Former U.S. Treasury Secretary Lawrence Summers said that although he still thinks the economy is overheating, he did not expect the recent fall in bond yields.

"I didn't expect this decline in nominal yields," Summers said in an interview with Wall Street Week's David Westin. "I was taken aback. I thought yields should go up even more. "

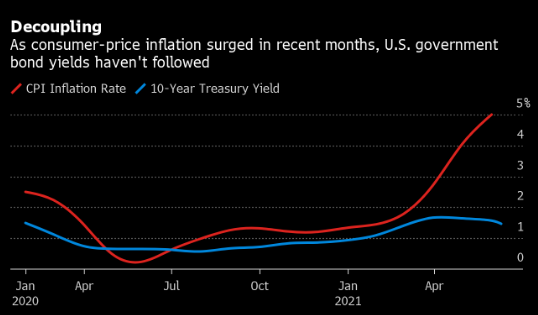

Although the government reported that CPI surged 5 per cent in May from a year earlier, the biggest increase since 2008, the yield on the key 10-year Treasury note fell to a three-month low of 1.43 per cent on Thursday. It closed at 1.45% on Friday. When inflation fears rise, borrowing costs usually rise.

Mr Summers said the fall in yields could reflect a number of factors, including betting that the Fed was more focused on driving down unemployment rather than inflation, and that money flowed into the US market from abroad.

Mr Summers said the fall in yields could reflect a number of factors, including betting that the Fed was more focused on driving down unemployment rather than inflation, and that money flowed into the US market from abroad.

"people think that the Fed is focused on unemployment rather than inflationary pressures, so they cut their view on interest rates," he said.

Nonetheless, he predicts that CPI will grow at an annual rate of more than 4 per cent by the end of the year. He says faster inflation also means that so-called real interest rates have fallen, even if the economy is heating up.

"despite the booming economy, monetary policy has been steadily loosening this year," Summers said. "

萨默斯表示,收益率下跌可能反映了多种因素,包括押注美联储更关注于压低失业率而不是压低通货膨胀,以及资金从国外流入美国市场。

萨默斯表示,收益率下跌可能反映了多种因素,包括押注美联储更关注于压低失业率而不是压低通货膨胀,以及资金从国外流入美国市场。