the highest ratio of forward price-to-earnings.

与其他汽车股票相比,特斯拉的股票是最昂贵的,并且其前瞻性市盈率是最高的。

| Automobile Stocks | Forward P/E |

| Tesla Inc (NASDAQ:TSLA) | 117.647 |

| Toyota Motor Corporation (NYSE:TM) | 9.66 |

| General Motors Company (NYSE:GM) | 5.05 |

| Honda Motor (NYSE:HMC) | 6.78 |

| Ford Motor Company (NYSE:F) | 6.18 |

| Li Auto Inc (NASDAQ:LI) | 15.36 |

| Average | 26.7795 |

| 汽车股票 | 前瞻市盈率 |

| 特斯拉公司(纳斯达克:TSLA) | 117.647 |

| 丰田汽车公司(纽交所:TM) | 9.66 |

| 通用汽车公司 (纽交所:GM) | 5.05 |

| 本田汽车 (纽约证券交易所:HMC) | 6.78 |

| 福特汽车公司 (纽约证券交易所:F) | 6.18 |

| 理想汽车公司 (纳斯达克:LI) | 15.36 |

| 平均 | 26.7795 |

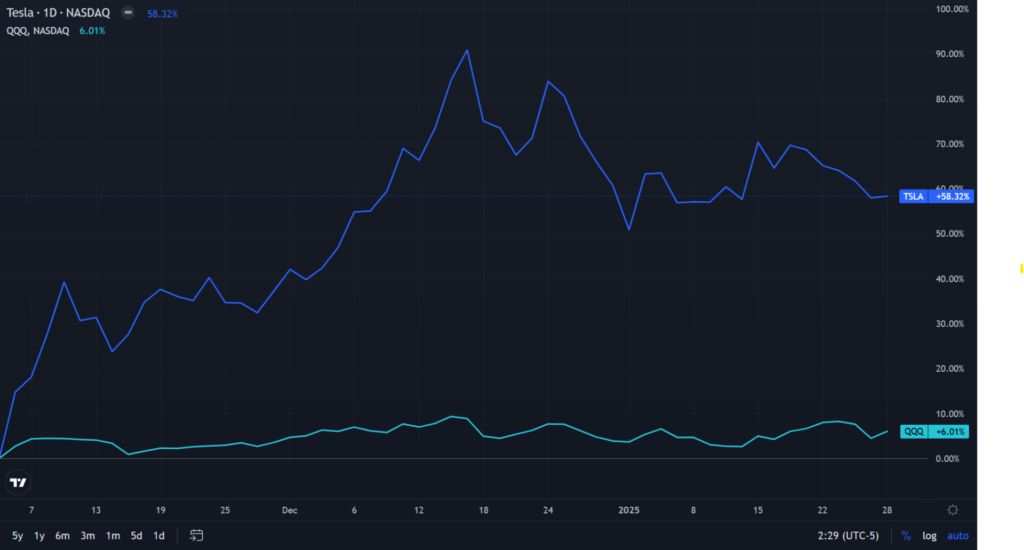

Why It Matters: Following the U.S. presidential election on Nov. 5, Tesla shares experienced a remarkable surge, climbing 58.32% according to Benzinga Pro. This growth far exceeded the 6.01% gain seen by the Invesco QQQ Trust ETF (NASDAQ:QQQ), which tracks the Nasdaq 100 index.

重要性:在11月5日的美国总统选举后,特斯拉股票经历了显著的上涨,涨幅达到58.32%,根据Benzinga Pro的数据。这个增长远远超过了跟踪纳斯达克100指数的纳指100ETF-Invesco QQQ Trust(NASDAQ:QQQ)的6.01%的涨幅。

Although Tesla has a history of missing revenue estimates, which has happened in four of the last five quarters and six of the last ten quarters, this post-election surge has significantly improved the investment picture, turning a period of mixed performance into a highly profitable one for Tesla shareholders.

尽管特斯拉在营收预估上有着未达标的历史,这种情况在过去五个季度中的四个季度及过去十个季度中的六个季度都有发生,但这次选后暴涨显著改善了投资前景,将一个表现混合的时期转变为特斯拉股东的高度盈利期。

| Performance | Invesco QQQ Trust ETF | Tesla Stock |

| Since Nov. 5 | 6.01% | 58.32% |

| One Year | 21.88% | 108.50% |

| Five Year | 138.19% | 817.89% |

| 表现 | 纳指100ETF-Invesco QQQ Trust | 特斯拉股票 |

| 自11月5日以来 | 6.01% | 58.32% |

| 一年 | 21.88% | 108.50% |

| 五年 | 138.19% | 817.89% |

As there was skepticism around the development of its full-self-drive feature, Musk released a video ahead of its fourth-quarter earnings showcasing how the company's cars can now drive themselves from the factory to the loading docks.

由于对其全自驾功能的发展存在怀疑,马斯克在第四季度财报发布前发布了一段视频,展示了公司的汽车现在可以从工厂自驾驶到装货码头。

Unsupervised full self-driving begins

— Elon Musk (@elonmusk) January 29, 2025

无人监督的全自动驾驶开始了

— 埃隆·马斯克 (@elonmusk) 2025年1月29日

Tesla is projected to report fourth-quarter revenue of $27.13 billion, up from last year's $25.17 billion, according to Benzinga Pro data. Earnings per share (EPS) are expected to rise to $0.74 from $0.71.

根据Benzinga Pro的数据,特斯拉预计报告第四季度营业收入为271.3亿,较去年的251.7亿有所增加。每股收益(EPS)预计将从0.71上升到0.74。

Also, the automaker's fourth-quarter deliveries reached a record 495,570 vehicles, with production at 459,445. However, this positive news is overshadowed by the company's overall 2024 performance. Total deliveries fell to 1.79 million, compared to 1.81 million in 2023, representing the first annual decline in Tesla's history.

同时,汽车制造商第四季度的交付量达到了创纪录的495,570辆,产量为459,445辆。然而,这一积极的消息却被公司2024年的整体表现所掩盖。总交付量下降至179万,而2023年为181万,这标志着特斯拉历史上的首次年度下降。

TSLA has a consensus 'hold' with a price target of $308.4, according to the 34 analysts tracked by Benzinga. The high target is $550, and the low is $24.86. Recent ratings by Wedbush, Piper Sandler, and Barclays suggest a $458.33 target, implying a 15.55% upside.

根据Benzinga跟踪的34位分析师的共识,TSLA被评估为'持有',目标价格为308.4美元。最高目标为550美元,最低目标为24.86美元。Wedbush、派杰投资和巴克莱银行最近的评级建议目标价为458.33美元,意味着有15.55%的上涨空间。

- DeepSeek Buzz Batters Big Tech But This Analyst Says 'Buy The Dip:' Here's Are Top 5 Semiconductor ETFs With The Lowest Expense Ratios That You Can Consider

- DeepSeek的热度冲击了大型科技公司,但这位分析师表示“买入逢低”:以下是您可以考虑的费用比率最低的五只半导体ETF。

Photo courtesy: Shutterstock

照片提供:shutterstock

评论(0)

请选择举报原因