Check Out What Whales Are Doing With Nu Holdings

Check Out What Whales Are Doing With Nu Holdings

Investors with a lot of money to spend have taken a bullish stance on Nu Holdings (NYSE:NU).

資金雄厚的投資者對Nu Holdings(紐交所:NU)採取了看好的態度。

And retail traders should know.

零售交易者應該了解這一點。

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

我們今天注意到,當我們在Benzinga跟蹤的公開可用的期權歷史中出現這些頭寸時。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with NU, it often means somebody knows something is about to happen.

無論這些是機構還是隻是富有的個人,我們都不知道。但當NU發生如此大的事件時,通常意味着有人知道即將發生的事情。

Today, Benzinga's options scanner spotted 13 options trades for Nu Holdings.

今天,Benzinga的期權掃描儀發現了13筆Nu Holdings的期權交易。

This isn't normal.

這並不正常。

The overall sentiment of these big-money traders is split between 61% bullish and 30%, bearish.

這些大資金交易者的整體情緒在61%的看好與30%的看淡之間分歧。

Out of all of the options we uncovered, there was 1 put, for a total amount of $1,812,000, and 12, calls, for a total amount of $658,195.

在我們發現的所有期權中,有1筆看跌期權,總金額爲1,812,000美元,和12筆看漲期權,總金額爲658,195美元。

Projected Price Targets

預計價格目標

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $9.0 and $20.0 for Nu Holdings, spanning the last three months.

在評估了成交量和未平倉合約後,很明顯主要市場參與者在關注Nu Holdings的價格區間在$9.0到$20.0之間,涵蓋了過去三個月。

Volume & Open Interest Development

成交量和持倉量的評估是期權交易中的一個關鍵步驟。這些指標揭示了阿里巴巴集團(Alibaba Gr Hldgs)特定執行價格期權的流動性和投資者興趣。下面的數據可視化了在過去30天內,阿里巴巴集團(Alibaba Gr Hldgs)在執行價格在74.0美元到120.0美元區間內的看漲看跌期權中,成交量和持倉量的波動情況。

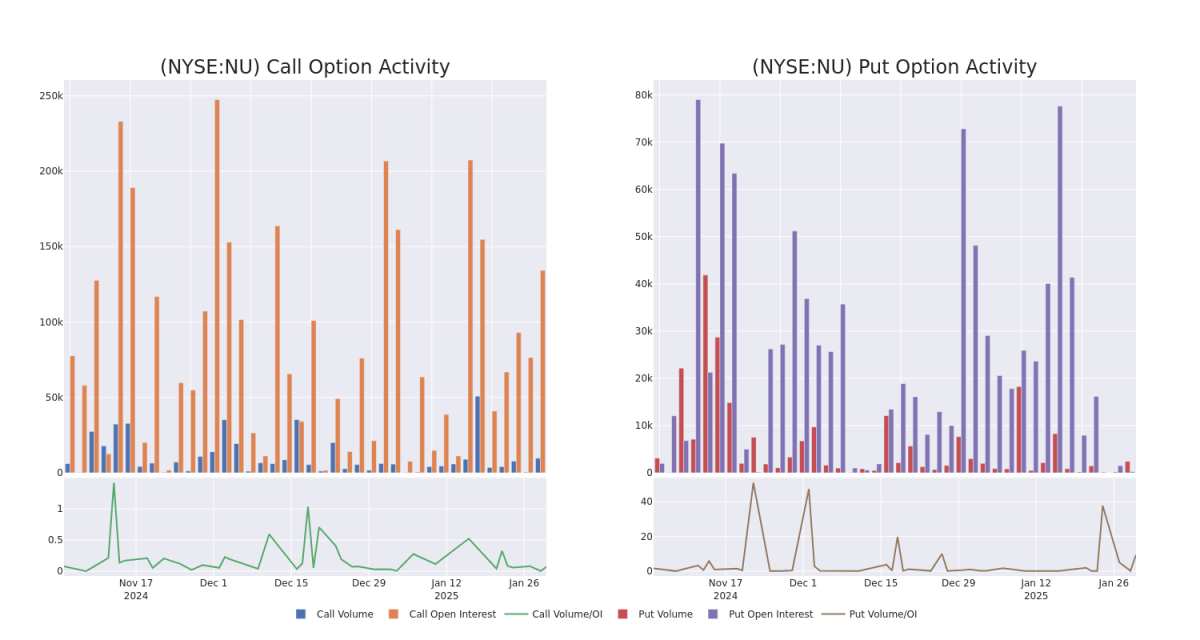

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Nu Holdings's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Nu Holdings's whale trades within a strike price range from $9.0 to $20.0 in the last 30 days.

關注成交量和未平倉合約是交易期權時一個強有力的舉措。這些數據可以幫助您跟蹤Nu Holdings在特定行權價的流動性和興趣。下面,我們可以觀察到過去30天中,所有Nu Holdings的大手交易在$9.0到$20.0的行權價格區間內,看漲和看跌的成交量和未平倉合約的演變。

Nu Holdings Option Volume And Open Interest Over Last 30 Days

Nu Holdings過去30天的期權成交量和未平倉合約

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NU | PUT | TRADE | BULLISH | 01/15/27 | $8.4 | $7.4 | $7.55 | $20.00 | $1.8M | 258 | 2.4K |

| NU | CALL | SWEEP | BULLISH | 02/21/25 | $0.46 | $0.45 | $0.46 | $13.50 | $184.4K | 1.4K | 4.8K |

| NU | CALL | SWEEP | BEARISH | 08/15/25 | $4.6 | $4.5 | $4.5 | $9.00 | $112.5K | 356 | 250 |

| NU | CALL | SWEEP | BEARISH | 02/14/25 | $0.92 | $0.88 | $0.89 | $12.50 | $44.5K | 2.5K | 1.0K |

| NU | CALL | SWEEP | BEARISH | 02/14/25 | $0.92 | $0.87 | $0.87 | $12.50 | $43.5K | 2.5K | 89 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 行權價 | 總交易價格 | 未平倉合約 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NU | 看跌 | 交易 | 看好 | 01/15/27 | $8.4 | $7.4 | $7.55 | $20.00 | 180萬美元 | 258 | 2.4K |

| NU | 看漲 | 掃單 | 看好 | 02/21/25 | $0.46 | $0.45 | $0.46 | $13.50 | $184.4K | 1.4K | 4.8K |

| NU | 看漲 | 掃單 | 看淡 | 08/15/25 | $4.6 | $4.5 | $4.5 | $9.00 | $112.5K | 356 | 250 |

| NU | 看漲 | 掃單 | 看淡 | 02/14/25 | $0.92 | $0.88 | $0.89 | $12.50 | $44.5K | 2.5K | 1.0K |

| NU | 看漲 | 掃單 | 看淡 | 02/14/25 | $0.92 | $0.87 | $0.87 | $12.50 | 43.5K美元 | 2.5K | 89 |

About Nu Holdings

關於Nu Holdings

Nu Holdings Ltd is engaged in providing digital banking services. It offers several financial services such as Credit cards, Personal Account, Investments, Personal Loans, Insurance, Mobile payments, Business Accounts, and Rewards. The company earns the majority of its revenue in Brazil.

Nu Holdings Ltd從事數字銀行服務。它提供多種金融服務,如信用卡、個人賬戶、投資、個人貸款、保險、移動支付、企業賬戶和獎勵。該公司在巴西的營業收入佔大多數。

After a thorough review of the options trading surrounding Nu Holdings, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在對圍繞Nu Holdings的期權交易進行全面審查後,我們繼續更詳細地考察該公司。這包括對其當前市場狀態和業績的評估。

Present Market Standing of Nu Holdings

Nu Holdings的當前市場狀況

- With a trading volume of 36,400,343, the price of NU is up by 6.57%, reaching $13.38.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 21 days from now.

- NU的成交量爲36,400,343,價格上漲6.57%,達到$13.38。

- 當前的RSI值表明該股票可能被超買。

- 下一份業績計劃在21天后發佈。

Turn $1000 into $1270 in just 20 days?

在短短20天內將1000美元變成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

一位擁有20年經驗的期權交易員揭示了他的單行圖表技巧,幫助判斷何時買入和賣出。複製他的交易,這些交易每20天平均獲得27%的利潤。點擊這裏獲取訪問權限。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

與僅僅交易股票相比,期權是一種風險較高的資產,但它們具有更高的盈利潛力。嚴肅的期權交易者通過日常學習、逐步進出交易、關注多個因數以及密切關注市場來管理這種風險。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with NU, it often means somebody knows something is about to happen.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with NU, it often means somebody knows something is about to happen.

評論(0)

請選擇舉報原因