Original title: global ETF total assets break through the $9 trillion mark, which categories are the most popular?

Over the past decade, zero hedging on financial blogs has widely discussed the investment pattern of ETF, with the most common mention being that ETF is sometimes swayed by potential factors, occasionally pointing out that the rise of passive investment in such assets may lead to illiquidity in the event of renewed market volatility.

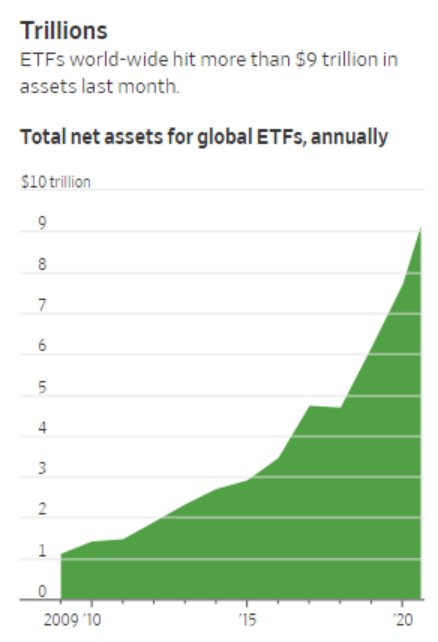

This week, figures from the Wall Street Journal Morningstar pointed out that ETF's total assets have exceeded $9.1 trillion. Now it seems that these warnings are more noteworthy than ever before.

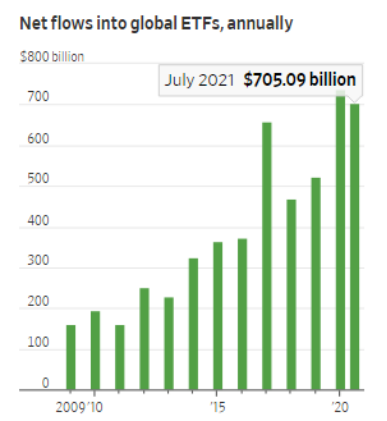

So far this year, the net inflow of ETF has almost exceeded the total net inflow of $736.5 billion for the whole of 2020. According to the Wall Street Journal, most of the money went into cheap index-tracking funds, including large-cap stocks and short-term bond ETF, as well as products to hedge against inflation.

So far this year, the net inflow of ETF has almost exceeded the total net inflow of $736.5 billion for the whole of 2020. According to the Wall Street Journal, most of the money went into cheap index-tracking funds, including large-cap stocks and short-term bond ETF, as well as products to hedge against inflation.

Of this total, the net inflow of US ETF is about US $519 billion, which brings US ETF assets to about US $6.6 trillion.

Anaelle Ubaldino, head of ETF research and investment consulting at data company TrackInsight, said: ETF is probably the most successful product in the financial services sector in the past 20 years.

In the first seven months of this year, Vanguard pilot (Vanguard) had revenue of US $224 billion, more than competitor Blackrock.(Blackrock) 45% higher. Vanguard's two funds, the S & P 500 growth Index Fund and the S & P 500 value Index Fund, have received inflows of $32.3 billion and $23.4 billion respectively so far this year.

According to the Wall Street Journal, of the 10 funds with the largest inflows this year, 6 belong to Vanguard and the remaining 4 belong to Blackrock.

Actively managed ETF is also on the rise, the most eye-catching of which is ARK Invest's Ark Innovation ETF (ARKK). JPMorgan Chase & CoAnd other investment banks are also launching their own actively managed ETF. The bank even converted $10 billion of mutual funds into ETF last week, saying it was just the beginning.

Matt Bartolini, head of American research at State Street Bank SPDR, says ETF inflows are likely to reach $800 billion in 2021. He concluded:

"in such a short period of time, such a large amount of liquidity is dazzling. So the question is, how high can this number be in 2021? Especially when ETF is expected to join the 'four comma clubs' ($100,000,000,000, or $100 billion, with four commas in the middle). "

今年至今,ETF的净流入资金已经几乎超过了2020年全年的净流入总额——7365亿美元。华尔街日报指出,大部分资金流入了廉价的指数追踪基金,包括大盘股和短期债券ETF,以及对冲通货膨胀的产品。

今年至今,ETF的净流入资金已经几乎超过了2020年全年的净流入总额——7365亿美元。华尔街日报指出,大部分资金流入了廉价的指数追踪基金,包括大盘股和短期债券ETF,以及对冲通货膨胀的产品。