Global financial media last night and this morningThe main headlines of common concern are:

1. It is more important for the Federal Reserve to reduce the size and start the whole body when it ends than when it starts.

2. The unexpected stop in the growth of commercial equipment orders in the United States in July indicates the standstill of capital investment.

3. ECB Chief Economist: once the impact of the Fed's weight reduction appears, the central bank will take measures to deal with it.

4. Pfizer Inc seeks full approval from the United States for COVID-19 vaccine to strengthen the injection.

5. The PC market grew by 17% in the second quarter of 2021. Apple Inc continues to maintain the second place.

6. Delta Airlines increases the medical insurance premiums for unvaccinated employees to cover the higher cost of COVID-19.

It is more important for the Federal Reserve to reduce the size to start when the whole body ends than when it starts.

These days, all the discussion in the financial markets has focused on when the Fed will start to scale back its bond purchases, but for all markets, including equity and debt exchange, what is more important is when the bond purchases will end.

Investors have made few major moves and are eagerly waiting for the Jackson Hole seminar to begin on Thursday, and Federal Reserve Chairman Jerome Powell may provide clues on when and how the Fed will scale back its bond purchases on Friday. This will help determine the timetable for the Fed to raise interest rates.

The withdrawal of stimulus can be described as a boost, as a flood of liquidity in the financial system has pushed US stocks to record highs and Treasury yields remain just above a six-month low. In cases where Delta poses a new risk, reducing the size too quickly could derail the economic recovery and act too slowly or exacerbate inflationary pressures brought about by the restart of the economy.

Tom Essaye, a former Merrill Lynch trader, said, "the key point for the market is the speed with which the Fed withdraws its easing policy, as it determines how long it will take for the Fed to stop buying bonds completely, and then it will be the first time it will raise interest rates."

Us commercial equipment orders unexpectedly stopped growing in July, indicating a standstill in capital investment

Orders for commercial equipment received by US factories unexpectedly stopped growing in July after four consecutive months of growth, indicating that months of capital investment has ground to a halt.

Orders for core capital goods were flat in July, up from 1% the month before, according to data released by the commerce department on Wednesday. The index deducts aircraft and defence supplies and is seen as a barometer of investment in commercial equipment.

Orders for durable goods fell 0.1 per cent month-on-month, reflecting a decline in orders for commercial aircraft.

According to the survey, the median analyst estimate is a 0.5 per cent increase in core capital goods orders and a 0.3 per cent decline in overall durable goods orders.

Equipment expenditure has been an important driver of economic growth since mid-2020. A rebound in consumer spending and low inventories have boosted demand for industrial goods, although capacity constraints such as raw materials and labour pose persistent obstacles to the pace of production.

Chief Economist of the European Central Bank: once the impact of the Fed's weight reduction becomes apparent, the central bank will take measures.

Philip Lane, chief economist of the ECB, said the ECB was ready to deal with any market disruptions that might occur if the Fed began to downsize QE.

"the ECB is not a passive bystander," Lane said in an interview. If spillover effects affect the financing of the eurozone, we are willing and able to take appropriate action, as we have demonstrated.

Lane stressed that policymakers are determined to maintain a favourable financing environment in the euro zone, suggesting that it will take some time to decide how to make bond purchases once the epidemic-fighting emergency bond-buying program expires.

"We don't need to think about it too long in advance," Lane said. The next meeting of the management committee is in September and is still "very far" from the March deadline of the emergency bond-buying programme.

"Autumn and winter will provide us with more information about the epidemic, so we should use autumn to think about these issues," Lane said.

Pfizer Inc seeks full approval of COVID-19 Vaccine in the United States

Pfizer IncThe company and BioNTech SE said they were seeking full approval from US regulators to boost Covid-19 vaccination for people aged 16 and over.

The two companies announced on Wednesday that they had launched a rolling application for a third dose of vaccine biologics license to the US Food and Drug Administration (FDA). Pfizer IncAnd BioNTech said they planned to complete the application submission by the end of this week, bringing them closer to the approval of the reinforcement needle.

Earlier this week, the Pfizer Inc-BioNTech vaccine became the first vaccine officially approved by US regulators for use in people aged 16 and over. Moderna Inc Inc. AndJohnson & JohnsonThe company's vaccine is authorized for emergency use.

Pfizer Inc and BioNTech said on Wednesday that a late trial of 306 participants between the ages of 18 and 55 showed that booster injections after a second dose of the vaccine more than tripled the level of protective antibodies against the original strain of the coronavirus. The third dose of the vaccine also showed good safety and tolerance, according to the two companies. The test data will be submitted to a peer-reviewed journal.

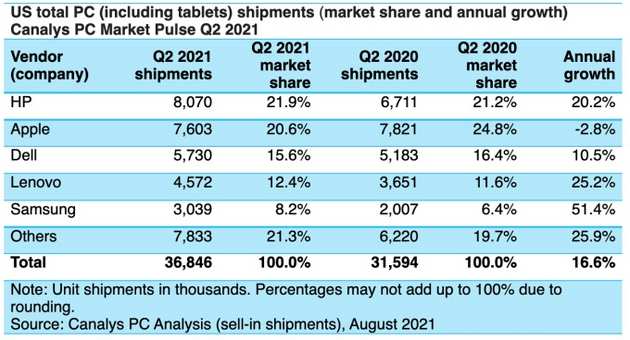

The PC market grew by 17% in the second quarter of 2021. Apple Inc continues to be in second place.

Market research company Canalys today released PC market data for the second quarter of 2021. Overall PC market sales rose 17 per cent in the second quarter from a year earlier, but growth slowed significantly compared with 74 per cent in the previous quarter, affected by a global chip shortage.

Data displayHewlett-PackardIt topped the list for the second consecutive quarter with a market share of 21.9%, an increase of more than 20% over the same period last year.AppleRanked second with a share of 20.6%. However, it is worth noting thatAppleThe growth rate has fallen by 2.8% this year.

DELLRanked third with 15.6%AssociationFollowed by 12.4%. If you look at the annual growth rate, Samsung has the highest growth rate, more than 50%.

Delta Airlines raises health insurance premiums for unvaccinated employees to cover higher COVID-19 costs

Ed Bastian, chief executive of Delta Air Lines, informed employees on Wednesday that health insurance premiums for employees who had not been vaccinated against COVID-19 would increase by $200 a month from November 1, citing high fees for employees hospitalized because of COVID-19 infection.

Delta said employees who had not been vaccinated against COVID-19 would also face other restrictions, including an indoor mask rule with immediate effect and weekly COVID-19 testing starting on Sept. 12.

Bastian said in an employee memo: "the average hospitalization cost of Delta Airlines employees infected with COVID-19 is US $50000, and the surcharge of US $200 is necessary to address the financial risks posed to the company by unvaccinated employees. In recent weeks since the emergence of the variant of B.1.617.2 COVID-19, all Delta employees hospitalized by COVID-19 have not completed their vaccinations. "

Delta also said that from September 30, "according to state and local laws, COVID-19 's salary protection will be provided only to people who have been fully vaccinated but have experienced a breakthrough infection."