来源:华尔街见闻

作者:许超

“商品旗手”高盛认为,在目前低库存背景下,供给短缺可能推动大宗商品价格进一步上升。随着北半球进入秋季,原油价格上涨可能促使投资者重返大宗商品再膨胀交易。

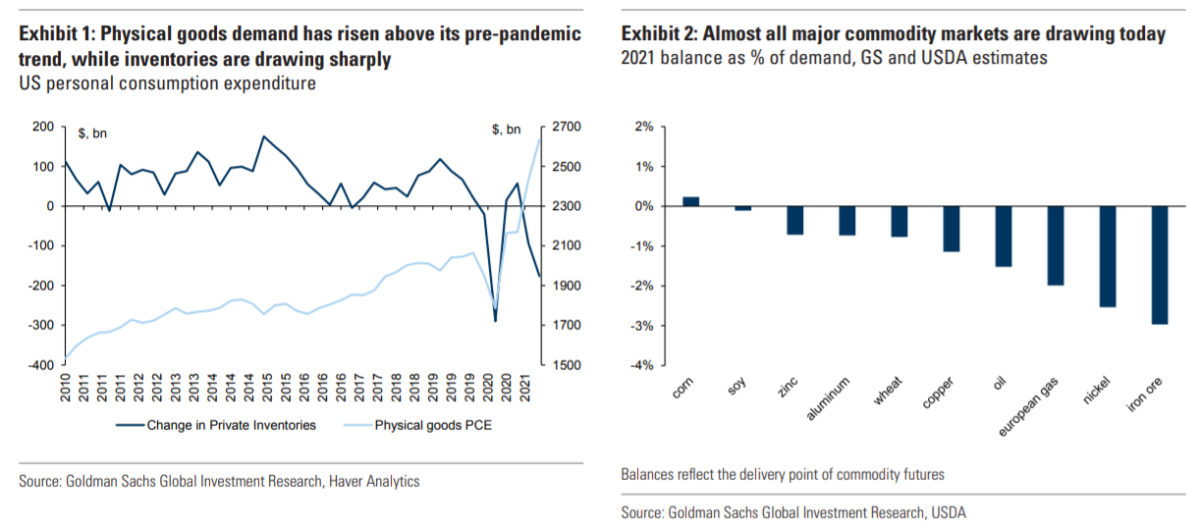

高盛表示,在疫苗接种范围不断扩大催化下,全球大宗商品需求已经逐步恢复。除原油以外,目前几乎所有的大宗商品需求都已经恢复到疫情前的水平。

高盛表示,在疫苗接种范围不断扩大催化下,全球大宗商品需求已经逐步恢复。除原油以外,目前几乎所有的大宗商品需求都已经恢复到疫情前的水平。

随着疫情期间积累的大宗商品库存持续下降,目前市场越来越容易受到短期供应中断(例如俄罗斯天然气出口中断)或需求意外增加(例如炎热的天气)的影响。

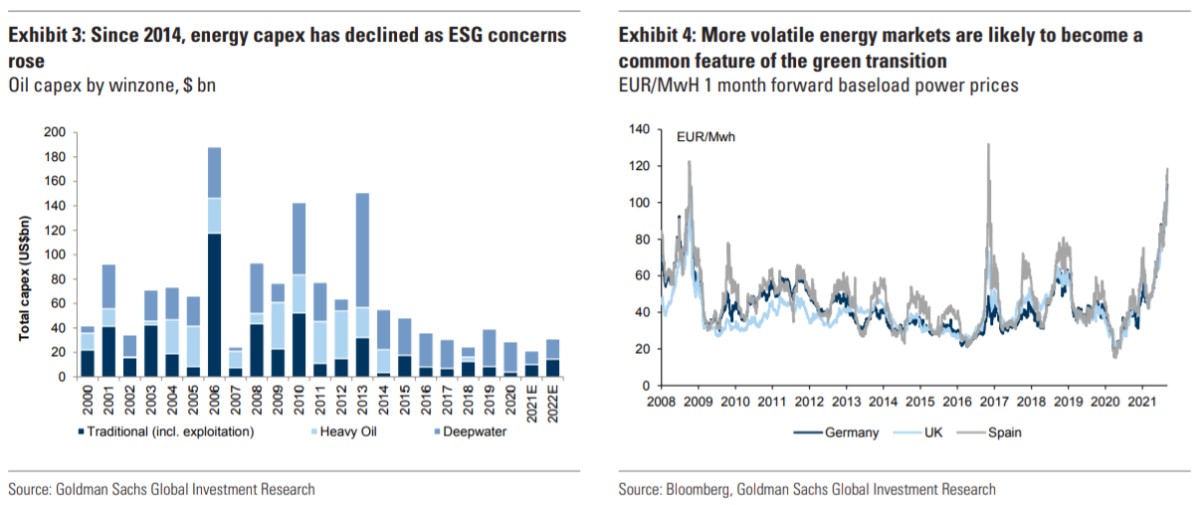

高盛指出,目前大宗商品短缺并不仅仅是新冠疫情造成的,自2008年金融危机后开始的长期资本支出下跌也是影响价格的重要因素:低资本开支限制了大宗商品的长期供给。

在2018-2020年需求疲软的环境中,低资本开支导致的大宗商品供给短缺并不明显。但自新冠疫情爆发以来,各国政府将通过大规模财政、货币刺激快速恢复经济活动作为优先事项,这使得大宗商品的结构性供应短缺变得愈发明显:库存的持续下降,使得供应短缺趋势愈发明显。

在交易层面,目前美股投资者已经基本放弃基于情绪而非基本面的再通胀交易:随着美国经济增长见顶,许多投资者认为通胀压力已经结束。

但高盛表示,认为通胀压力已经结束的观点对受增长率驱动的金融市场可能是正确的,但对受经济活动水平驱动的大宗商品市场则并不成立。大宗商品市场看涨依然遵循基本的供需原理:不管经济增长速度如何,只要需求高过供应,价格就会上涨。

在大宗商品库存持续下降、需求水平将继续上升之际。需求的小幅增长就会导致价格飙升。

高盛警告,随着北半球进入秋季,原油价格上涨可能成为投资者重返大宗商品再通胀交易的催化剂。

Delta病毒对全球原油需求影响有限,在疫情爆发期间石油需求几乎没有下降;而受“艾达”飓风冲击,美国原油生产恢复继续低于市场预期。考虑到伊朗协议破裂的背景下。如果油价重新回到80美元/桶的水平,全球投资者将重回大宗商品再通胀交易。

编辑/tina