Behind the Scenes of Carnival's Latest Options Trends

Behind the Scenes of Carnival's Latest Options Trends

Financial giants have made a conspicuous bearish move on Carnival. Our analysis of options history for Carnival (NYSE:CCL) revealed 11 unusual trades.

金融巨头对嘉年华的看淡动作十分明显。我们对嘉年华(纽交所:CCL)期权历史的分析揭示了11笔期权异动。

Delving into the details, we found 18% of traders were bullish, while 63% showed bearish tendencies. Out of all the trades we spotted, 4 were puts, with a value of $206,670, and 7 were calls, valued at $577,607.

深入分析后,我们发现18%的交易者看好,而63%则表现出看淡的倾向。在我们发现的所有交易中,有4笔是看跌期权,价值206,670美元,7笔是看涨期权,价值577,607美元。

Expected Price Movements

预期价格变动

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $25.0 to $30.0 for Carnival during the past quarter.

分析这些合约的成交量和未平仓合约,似乎大玩家在过去一个季度内关注嘉年华的价格范围在25.0美元到30.0美元之间。

Volume & Open Interest Development

成交量和持仓量的评估是期权交易中的一个关键步骤。这些指标揭示了阿里巴巴集团(Alibaba Gr Hldgs)特定执行价格期权的流动性和投资者兴趣。下面的数据可视化了在过去30天内,阿里巴巴集团(Alibaba Gr Hldgs)在执行价格在74.0美元到120.0美元区间内的看涨看跌期权中,成交量和持仓量的波动情况。

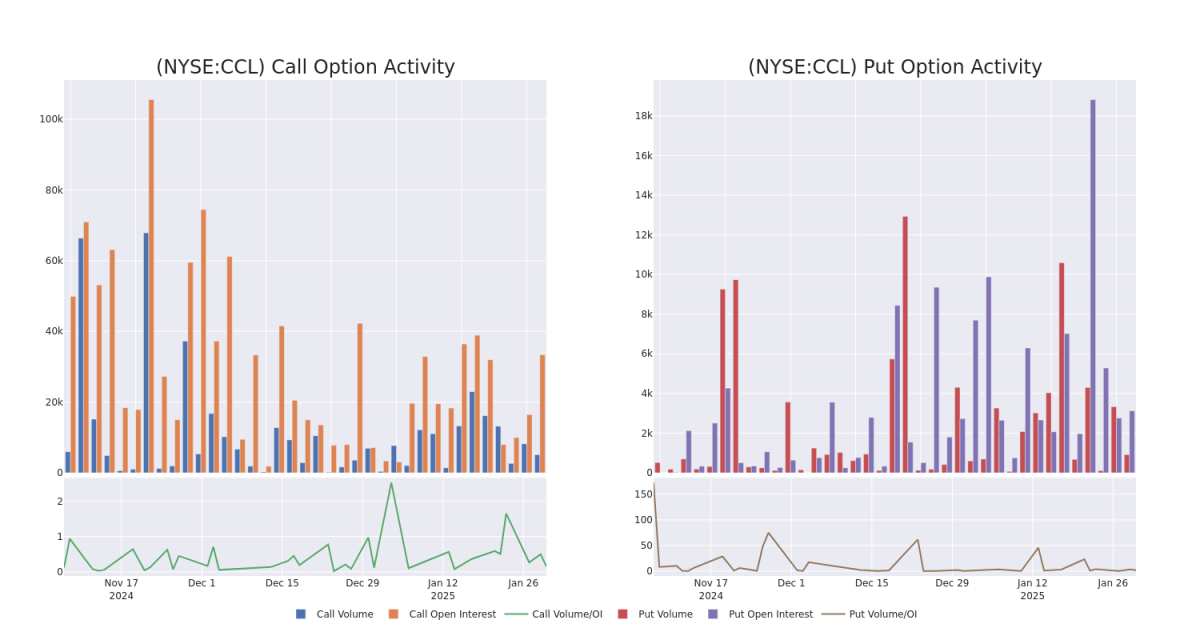

In today's trading context, the average open interest for options of Carnival stands at 4057.33, with a total volume reaching 6,049.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Carnival, situated within the strike price corridor from $25.0 to $30.0, throughout the last 30 days.

在今天的交易环境中,嘉年华期权的平均未平仓合约数为4057.33,总成交量达到6049.00。随附的图表描绘了嘉年华高价值交易中,看涨和看跌期权的成交量与未平仓合约的走势,位于25.0美元到30.0美元的行权价区间内,时间跨度为过去30天。

Carnival Option Volume And Open Interest Over Last 30 Days

嘉年华期权在过去30天的成交量和未平仓合约

Biggest Options Spotted:

最大的期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CCL | CALL | SWEEP | BULLISH | 04/17/25 | $1.58 | $1.55 | $1.58 | $30.00 | $164.2K | 4.8K | 1.8K |

| CCL | CALL | TRADE | NEUTRAL | 04/17/25 | $4.35 | $4.25 | $4.3 | $25.00 | $129.0K | 8.1K | 336 |

| CCL | CALL | SWEEP | BEARISH | 04/17/25 | $2.49 | $2.46 | $2.46 | $28.00 | $127.8K | 3.0K | 842 |

| CCL | PUT | SWEEP | BEARISH | 06/20/25 | $3.6 | $3.5 | $3.6 | $30.00 | $99.0K | 684 | 275 |

| CCL | CALL | SWEEP | BEARISH | 06/20/25 | $3.8 | $3.7 | $3.7 | $27.00 | $54.7K | 12.6K | 414 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 行权价 | 总交易价格 | 未平仓合约 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CCL | 看涨 | 扫单 | 看好 | 04/17/25 | $1.58 | $1.55 | $1.58 | $30.00 | $164.2K | 4.8K | 1.8K |

| CCL | 看涨 | 交易 | 中立 | 04/17/25 | $4.35 | $4.25 | $4.3 | $25.00 | 129.0K美元 | 8.1K | 336 |

| CCL | 看涨 | 扫单 | 看淡 | 04/17/25 | $2.49 | $2.46 | $2.46 | $28.00 | $127.8K | 3.0K | 842 |

| CCL | 看跌 | 扫单 | 看淡 | 06/20/25 | $3.6 | $3.5 | $3.6 | $30.00 | 99,000美元 | 684 | 275 |

| CCL | 看涨 | 扫单 | 看淡 | 06/20/25 | $3.8 | $3.7 | $3.7 | $27.00 | 54.7K美元 | 12.6K | 414 |

About Carnival

关于嘉年华

Carnival is the largest global cruise company, with more than 90 ships in service at the end of fiscal 2024. Its portfolio of brands includes Carnival Cruise Lines, Holland America, Princess Cruises, and Seabourn in North America; P&O Cruises and Cunard Line in the United Kingdom; Aida in Germany; Costa Cruises in Southern Europe. It's currently folding its P&O Australia brand into Carnival. The firm also owns Holland America Princess Alaska Tours in Alaska and the Canadian Yukon. Carnival's brands attracted 14 million guests in 2024.

嘉年华是全球最大的邮轮公司,截至2024财年末,运营着90多艘船只。其品牌组合包括北美的嘉年华邮轮公司、荷兰美国邮轮、公主邮轮和西伯利亚邮轮;英国的P&O邮轮和佳能邮轮;德国的Aida;南欧的Costa邮轮。目前正在将其P&O澳大利亚品牌并入嘉年华。该公司还拥有阿拉斯加的荷兰美国公主阿拉斯加旅游和加拿大育空地区的相关业务。2024年,嘉年华的品牌吸引了1400万名客人。

Current Position of Carnival

嘉年华的当前地位

- With a volume of 11,655,236, the price of CCL is up 0.9% at $28.16.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 55 days.

- CCL的成交量为11,655,236,价格上涨0.9%,达到28.16美元。

- RSI因子提示基准股可能被高估。

- 下次财报预计将在55天内发布。

Expert Opinions on Carnival

对嘉年华存托凭证的专家意见

In the last month, 2 experts released ratings on this stock with an average target price of $26.0.

在过去一个月,2位专家对这只股票发布了评级,平均目标价为26.0美元。

Unusual Options Activity Detected: Smart Money on the Move

检测到期权异动:聪明资金正在行动

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* Consistent in their evaluation, an analyst from Truist Securities keeps a Hold rating on Carnival with a target price of $30. * Consistent in their evaluation, an analyst from Morgan Stanley keeps a Underweight rating on Carnival with a target price of $22.

Benzinga Edge的期权异动板块在事件发生之前发现潜在的市场动向。查看大资金在你最喜欢的股票上采取了什么仓位。点击这里获取访问权限。* 一位来自Truist证券的分析师对嘉年华保持持有评级,目标价为30美元。 * 一位来自摩根士丹利的分析师对嘉年华保持减持评级,目标价为22美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

与仅仅交易股票相比,期权是一种风险较高的资产,但它们具有更高的盈利潜力。严肃的期权交易者通过日常学习、逐步进出交易、关注多个因子以及密切关注市场来管理这种风险。

In today's trading context, the average open interest for options of Carnival stands at 4057.33, with a total volume reaching 6,049.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Carnival, situated within the strike price corridor from $25.0 to $30.0, throughout the last 30 days.

In today's trading context, the average open interest for options of Carnival stands at 4057.33, with a total volume reaching 6,049.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Carnival, situated within the strike price corridor from $25.0 to $30.0, throughout the last 30 days.

评论(0)

请选择举报原因