Original title: JPMorgan Chase & Co: to hedge the risk of Fed policy? This market is more suitable.

Source: Jinshi data

JPMorgan Chase & Co said investors who want to hedge the risk of a change in Fed policy should consider investing in credit markets rather than stocks.

Strategists led by Marko Kolanovic wrote in a report on Monday:

Strategists led by Marko Kolanovic wrote in a report on Monday:

Although some volatility in the credit market is expected in the future, the hedging cost of investing in the credit market is lower than other hedging schemes.

Spreads between highly rated and high-yield bonds in the United States have continued to widen since mid-July. At the same time, this volatile trading environment is likely to continue until the end of the month as the market digests the impact of the delta variant and the risk of a policy change by the Fed. "

The strategist further said:

"while the market is likely to stabilize after the Fed withdraws, people who hedge related risks should consider using credit or credit volatility rather than stocks, because credit has limited upside and lower levels of implied volatility than equities."

At the same time, unpredictable factors such as the risk of the epidemic have made investors nervous, the US stock market is currently fluctuating near highs, and the costs of many hedging schemes are high.

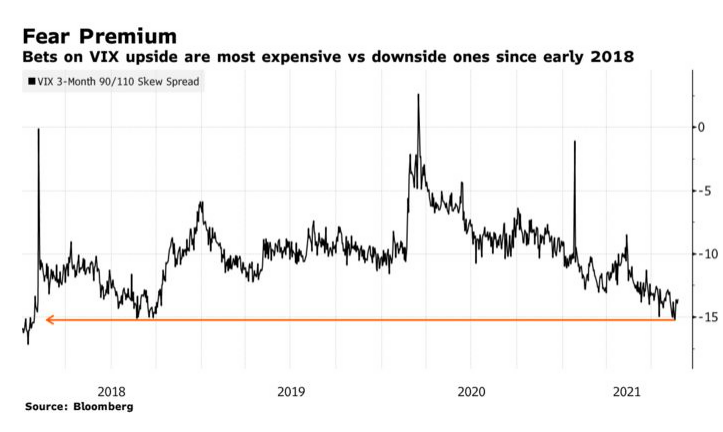

It also leads strategists to look beyond typical indicators such as VIX, where three-month bullish contracts are the most expensive in VIX. Therefore, the investment credit market needs to pay attention to this aspect.

JPMorgan Chase & Co, a strategist, wrote:

"at present, we are still bullish on interest rate spreads, but the risk of the variant virus and the Jackson Hole meeting may lead to some fluctuations in the short term in the future."

以 Marko Kolanovic 为首的策略师在本周一的报告中写道:

以 Marko Kolanovic 为首的策略师在本周一的报告中写道: