Source: Chuanshu Global Macro

Author: Soochow Macro team

What will happen when the oil price exceeds $80? What impact will it have on the global economy?

On Oct. 8, WTI crude oil futures stood above the $80 mark for the first time since November 2014.

During the National Day holiday in 2021, Brent oil stood steady at the $80 mark, hitting a three-year high as the world was hit by a global energy crisis and the latest OPEC+ meeting decided not to increase production.

Crude oil has been the brightest asset category in the world so far this year, whether it exceeded $60 in February or $70 in June, we judged that its follow-up trend was easy to rise and difficult to fall.

that,What will happen after the oil price exceeds $80 this time? What impact will it have on the global economy?

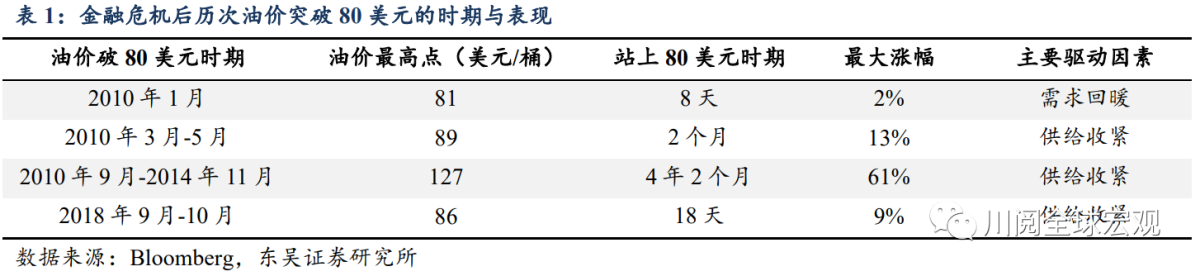

First of all, let's take a look back at history. Oil prices tend to rise after breaking through $60 or $70 after a financial crisis, but not after breaking through $80:

January 2010: Brent oil prices exceeded $80 on the first trading day after the New year. However, this wave of oil prices stood above $80 for only eight days before falling back to around $70 because the market was too optimistic about the global economic recovery at the beginning of the year.

2March-May 2010: Brent oil prices peaked at $89 after breaking $80, then fell to $69. The rise is mainly due to tighter supply, including strikes by refiners at the French oil giants and the oil spill in the Gulf of Mexico in the United States.

3 September 2010-November 2014: this round of oil prices stood above $80 for four years, reaching a maximum of $127. The main reason behind this is that OPEC has been adopting the strategy of production quota in the process of global economic recovery, hoping to maintain domestic political stability through high oil prices. Of course, this strategy was eventually disintegrated by a price war with US shale oil manufacturers.

September 2018-October 2018: due to the failure of the OPEC+ meeting to reach a resolution to further increase production, the oil price exceeded $80, rising as high as $86, and then fell back due to the rise in inventories after the increase in US shale production. This round of oil prices stood above $80 for only 18 days.

The above historical experience shows that unless there is a serious and persistent imbalance between supply and demand in the crude oil market, $80 is "unbearably high" for oil prices.

Therefore, whether the current round of oil prices can continue to rise after breaking through $80 depends on how quickly and to what extent the imbalance between supply and demand can be alleviated.

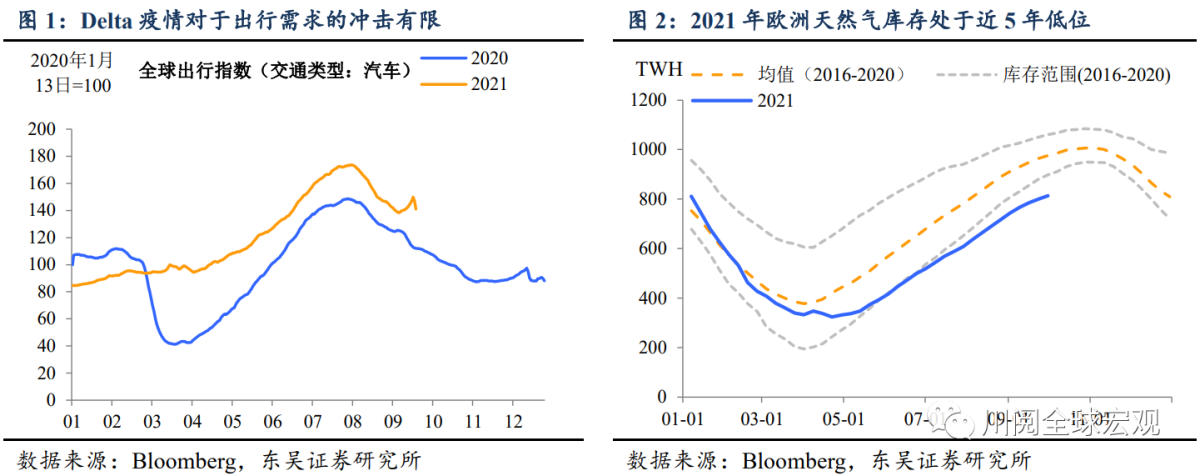

In terms of demand, on the one hand, due to the limited impact of the Delta virus, global traffic and travel demand is recovering rapidly (figure 1)

On the other hand, there is growing concern in the market about cold winters and power shortages, but global (especially in Europe) natural gas shortages (figure 2), renewable energy is unstable, heating oil and oil-based power generation are important options.

All of these will further boost demand for crude oil from the fourth quarter of 2021 to early 2022.

From the supply side, the main source of lower-than-expected supply since August 2021 is the slowdown in the growth rate of OPEC+ during repeated outbreaks (figure 3), and the passage of Hurricane Ide led to a more-than-expected decline in US crude oil production (figure 4).

After the OPEC+ meeting decided not to increase production, it can be expected that the tightening of supply in the crude oil market will not be alleviated by November 2021, while the decision of the next OPEC+ meeting in early November will undoubtedly determine the resumption of supply in the crude oil market from the end of the year to the beginning of next year.

To sum up,We don't think the oil price will fall any time soon after it breaks 80 US dollars.A noteworthy indicator is the inventory situation in the global crude oil market, as shown in figure 5, which is currently at a five-year low (figure 5), given that oil prices have exceeded $80 in the same period in 2018, this means that the current oil price is supported at $80, and if the index goes down further in the future, oil prices are still likely to rise further.

Of course, a potential risk is that progress in negotiations on the US-Iran nuclear deal will lead to the resumption of Iranian crude oil exports (figure 6).

What is the economic impact of oil prices above $80?

As we have previously reported, globally, the economic divide between the US and Europe is likely to intensify again because the US has shale oil, while the eurozone is completely dependent on crude oil imports and is more vulnerable to high oil prices (Table 2).

In addition, if the oil price stays above $80 in the fourth quarter, it will further boost the hub of China's PPI.

Risk hint: the epidemic spread more than expected, and the Fed tightened monetary policy more than expected.

Edit / phoebe