If US bond yields rise again, a slowdown in the economic recovery as a result of the rebound in the epidemic will put emerging market currencies at risk of selling.

Companies such as Fidelity International and Oriental Huili Bank believe that while the impact of US borrowing costs on currencies in developing countries has weakened in recent months, as China's economic growth has rebounded and the cushioning effect of low inflation has declined, then its impact on high-risk currencies is once again significant.

"for emerging market currencies, a very large and rapid rise in US front-end real yields would be a very bad outcome," said Paul Greer, a fund manager at Fidelity in London. "the recent swing in the US bond yield curve, particularly in the area of real yields, will continue to be the main driver of market sentiment in the very short term."

Emerging market currencies felt swings dominated by US Treasuries last week, with two-year yields rising sharply. The pain is likely to intensify if major economic data support expectations of macroeconomic deterioration.

Emerging market currencies felt swings dominated by US Treasuries last week, with two-year yields rising sharply. The pain is likely to intensify if major economic data support expectations of macroeconomic deterioration.

Apart from this week's economic data, traders' biggest clue about the direction of Fed policy may come from the Jackson Hole seminar later this month.

Correlation instability

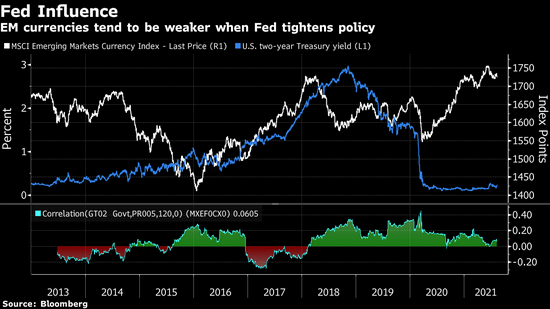

The benchmark index of emerging market currencies is down about 2 per cent from its record high in June and is about to erase its gains so far this year. The 120-day correlation between the index and the US two-year yield remains near zero, meaning the two are independent of each other, and fund managers warn of complacency.

Prior to that, US bond yields have weakened over the past two months. While falling US interest rates prompted investors to seek higher yields, emerging market exchange rates failed to benefit because of concerns that an outbreak caused by the Delta mutation could hamper economic growth.

"growth andLiquidity may actually be the strongest resistance in the second half of the year, which explains why lower US yields did not support emerging market currencies in July, "said Witold Bahrke, senior macro strategist at Nordea Investment in Copenhagen. "the medium-term outlook for emerging market currencies depends largely on yields, growth dynamics and liquidity."

While the sensitivity of emerging market currencies to US debt movements has fluctuated for years, the impact of US yields on local returns in emerging markets cannot be ruled out, according to Aviva Investors.

新兴市场货币上周感受到了美债主导的震荡,2年期收益率大幅上涨。如果主要经济数据佐证了宏观经济恶化的预期,那么痛感可能还会加剧。

新兴市场货币上周感受到了美债主导的震荡,2年期收益率大幅上涨。如果主要经济数据佐证了宏观经济恶化的预期,那么痛感可能还会加剧。